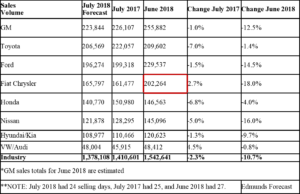

Click to enlarge.

Edmunds forecasts that 1,378,108 new cars and trucks will be sold in the U.S. in July for an estimated seasonally adjusted annual rate (SAAR) of 16.7 million. This reflects a 10.7% decrease in sales from June 2018 and a 2.3% decrease from July 2017. Edmunds experts note that unseasonably strong June may have played a role in pulling ahead sales. However, J.D. Power and LMC Automotive say sales are projected to reach 1,156,200 units, a 3.2% decrease compared with July 2017. ( July 2018 has one less selling day than July 2017.) Without the selling-day adjustment, retail sales would be down 7.1%. Edmunds notes sales experienced a lift in the first half of the month thanks to Fourth of July sales, but then dropped in the second half of the month.

“July sales are looking reasonably strong, but we’re starting to see the first signs of speed bumps on the road ahead,” said Jeremy Acevedo, manager of industry analysis at Edmunds. “With market factors such as rising interest rates keeping shoppers at bay, we expect to see a continued slowdown of the vigorous sales pace that the industry experienced in the first half of the year.”

“While it’s disappointing for the retail sales pace to post declines again, it’s important to remember that July only has 24 selling days this year, the fewest for the month since 2012 and one less weekend than last year,” said Thomas King, Senior Vice President of the Data and Analytics Division at J.D. Power. “More notable is that incentive spending is on pace to post year-over-year declines for the first time in 54 months.”

Incentive spending through the first two weeks of July was $3,665 per unit, down $204 from the same time last year. The decline has been driven by reduced spending on cars, down $579, while spending to trucks/SUVs is up $5.

“Reduced spending is a positive indicator for the health of the industry, but it is being driven solely by performance from cars,” King said. “Sustaining lower levels of incentives will remain a challenge, and considerable potential exists for spending to rise at the end of July and in the months ahead.”

By the LMC Numbers

- The average new-vehicle retail transaction price to date in July is $31,561, an all-time monthly record. The previous high for the month of July—$30,950—was set last year.

- Average incentive spending per unit to date in July is $3,665, down from $3,869 during the same period last year.

- Consumers are on pace to spend $36.5 billion on new vehicles in July, which is nearly $2 billion less than last year’s level.

- Trucks account for 68% of new-vehicle retail sales through July 22—the highest level ever for the month of July—making it the 25th consecutive month above 60%.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, is 68 days through July 22, down 4 days from last year.

- Fleet sales are expected to total 171,300 units in July, up 6.1% from July 2017. Fleet volume is expected to account for 13% of total light-vehicle sales, up 1%age point vs. last year.

“With the first half of 2018 being slightly ahead of volume expectations, the second half is poised for a pullback from the robust second half of 2017,” said Jeff Schuster at LMC Automotive. “July’s expected performance is consistent with that notion. Short-sighted tariffs—and retaliatory responses—are the most significant risk factor for the U.S. and global markets. In fact, significant escalation of tariffs could derail America’s strong economic growth and even push the market into a premature recession.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

New Vehicle Sales to Slip in July?

Click to enlarge.

Edmunds forecasts that 1,378,108 new cars and trucks will be sold in the U.S. in July for an estimated seasonally adjusted annual rate (SAAR) of 16.7 million. This reflects a 10.7% decrease in sales from June 2018 and a 2.3% decrease from July 2017. Edmunds experts note that unseasonably strong June may have played a role in pulling ahead sales. However, J.D. Power and LMC Automotive say sales are projected to reach 1,156,200 units, a 3.2% decrease compared with July 2017. ( July 2018 has one less selling day than July 2017.) Without the selling-day adjustment, retail sales would be down 7.1%. Edmunds notes sales experienced a lift in the first half of the month thanks to Fourth of July sales, but then dropped in the second half of the month.

“July sales are looking reasonably strong, but we’re starting to see the first signs of speed bumps on the road ahead,” said Jeremy Acevedo, manager of industry analysis at Edmunds. “With market factors such as rising interest rates keeping shoppers at bay, we expect to see a continued slowdown of the vigorous sales pace that the industry experienced in the first half of the year.”

“While it’s disappointing for the retail sales pace to post declines again, it’s important to remember that July only has 24 selling days this year, the fewest for the month since 2012 and one less weekend than last year,” said Thomas King, Senior Vice President of the Data and Analytics Division at J.D. Power. “More notable is that incentive spending is on pace to post year-over-year declines for the first time in 54 months.”

Incentive spending through the first two weeks of July was $3,665 per unit, down $204 from the same time last year. The decline has been driven by reduced spending on cars, down $579, while spending to trucks/SUVs is up $5.

“Reduced spending is a positive indicator for the health of the industry, but it is being driven solely by performance from cars,” King said. “Sustaining lower levels of incentives will remain a challenge, and considerable potential exists for spending to rise at the end of July and in the months ahead.”

By the LMC Numbers

“With the first half of 2018 being slightly ahead of volume expectations, the second half is poised for a pullback from the robust second half of 2017,” said Jeff Schuster at LMC Automotive. “July’s expected performance is consistent with that notion. Short-sighted tariffs—and retaliatory responses—are the most significant risk factor for the U.S. and global markets. In fact, significant escalation of tariffs could derail America’s strong economic growth and even push the market into a premature recession.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.