The use of onboard computers and their ability to track and record automobile use is contributing to the slow expansion of usage-based insurance. It also opens the possibility for accident reconstruction, law enforcement monitoring and myriad other uses of the data, including threats to privacy. There is a privacy issue for personal users of usage based insurance since they are giving an insurance company access to your actual driving mileage and times in order to adjust their rates.

In the insurance industry this is not a privacy problem – so far – since usage based policies require the consent of the company or individual to put it in place. Foursquare, Facebook, and other location-based services suggests that people are willing to divulge personal data in a public forum. However, how many people will they do so to get discounts for auto insurance?

Moreover, so called OBD-II based telematics in the U.S. – aka onboard diagnostics – are rudimentary and controversial, but they have the potential to reshape the usage based auto insurance market to reward good or infrequent low-risk drivers while charging other, more risk exposed drivers higher fees. At the moment usage based insurance, aka UBI, is the most popular service in the North American market, as vehicle owners can get so called ‘good driver’ discounts on insurance premiums, according to consultancy Frost & Sullivan. (See AutoInformed.com on: Telematics are ‘Driving’ Growth in Usage Based Insurance and Consumers Will Commit Fraud for Cheaper Car Insurance and Ford, State Farm Offer Auto Insurance Based on Miles Driven)

According to Celant, a consulting firm on the application of information technology in the financial industry, an experiment is being conducted globally by the insurance companies. Thus far usage based insurance is a small market although tracking and such is increasingly prevalent in corporate fleets.

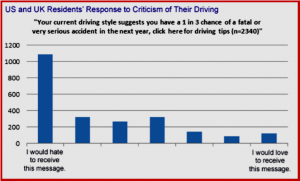

A Celant report on insurance developments also includes results of a survey on how receptive customers would be to real time feedback on their driving. How would you like to receive this message while driving: Your current driving style suggests that you have a one in three chance of having a fatal or very serious accident during the next year. Click here or go to slowdown.com for driving tips.

Wunelli has now reached its billionth mile of driving behavior tracked, analyzed and scored primarily in the UK. The data is collected via fixed telematics devices and the growing number of smartphone telematics apps developed for insurers.

The data gathered and analyzed to date has revealed that women are better drivers than men, identified the cars on the road driven by individuals most likely to speed, and derived key accident triggers such as hard accelerating, braking, night time driving and speeding.

Based on the large volume of telematics data collected with associated claims exposures, Wunelli is now working on predictive First Notification of Loss (FNOL) algorithms. These algorithms are intended to give insurers insight into the highest risks for large, future claims losses and, allegedly, help improve the claims process for consumers.

Paul Stacy, founding Director of Wunelli says, “Predictive FNOL is a game changer for telematics claims management and a great example of how powerful this data can be.”

In addition to the UK, Wunelli and LexisNexis are working with U.S. insurers to use the billion miles of experience and predictive risk models. Wunelli will also use this data to help insurers launch telematics programs in developing countries such as China and Brazil.

The collection, analysis and scoring of driving behavior data since 2009 has led to significant advances in how insurers deliver usage-based insurance (UBI) policies, created insights that are changing the way insurers underwrite private motor cover and manage claims, and changing the way consumers think about their driving behavior patterns, Wunelli claims.