Click for more information.

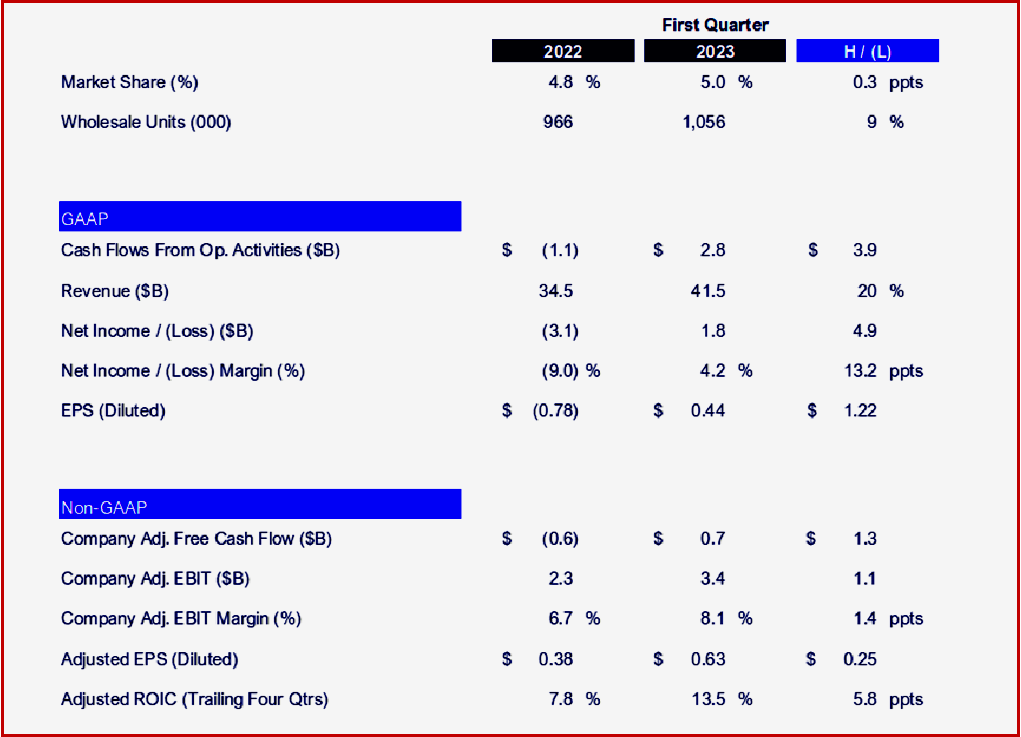

Late yesterday Ford Motor posted Q1 2023 revenue of $41.5 billion, up 20% from the same period a year ago on shipments ~1.1 million vehicles, a 9% increase with $1.5B in net income. A year ago Ford posted a net loss of $3.1 billion. However, in an SEC filing today, Ford said it projects restructuring charges between $1.5 billion and $2 billion in 2023 by reducing employees and exiting unprofitable locations. Brazil, Europe and India appear to be likely restructuring targets. US headcount cuts remains an open question.

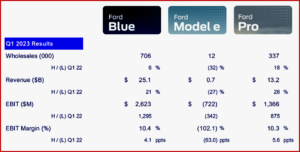

“The first quarter of organizing around and running the company on behalf of distinct customer groups produced solid operating results and a glimpse of the promise of its Ford+ growth plan,” said Ford CEO Jim Farley. Ford reaffirmed guidance for full-year 2023 adjusted EBIT of $9 billion to $11 billion. Profitability in Q1 was helped by a favorable mix of products, higher net pricing and increased volume and was broadly based geographically. However its EV business is still hemorrhaging money, posting a loss of $722 million.

Click for more information.

Ford Credit’s earnings before taxes of $303 million were down from last year because of a lower financing margin, increased credit losses and a decline in leasing income. The company’s credit-loss performance remains below its historical average but is “trending upward toward more normal levels.” Auction values remain strong, though down from their peak in the first half of 2022.

Ford’s operating targets presume complicated variables:

- Headwinds – including economic uncertainty around the globe; higher industry-wide customer incentives, as vehicle supply-and-demand re-balances; a lower profit from Ford Credit; lower past service pension income; exchange rates; and growth-related investments, e.g., in customer experience, connected services and capital expenditures, and

- Tailwinds – such as supply chain improvements and higher industry volumes; launch of the all-new Super Duty truck; and lower costs of goods sold, including for materials and commodities.

Ford will host its next capital markets event on 21 and 22 May, where it will update investors, analysts and others on the Ford+ strategy, including key performance indicators and financial targets for each of the business segments. The company plans to report its second-quarter 2023 financial results on Thursday 27 July.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Q1 Sales, Profits, Cash Flow Up. But…

Click for more information.

Late yesterday Ford Motor posted Q1 2023 revenue of $41.5 billion, up 20% from the same period a year ago on shipments ~1.1 million vehicles, a 9% increase with $1.5B in net income. A year ago Ford posted a net loss of $3.1 billion. However, in an SEC filing today, Ford said it projects restructuring charges between $1.5 billion and $2 billion in 2023 by reducing employees and exiting unprofitable locations. Brazil, Europe and India appear to be likely restructuring targets. US headcount cuts remains an open question.

“The first quarter of organizing around and running the company on behalf of distinct customer groups produced solid operating results and a glimpse of the promise of its Ford+ growth plan,” said Ford CEO Jim Farley. Ford reaffirmed guidance for full-year 2023 adjusted EBIT of $9 billion to $11 billion. Profitability in Q1 was helped by a favorable mix of products, higher net pricing and increased volume and was broadly based geographically. However its EV business is still hemorrhaging money, posting a loss of $722 million.

Click for more information.

Ford Credit’s earnings before taxes of $303 million were down from last year because of a lower financing margin, increased credit losses and a decline in leasing income. The company’s credit-loss performance remains below its historical average but is “trending upward toward more normal levels.” Auction values remain strong, though down from their peak in the first half of 2022.

Ford’s operating targets presume complicated variables:

Ford will host its next capital markets event on 21 and 22 May, where it will update investors, analysts and others on the Ford+ strategy, including key performance indicators and financial targets for each of the business segments. The company plans to report its second-quarter 2023 financial results on Thursday 27 July.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.