The U.S. auto sales expansion is continuing despite a frigid February according to the latest forecast that shows a large 8.5% increase for the industry. New light vehicle sales, including fleet, should reach 1,295,600 units for the month.

This same 8.5% increase is projected on a daily selling rate (DSR) basis with 24 selling days this February versus a year ago. This means a seasonally adjusted annualized rate (SAAR) of 16.7 million new units on continued strong consumer demand.

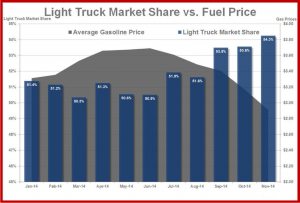

“Gas prices inched back up this month, but it didn’t appear to have much impact on shoppers’ choices. We’re still seeing a strong market for trucks and SUVs — especially compact crossover SUVs, which continue to ride an impressive wave of popularity,” said Edmunds.com Senior Analyst Jessica Caldwell. “It is likely that the hard-hitting winter weather motivated some buyers to upgrade from their two-wheel drive vehicles.”

Incentive spending by automakers averaged $2,623 per vehicle in February, down 2.9% from a year ago and up 1.4% compared to January 2015. The projected registration mix of 81.8% retail sales and 18.2% fleet versus 80.7% retail and 19.3% fleet last February. Total used auto sales, including franchise and independent dealerships and private party transactions, may exceed 3,315,654, up 1.5% compared with February 2014.

GDP is growing for the third consecutive quarter and a healthy stock market, the U.S. economy is recovering from the Republican induced Great Recession. Moreover, continuing relatively low gas prices continue to help consumer confidence and support increased personal spending.

“Strong February auto sales signal a very healthy U.S. economy,” said Eric Lyman, vice president of industry insights for TrueCar, the source of the sales projection. “Given this month’s robust demand, the industry remains on track to hit TrueCar’s 17 million-unit projection for the 2015.”

While the outlook for 2015 auto sales and U.S. economic expansion is strong, this month’s disruption in operations at West Coast ports may have some impact. A preliminary resolution between workers and port operators was announced on 20 February after a standoff that slowed shipments of parts and imported vehicles to some automakers. February auto sales appear unaffected though Japan-based manufacturers such as Honda, Toyota and Subaru curbed production this month, a move that may tighten March inventories.