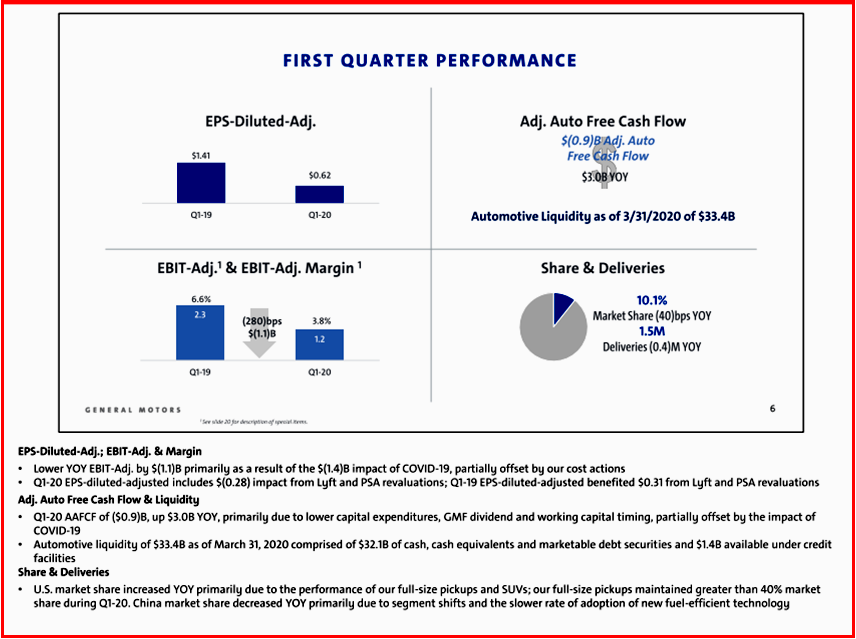

General Motors today posted EPS-diluted of $0.17 and EPS-diluted-adjusted of $0.62. The COVID-19 impact on EBIT-adjusted was $(1.4) billion. GM ended quarter with $33.4 billion in automotive liquidity as the global economy headed toward a depression. In March GM suspended production and cancelled earnings projections for the entire year.

First Quarter 2020 results

- EPS-diluted of $0.17 and EPS-diluted-adjusted of $0.62

- EPS diluted-adjusted includes a $(0.28) impact from Lyft and PSA revaluations

- Income of $0.3 billion, and EBIT-adj. of $1.2 billion, which includes a $(1.4) billion COVID-19 impact

- Revenue of $32.7 billion

- GM North America EBIT-adjusted of $2.2 billion

- GM Financial EBT-adjusted of $0.2 billion

First Quarter Sales

GM sales in the U.S. declined about 7%, from the effects of the pandemic. While sales have been impacted differently across geographies, for many dealers, demand for full-size trucks remained strong. Sales of GM’s full-size pickups rose about 27% year-over-year, with an apparent gain in retail market share. They captured ~41% of combined light- and heavy-duty segments in the first quarter (J.D. Power). In China, following the strongest sales impact in February, the industry started to pick up in March narrowing the monthly sales decline.

Considerable planning is underway to restart operations in North America. Based on conversations and collaboration with unions and government officials, GM is targeting to restart the majority of manufacturing operations on May 18 in the U.S. and Canada under extensive safety measures.

These global, standardized measures were learned from GM facilities in China; Korea; Kokomo, Indiana; Arlington, Texas; Warren, Michigan; Customer Care & Aftersales operations, as well as collaboration with union leadership and supplier partners.

“These procedures meet or exceed CDC and WHO guidelines,” GM said, “and are designed to keep people safe when they arrive, while they work and as they leave the facility.”

When GM suspended operations, it also moved to preserve its liquidity. GM ended the quarter with a strong $33.4 billion in automotive liquidity, including an approximately $16 billion draw-down from its revolving credit facilities. In addition, the company extended $3.6 billion under its three-year revolving credit agreement, and GM and GM Financial renewed their 364-day $2 billion revolver.

GM International Restructuring

In February, GM announced it will wind down engineering, vehicle sales – except for GM specialty vehicles – and design operations in Australia and New Zealand and retire the Holden brand by 2021. GM also agreed to sell its Rayong plant in Thailand to Great Wall Motors. As a result, the company recorded total after tax cash and non-cash charges of $0.7 billion in the First quarter.

An All-Electric Future?

During the pandemic, product development work on the company’s future EV and AV portfolios is progressing at a rapid pace. In addition, ongoing work continues at Detroit-Hamtramck to convert the facility to be GM’s first assembly plant fully devoted to EVs. (Consumer Feelings on Future Mobility Technologies Declines)

In March, GM shared its EV strategy and claimed that its technical expertise, flexibility, and scale will allow the company to lead in the future of EVs, producing sales quickly, efficiently, and profitably. This strategy includes a modular propulsion system and a highly flexible, third-generation global EV platform powered by the proprietary Ultium battery system.

AutoInformed on

On June 22, 2020, General Motors Financial Company, Inc. (the “Company”) closed the public offering of $1,250,000,000 aggregate principal amount of its 2.750% senior notes due 2025 (the “2025 Notes”) and $750,000,000 aggregate principal amount of its 3.600% senior notes due 2030 (the “2030 Notes” and, together with the 2025 Notes, the “Notes”) pursuant to an underwriting agreement, dated June 17, 2020 (the “Underwriting Agreement”), by and among the Company and Citigroup Global Markets Inc., Credit Agricole Securities (USA) Inc., J.P. Morgan Securities LLC, Lloyds Securities Inc., SMBC Nikko Securities America, Inc. and Wells Fargo Securities, LLC, as representatives of the several underwriters named therein (the “Underwriters”). Pursuant to the Underwriting Agreement, the Company has agreed to indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), or to contribute to payments the Underwriters may be required to make because of any of those liabilities.

The Notes were sold pursuant to a shelf registration statement on Form S-3 (File No. 333-235468) (the “Registration Statement”), which was filed with the Securities and Exchange Commission (the “SEC”) on December 12, 2019 and became automatically effective. A prospectus supplement, dated June 17, 2020, relating to the Notes and supplementing the prospectus dated December 12, 2019, was filed with the SEC pursuant to Rule 424(b) under the Securities Act.

The Company estimates that the net proceeds of the offering of the Notes were approximately $1.99 billion, after deducting the Underwriters’ discounts and the estimated expenses of the offering. The net proceeds from the offering of the Notes will be added to the Company’s general funds and will be available for general corporate purposes.

The Notes were issued as series of debt securities pursuant to an indenture, dated October 13, 2015 (as amended or supplemented to the date hereof, the “Base Indenture”), between the Company and Wells Fargo Bank, National Association, as trustee (the “Trustee”), as supplemented by the thirty-eighth supplemental indenture thereto, dated June 22, 2020 (the “Supplemental Indenture” and, together with the Base Indenture, the “Indenture”), between the Company and the Trustee.

The Notes are the Company’s unsecured senior obligations. The Notes will rank senior in right of payment to all of the Company’s existing and future indebtedness and other obligations that are expressly subordinated in right of payment to the Notes; pari passu in right of payment with all of the Company’s existing and future indebtedness that is not so subordinated, including, without limitation, the Company’s other senior notes; effectively junior to any of the Company’s secured indebtedness and other secured obligations to the extent of the assets securing such indebtedness or other secured obligations; and effectively junior to any liabilities of the Company’s subsidiaries.

The 2025 Notes will bear interest at a rate of 2.750% per annum, payable semi-annually in arrears on June 20 and December 20 of each year, commencing on December 20, 2020. Unless earlier redeemed, the 2025 Notes will mature on June 20, 2025.

The 2030 Notes will bear interest at a rate of 3.600% per annum, payable semi-annually in arrears on June 21 and December 21 of each year, commencing on December 21, 2020. Unless earlier redeemed, the 2030 Notes will mature on June 21, 2030.

Interest will accrue on the Notes from June 22, 2020.