Toyota Motor Corporation (TMC) will repurchase its First Series Model AA Class Shares (AA Shares) and cancel all AA Shares on the condition that said shares are repurchased by April 2021. There are 45,092,330 AA shares involved in the proposed cancellation at priced at of ¥477,888,513,340 yen, ~ $4,593,942,279.

If the transaction proceeds, shareholders who by exercising their voting rights to a “high degree” have actively participated in the management of TMC will no longer be of concern to TMC management. “The perception that growth in the automotive industry has contributed to the threat of climate change and the overuse of global resources has led investors to demand that the industry address sustainability in their strategy and business practices,” says CAR. Environmental, social and corporate governance issues – so-called ESGs – are at the heart of a growing movement to measure the sustainability and societal impact of an investment in a company or business. The theory – yet to be convincingly proven in AutoInformed’s view – is that this will help predict the future financial performance of companies. (Daimler Issues Its First Green Bond of €1 Billion)

If the transaction proceeds, shareholders who by exercising their voting rights to a “high degree” have actively participated in the management of TMC will no longer be of concern to TMC management. “The perception that growth in the automotive industry has contributed to the threat of climate change and the overuse of global resources has led investors to demand that the industry address sustainability in their strategy and business practices,” says CAR. Environmental, social and corporate governance issues – so-called ESGs – are at the heart of a growing movement to measure the sustainability and societal impact of an investment in a company or business. The theory – yet to be convincingly proven in AutoInformed’s view – is that this will help predict the future financial performance of companies. (Daimler Issues Its First Green Bond of €1 Billion)

TMC issued AA Shares, which incorrectly assumed a “mid-to-long-term holding period,” on 24 July 2015 to finance R&D affiliated with new automotive business cycles stemming from disruptive technologies. At the time it reflected the potentially ruinous development costs of electric vehicles and other low CO2 or CO2 free emissions and propulsion systems, as well as connected, shared and autonomous vehicles – an industry challenge that remains to this day. It also showed financial sensitivities from the lingering negative effects of the Great Recession and investors growing weary of the enormous capital costs and hence low returns of the automobile business. (Japan Inc: Toyota and Hino to Pioneer Light-Duty Fuel Cell Electric Trucks with Seven-Eleven, FamilyMart, and Lawson)

In a statement this morning from Toyota City, Japan, TMC said: “From the time when the AA Shares were issued up to the present, TMC has been accelerating initiatives related to ESG factors, the SDGs (Sustainable Development Goals), and others necessary for realizing a sustainable society in the mid-to-long term, centered on all stakeholders, such as various organizations and individuals, including not only shareholders but also businesses and consumers, investors, and employees. In doing so, a way of thinking that evaluates corporate growth and development from a more mid-to-long-term perspective has begun to spread within TMC, along with the forming of a value system that questions a company’s meaning of existence in society. AA Shares were issued precisely to make such ways of thinking and new value systems a reality.”

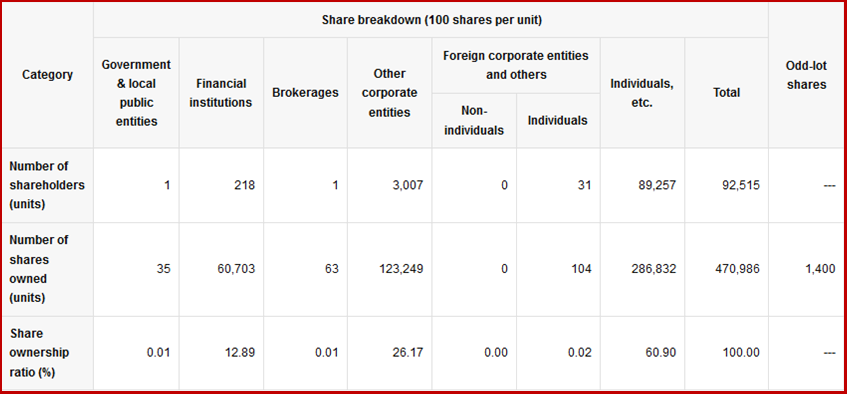

Outline of Share Repurchase and Cancellation

- Repurchase price – Amount equivalent to issue price + amount equivalent to accrued dividends (Issue Price by the annual dividend rate of 2.5%.)

- Date or repurchase – April 2, 2021

- Date of cancellation – April 3, 2021

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota to Cut AA Shares for Sustainable Development

Toyota Motor Corporation (TMC) will repurchase its First Series Model AA Class Shares (AA Shares) and cancel all AA Shares on the condition that said shares are repurchased by April 2021. There are 45,092,330 AA shares involved in the proposed cancellation at priced at of ¥477,888,513,340 yen, ~ $4,593,942,279.

TMC issued AA Shares, which incorrectly assumed a “mid-to-long-term holding period,” on 24 July 2015 to finance R&D affiliated with new automotive business cycles stemming from disruptive technologies. At the time it reflected the potentially ruinous development costs of electric vehicles and other low CO2 or CO2 free emissions and propulsion systems, as well as connected, shared and autonomous vehicles – an industry challenge that remains to this day. It also showed financial sensitivities from the lingering negative effects of the Great Recession and investors growing weary of the enormous capital costs and hence low returns of the automobile business. (Japan Inc: Toyota and Hino to Pioneer Light-Duty Fuel Cell Electric Trucks with Seven-Eleven, FamilyMart, and Lawson)

In a statement this morning from Toyota City, Japan, TMC said: “From the time when the AA Shares were issued up to the present, TMC has been accelerating initiatives related to ESG factors, the SDGs (Sustainable Development Goals), and others necessary for realizing a sustainable society in the mid-to-long term, centered on all stakeholders, such as various organizations and individuals, including not only shareholders but also businesses and consumers, investors, and employees. In doing so, a way of thinking that evaluates corporate growth and development from a more mid-to-long-term perspective has begun to spread within TMC, along with the forming of a value system that questions a company’s meaning of existence in society. AA Shares were issued precisely to make such ways of thinking and new value systems a reality.”

Outline of Share Repurchase and Cancellation

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.