“Chevrolet, GMC, Buick and Cadillac were especially well prepared when demand recovered faster than expected – Chevrolet and GMC with their outstanding full-size and midsize pickups. All with a mix of new small- and full-size SUVs, which we launched on time despite the pandemic, said CEO Barra.

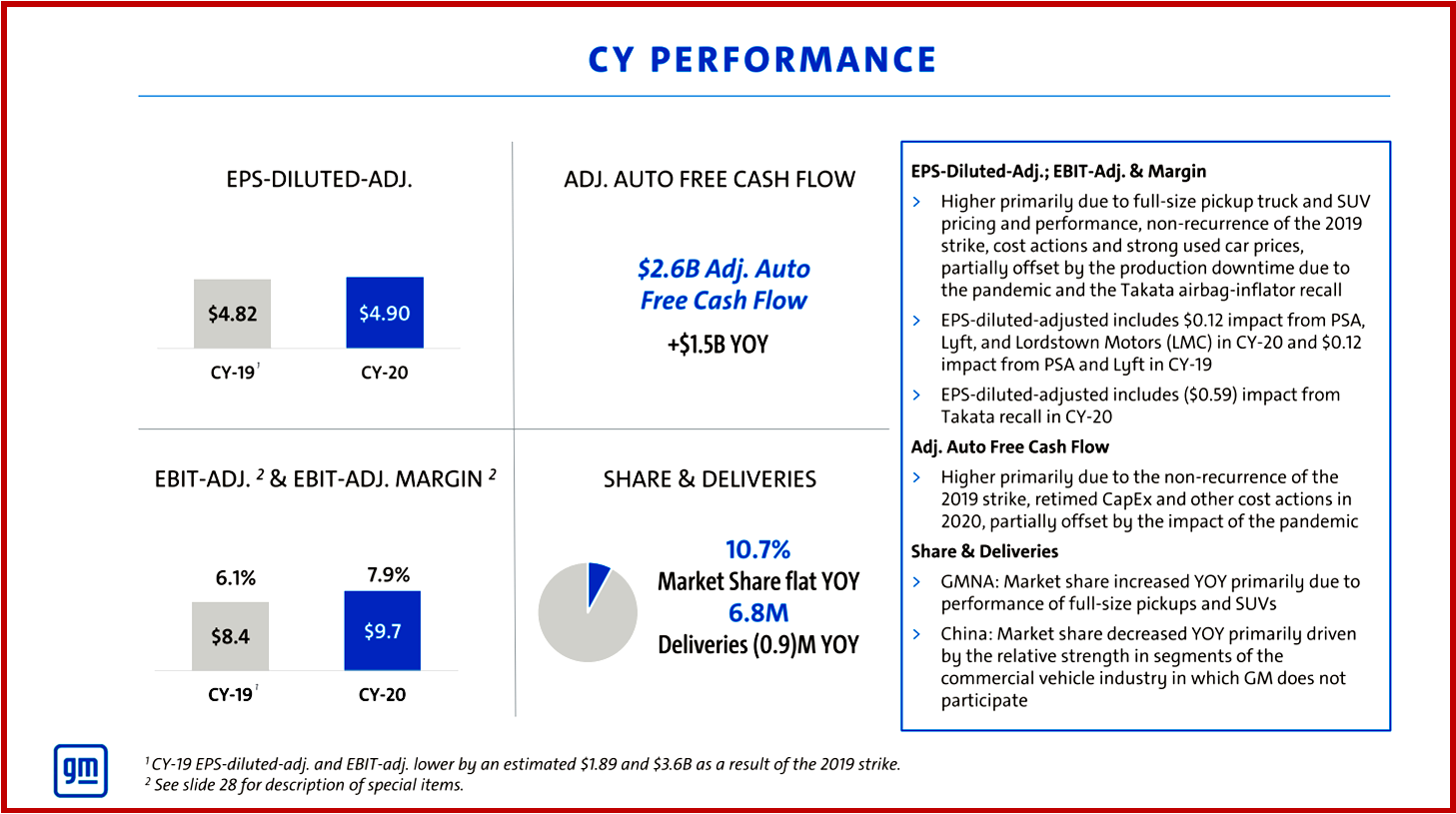

General Motors Co. (NYSE: GM) today reported 2020 full-year Earnings of $6.427 billion and Q4 earnings of $2.846 billion – both hurt by production interruptions caused by the COVID-19 pandemic and the Takata airbag-inflator recall announced in November. For the full year GM’s market share was flat at 10.7%; deliveries declined 900,000 at 6.8 million.

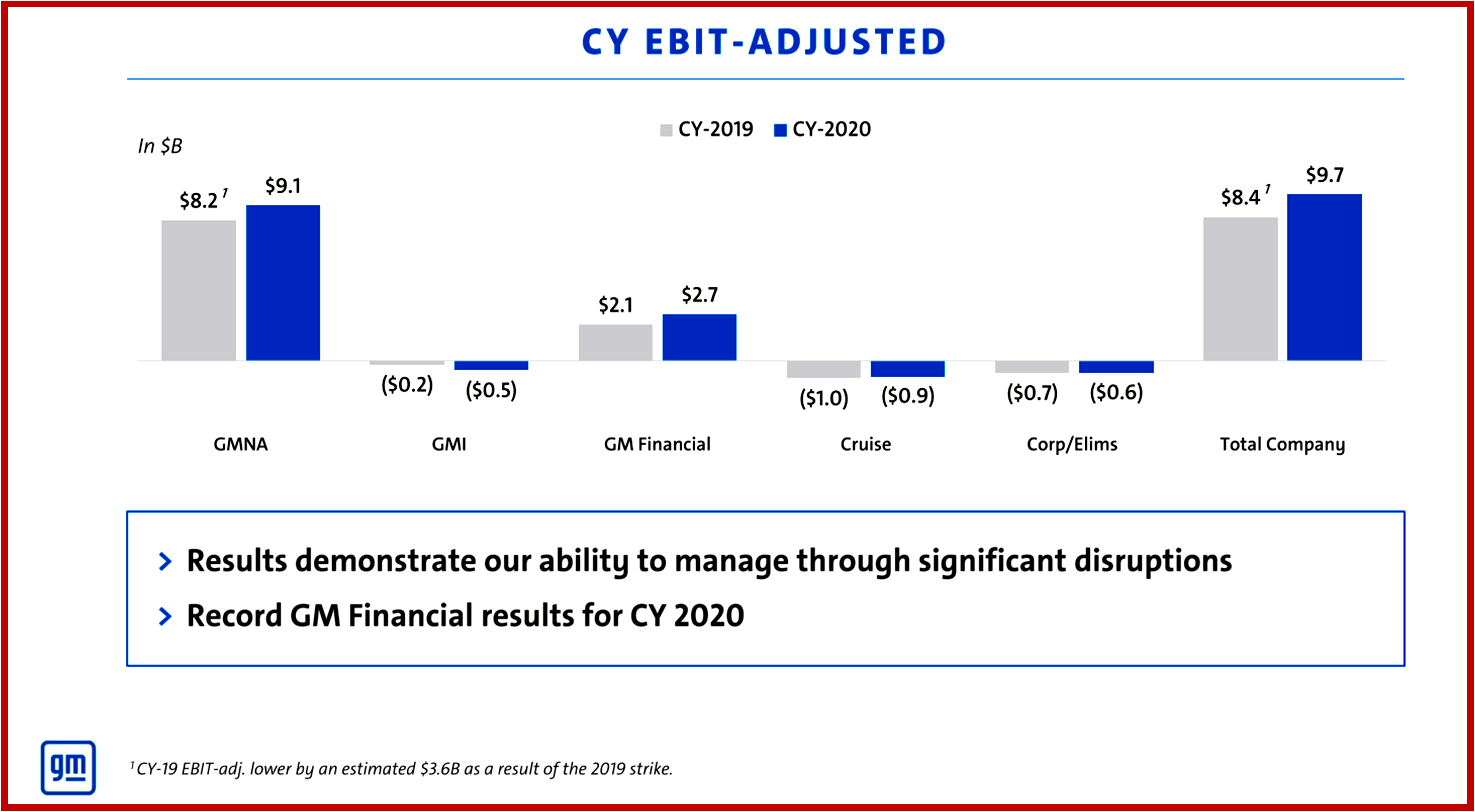

GM Financial reported record full-year EBT-adjusted of $2.7 billion. GM North America posted full-year EBIT-adjusted of $9.1 billion, and EBIT-adjusted margin of 9.4%. GM International lost money at a full-year EBIT-adjusted of $(0.5) billion with China Equity Income of $0.5 billion. Cruise struggled with a full-year EBIT-adjusted loss of $(0.9) billion. (see AutoInformed – NHTSA Nixes GM Petition for Exclusion of Millions of Big Trucks and SUVs from Takata Airbag Recalls, GM 2020 US Sales – Infected by Covid – Are Down -12%, GM to Make CAMI a Commercial Electric Vehicle Plant, GM, Cruise, Microsoft to Commercialize Self-Driving Vehicles)

In a letter to shareholders, GM Chairman and CEO Mary Barra noted, “During the pandemic, we also found better and faster ways to work, and accelerated mission-critical growth businesses like our electric and self-driving vehicle initiatives. For example:

In a letter to shareholders, GM Chairman and CEO Mary Barra noted, “During the pandemic, we also found better and faster ways to work, and accelerated mission-critical growth businesses like our electric and self-driving vehicle initiatives. For example:

- We increased our EV and AV investments to $27 billion from 2020 through 2025. That includes launching 30 EVs globally and achieving EV market leadership in North America. By mid-decade, GM is aiming to sell a million EVs per year in our two largest markets – North America and China, with our joint venture partners. (Environmental About Face – General Motors Ditching Internal Combustion Engines by 2035. Carbon Neutral by 2040?, GM to Sell Navistar Hydrotec Fuel Cell Power Cubes for EVs)

- Ultium Cells LLC, our joint venture with LG Chem, broke ground on a nearly 3-million-square-foot plant in Lordstown, Ohio that will produce millions of battery cells every year.

- We announced Ultifi, a reimagined, personalized EV customer experience with a single platform that simplifies discovery, education and management of GM products and services.

- And we introduced Periscope, a new safety brand that integrates vehicle technology, research and advocacy for policies that promote safer driving.”

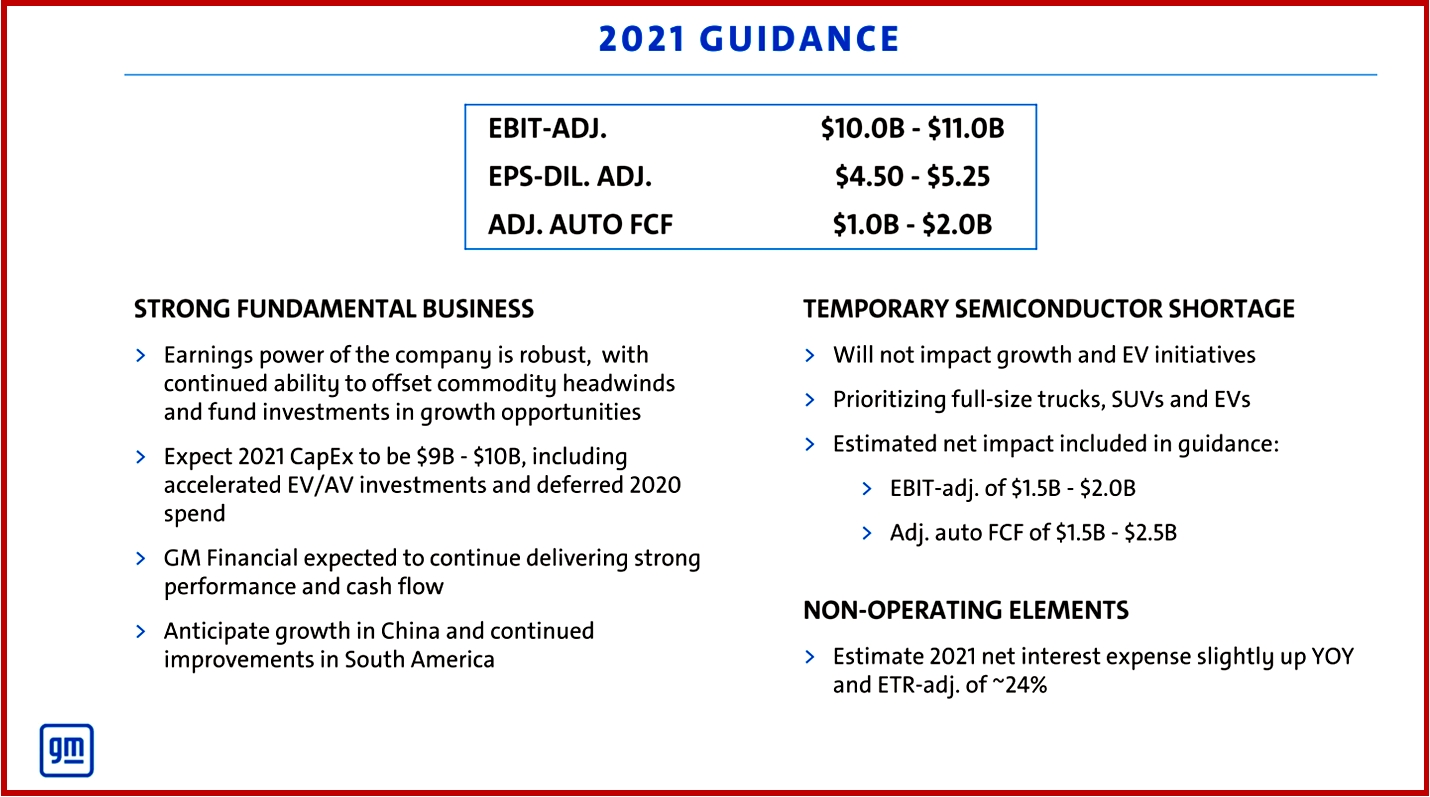

CEO Barra also said during the earnings call the chip shortage could cut $2 billion from 2021 profits but the sales of high-profit trucks would not be affected. GM had previously announced that three of its North American plants – Fairfax in Kansas City, Kansas, CAMI in Ingersoll, Ontario and San Luis Potosi in Mexico — would be down for a week due to the chip shortage. Now the shutdown will extend through at least mid-March when it will reconsider its production plans.

GM Full-year 2020 highlights

- EPS-diluted of $4.33, and EPS-diluted-adjusted of $4.90

- Full-year income of $6.4 billion, and EBIT-adjusted of $9.7 billion

- Full-year EBIT-adjusted margin of 7.9%

- Full-year automotive operating cash flow of $7.5 billion, and adjusted automotive free cash flow of $2.6 billion

- GM North America full-year EBIT-adjusted of $9.1 billion, and EBIT-adjusted margin of 9.4%

- GM International full-year EBIT-adjusted of $(0.5) billion

- China Equity Income of $0.5 billion

- Cruise full-year EBIT-adjusted of $(0.9) billion

- GM Financial reported record full-year EBT-adjusted of $2.7 billion

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

General Motors Posts 2020 Earnings of $6.4 Billion. Q4 at $2.8B

“Chevrolet, GMC, Buick and Cadillac were especially well prepared when demand recovered faster than expected – Chevrolet and GMC with their outstanding full-size and midsize pickups. All with a mix of new small- and full-size SUVs, which we launched on time despite the pandemic, said CEO Barra.

General Motors Co. (NYSE: GM) today reported 2020 full-year Earnings of $6.427 billion and Q4 earnings of $2.846 billion – both hurt by production interruptions caused by the COVID-19 pandemic and the Takata airbag-inflator recall announced in November. For the full year GM’s market share was flat at 10.7%; deliveries declined 900,000 at 6.8 million.

GM Financial reported record full-year EBT-adjusted of $2.7 billion. GM North America posted full-year EBIT-adjusted of $9.1 billion, and EBIT-adjusted margin of 9.4%. GM International lost money at a full-year EBIT-adjusted of $(0.5) billion with China Equity Income of $0.5 billion. Cruise struggled with a full-year EBIT-adjusted loss of $(0.9) billion. (see AutoInformed – NHTSA Nixes GM Petition for Exclusion of Millions of Big Trucks and SUVs from Takata Airbag Recalls, GM 2020 US Sales – Infected by Covid – Are Down -12%, GM to Make CAMI a Commercial Electric Vehicle Plant, GM, Cruise, Microsoft to Commercialize Self-Driving Vehicles)

CEO Barra also said during the earnings call the chip shortage could cut $2 billion from 2021 profits but the sales of high-profit trucks would not be affected. GM had previously announced that three of its North American plants – Fairfax in Kansas City, Kansas, CAMI in Ingersoll, Ontario and San Luis Potosi in Mexico — would be down for a week due to the chip shortage. Now the shutdown will extend through at least mid-March when it will reconsider its production plans.

GM Full-year 2020 highlights

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.