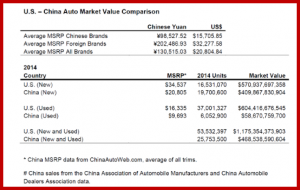

New vehicles sold by domestic Chinese brands had an average MSRP of just $15,706, while foreign makes commanded an average MSRP of about $32,278.

Total value for new vehicles sold in China, the world’s largest market by volume, lagged the U.S. by as much as $161 billion last year, based on a comparison of pricing data.

Sales in China were a record 19.7 million new autos in 2014, according to the China Association of Automobile Manufacturers, 19% more than the 16.5 million new cars and light trucks purchased by U.S. consumers.

However, with an average new vehicle price equivalent to $20,805, based on a TrueCar analysis of manufacturer suggested retail prices (MSRP) for more than 750 models and trim levels, Chinese sales may have totaled $409.9 billion versus $570.9 billion in the U.S., where MSRP averaged $34,537 in 2014.

On a total volume basis, including new and used autos, the U.S. remained a bigger market last year with a combined 53.5 million purchases, more than double the 25.7 million new and used vehicles sold in China.

New vehicles sold by domestic Chinese brands had an average MSRP of just $15,706, while foreign makes commanded an average MSRP of about $32,278, based on TrueCar’s analysis of all models and trim levels listed on ChinaAutoWeb.com.

“While the growth of China’s new vehicle market over the last decade has been impressive, the total value of that market remains considerably lower than the U.S. and will remain so for some time,” said John Krafcik, president of TrueCar. “Vehicle prices will continue to rise, yet global automakers competing for China’s consumers must also continue to share half of everything they make in the region with domestic market partners.”