US light vehicle sales for 2023 are now forecast at 14.6 million units, according to Patrick Manzi, Chief Economist of the National Automobile Dealers Assn. Light-vehicle sales in April 2023 rose significantly year-over-year at a 15.9 million unit Seasonally Adjusted Annual Rate (SAAR), which was an increase of 11.4% compared with a 14.3 million SAAR for April 2022. (AutoInformed: April US Light Vehicle Sales up 10%). This means that April’s volumes were comparable with pre-pandemic levels as the Biden recovery continues. The question is for how long?

“Increased vehicle availability, which alleviated some consumer and fleet pent-up demand, helped fuel the sales rise. According to Wards Intelligence, fleet sales are forecast to account for 16% of April 2023 sales,” Manzi said. “We expect continued sales improvement driven by greater vehicle availability as more OEMs move past the chip shortage. Our forecast for 2023 is 14.6 million units,” according to Manzi.

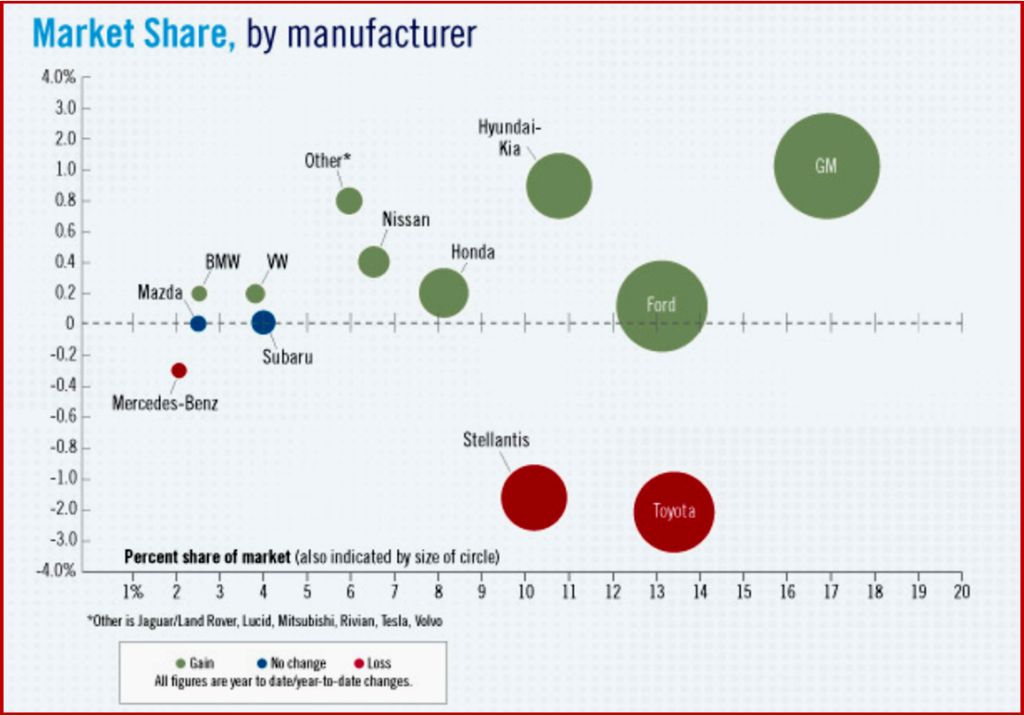

Click chart for more information.

Forecasting is a risky business in these times. Multiple factors are in play. The increasing number of new-vehicle incentives also contributed to the April sales gains. According to J.D. Power, average incentive spending per unit in April is expected to total $1599, an increase of, gulp, 58.9% compared with April 2022. While average incentive spending has risen from extreme lows, it has not increased at the same rate at all automakers. Some brands have been able to finally increase new-vehicle supply, but others are still struggling. To state the obvious, brands with more to sell are positioned to offer incentives. Key here might be the return of Memorial Day sales later at the end of May.

Average interest rates and transaction prices remain high and continue to keep new-vehicle monthly payments elevated. The latest Federal Reserve increase from a target range of 5% to 5.25% could send the US into a deep recession. According to J.D. Power, the average interest rate on a new-vehicle finance contract in April 2023 is expected to be $729, an increase of $48 year-over-year. The average interest rate on a new-vehicle finance contract should reach 6.8% in April 2023, or 227 basis points higher compared with April 2022. Interest rates will now go higher.

And then there’s the debt spending limit, which Republicans are holding hostage US workers and the economy, which threatens a self-induced recession or a Global Depression.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

NADA – 2023 US Sales Forecast at 14.6 Million

US light vehicle sales for 2023 are now forecast at 14.6 million units, according to Patrick Manzi, Chief Economist of the National Automobile Dealers Assn. Light-vehicle sales in April 2023 rose significantly year-over-year at a 15.9 million unit Seasonally Adjusted Annual Rate (SAAR), which was an increase of 11.4% compared with a 14.3 million SAAR for April 2022. (AutoInformed: April US Light Vehicle Sales up 10%). This means that April’s volumes were comparable with pre-pandemic levels as the Biden recovery continues. The question is for how long?

“Increased vehicle availability, which alleviated some consumer and fleet pent-up demand, helped fuel the sales rise. According to Wards Intelligence, fleet sales are forecast to account for 16% of April 2023 sales,” Manzi said. “We expect continued sales improvement driven by greater vehicle availability as more OEMs move past the chip shortage. Our forecast for 2023 is 14.6 million units,” according to Manzi.

Click chart for more information.

Forecasting is a risky business in these times. Multiple factors are in play. The increasing number of new-vehicle incentives also contributed to the April sales gains. According to J.D. Power, average incentive spending per unit in April is expected to total $1599, an increase of, gulp, 58.9% compared with April 2022. While average incentive spending has risen from extreme lows, it has not increased at the same rate at all automakers. Some brands have been able to finally increase new-vehicle supply, but others are still struggling. To state the obvious, brands with more to sell are positioned to offer incentives. Key here might be the return of Memorial Day sales later at the end of May.

Average interest rates and transaction prices remain high and continue to keep new-vehicle monthly payments elevated. The latest Federal Reserve increase from a target range of 5% to 5.25% could send the US into a deep recession. According to J.D. Power, the average interest rate on a new-vehicle finance contract in April 2023 is expected to be $729, an increase of $48 year-over-year. The average interest rate on a new-vehicle finance contract should reach 6.8% in April 2023, or 227 basis points higher compared with April 2022. Interest rates will now go higher.

And then there’s the debt spending limit, which Republicans are holding hostage US workers and the economy, which threatens a self-induced recession or a Global Depression.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.