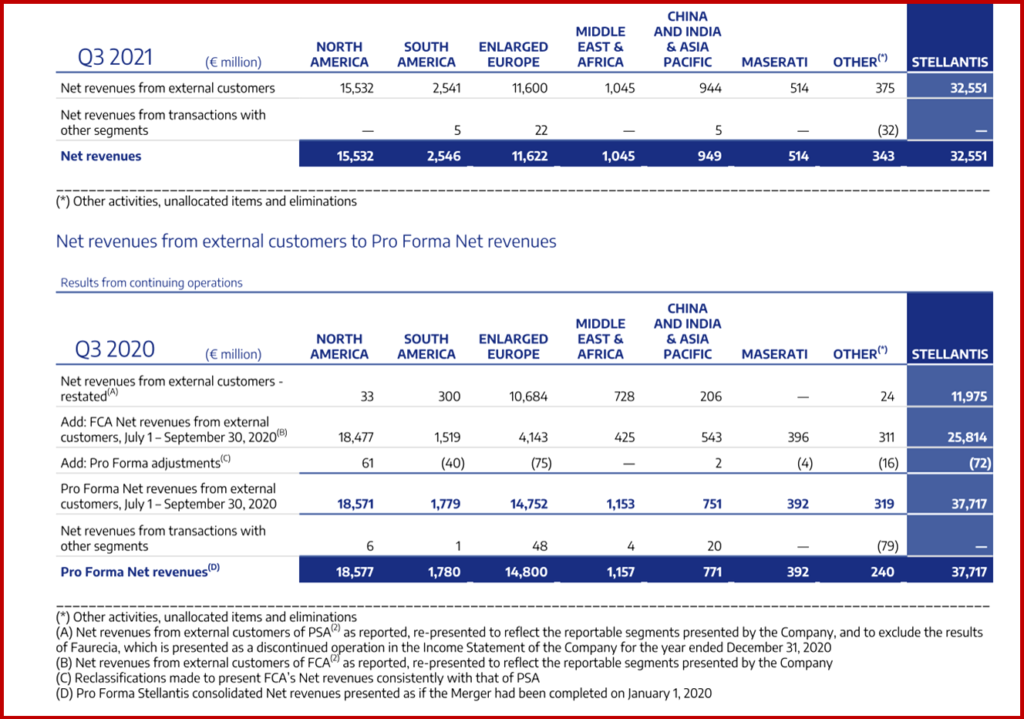

Stellantis late yesterday reported Q3 net revenues of €32.6 billion, a decrease of -14% year-over-year. Even with improved vehicle mix and positive net pricing helping revenues, this was more than offset by lower volumes. Results were based on shipments of 1,131,000 units, down 27% compared to Q3 2020. This was primarily the result of the loss of ~30% of Q3 2021 planned production of 600,000 units because of unfilled semiconductor orders.

Click to Enlarge.

As always executives tried to spin the weak performance positively.

“Stellantis’ Q3 net revenues reflect the success of our recent vehicle launches, including new electrified offerings, combined with significant commercial and industrial actions executed by our teams in response to unfilled semiconductor orders. Full year guidance1 is therefore confirmed despite continued poor visibility of component supply” said Richard Palmer, CFO. (Stellantis Posts Record H1 Results. Full-Year Guidance Upped, Stellantis New Credit Line €12B Tops PSA and FCA Combined)

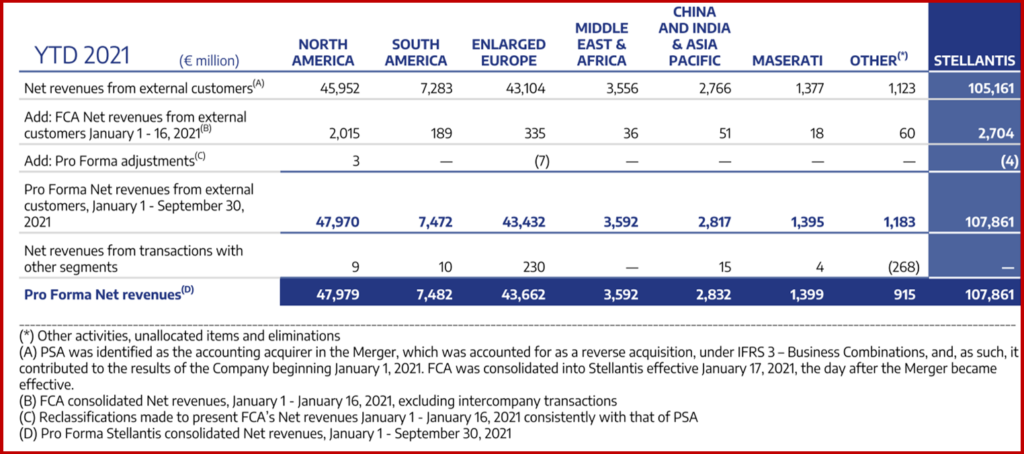

The company spun the weak results as positive. Click to Enlarge.

There is some reason for the optimism. New vehicle launches this year include the DS 4, Jeep Grand Cherokee L, Opel Mokka and Peugeot 308. In September, the all-new Grand Wagoneer and Wagoneer went on sale. And the all-new Jeep Grand Cherokee along with the first-ever electrified Grand Cherokee 4xe in the queue.

Segment Results (all market shares as of Q3 2021)

- EU30 Commercial Vehicles market leader with 32.0% share.

- U.S. retail share up 50 bps from Q2 2021 to 11.5%.

- Maintained market leadership in South America, Brazil and Argentina with 24.4%, 35.6% and 31.0% share, respectively.

- Maserati market share up 40 bps y-o-y to 2.4%. Started deliveries of all-new Maserati MC20.

Strategic Partnerships

- Electrification strategy accelerating with several strategic partnerships announced to expand battery cell capacity across Europe and North America.

- Entered definitive agreement to acquire First Investors Financial Services Group, a significant milestone to establishing a captive U.S. finance company.

- Mercedes-Benz to join ACC JV as equal partner with Stellantis and TotalEnergies; raise cell capacity plan in Europe to at least 120 GWh by 2030

- Entered MOUs with LG Energy Solution and Samsung SDI to form separate battery JVs in North America, providing at least 63 GWh of total cell capacity by 2025

Fine Print and Footnotes

- ~10% of adjusted operating income margin is the net revenue guidance.

AutoInformed on Stellantis

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Posts Q3 Net Revenues of €32.6 Billion -14%

Stellantis late yesterday reported Q3 net revenues of €32.6 billion, a decrease of -14% year-over-year. Even with improved vehicle mix and positive net pricing helping revenues, this was more than offset by lower volumes. Results were based on shipments of 1,131,000 units, down 27% compared to Q3 2020. This was primarily the result of the loss of ~30% of Q3 2021 planned production of 600,000 units because of unfilled semiconductor orders.

Click to Enlarge.

As always executives tried to spin the weak performance positively.

“Stellantis’ Q3 net revenues reflect the success of our recent vehicle launches, including new electrified offerings, combined with significant commercial and industrial actions executed by our teams in response to unfilled semiconductor orders. Full year guidance1 is therefore confirmed despite continued poor visibility of component supply” said Richard Palmer, CFO. (Stellantis Posts Record H1 Results. Full-Year Guidance Upped, Stellantis New Credit Line €12B Tops PSA and FCA Combined)

The company spun the weak results as positive. Click to Enlarge.

There is some reason for the optimism. New vehicle launches this year include the DS 4, Jeep Grand Cherokee L, Opel Mokka and Peugeot 308. In September, the all-new Grand Wagoneer and Wagoneer went on sale. And the all-new Jeep Grand Cherokee along with the first-ever electrified Grand Cherokee 4xe in the queue.

Segment Results (all market shares as of Q3 2021)

Strategic Partnerships

Fine Print and Footnotes

AutoInformed on Stellantis

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.