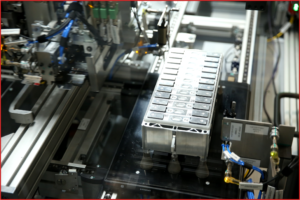

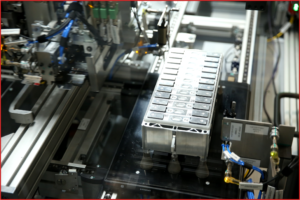

BMW – Battery cells combined into a battery module at Shenyang Battery Plant in China.

BMW AG said today its preliminary Automotive segment Free Cash Flow for the fourth quarter 2020 is around €2.8 billion (Q4 2019: € 1.5 billion), leading to around €3.4 billion (2019: € 2.6 billion) for the full year 2020. It claimed this exceeded “current market expectations.”

The positive operating result of the Automotive segment in the fourth quarter is partially due to “better than expected re-marketing results in the pre-owned car market.” This of course has a positive effect in the Financial Services segment, leading to a Return on Equity for the segment which is only slightly down on prior year as opposed to a moderate decline as indicated in the current outlook. However, the EBIT margin in the Automotive Segment for the full year 2020 is at the “upper end of the 0 – 3% corridor.” The Group EBT remains within the outlook and in line with market expectations. (COVID Effects: BMW AG FY Earnings Guidance – Zero)

Free Cash Flow development of the Automotive Segment in the fourth quarter 2020 is driven mainly by a positive operating result in the Automotive segment from:

- Continued focused management of inventories

- Lower than expected consumption of warranty provisions as a result of lock-down measures.

- Higher down payments received from BMW Group dealerships, most notably in China in line with the positive market development,

- and in the UK relating to Brexit.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Pingback: Q1 Financial Results of BMW Exceed Market Expectations | AutoInformed

BMW Group is determined to remain on a course of recovery in 2021 and has set itself ambitious targets, including significant growth in Group profit before tax. The Automotive segment is expected to a record a solid increase in deliveries. The segment EBIT margin is forecast to improve to within a range of 6 and 8 percent for the full year 2021.

The Group’s business performance for the financial year 2020 clearly reflects the impact of the corona pandemic. Due to worldwide lock-downs lasting several weeks, vehicle deliveries to customers fell by a moderate 8.4% to 2,325,179 units. Defying this trend, growth was particularly strong in the upper luxury segment, with deliveries up by 12.4% to more than 115,000 vehicles, mainly reflecting the performance of the 7 Series and the 8 Series as well as that of the BMW X7 in its first full year on the market. Indeed, sales in this profitable segment have soared by over 70% since 2018.

Group revenues decreased moderately to €98,990 million (2019: €104,210 million; -5.0%). Profit before financial result decreased significantly to € 4,830 million (2019: € 7,411 million; -34.8%). Profit before tax fell to € 5,222 million (2019: € 7,118 million; -26.6%) partly reflecting the negative impact of unfavorable currency factors. The Group’s pre-tax margin came in at 5.3% (2019: 6.8%).

The Automotive segment’s EBIT margin for the year finished at 2.7% (2019: 4.9%). The BMW Group thus met its forecast of achieving an EBIT margin within the upper third of the targeted range of 0 to 3%. The fourth-quarter EBIT margin even improved year-on-year, rising to 7.7% in the final three-month period of 2020 (Q4 2019: 6.8%). Free cash flow generated by the Automotive segment also developed positively during the second half of the year, turning around from a pandemic-related negative free cash flow in the first six-month period to a positive free cash flow for the full year of € 3,395 million (2019: € 2,567 million), with good contributions coming from improving earnings and more efficient inventories management. Other factors affecting free cash flow were the lower amount of warranty provisions utilized, higher proceeds from the sale of pre-owned vehicles and increased advance payments from dealerships during the final quarter.