Ally Financial today announced it has repaid the remaining $4.5 billion in debt issued under the FDIC’s Temporary Liquidity Guarantee Program or TLGP. Ally, formerly GMAC, borrowed the money on in June 2009 at the height of the financial crisis. This follows a payback of $2.9 billion to TLGP last October. (Read AutoInformed on Ally Financial Repays $2.9 Billion of FDIC Debt)

“Repayment of the remaining debt issued under the TLGP marks an important milestone for Ally as we continue our plans to exit the government support programs utilized during the financial crisis,” said Jeffrey Brown, an executive vice president at Ally.

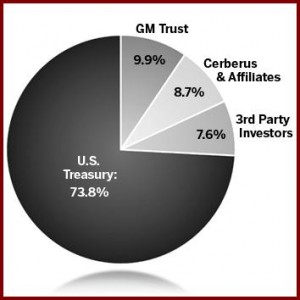

The U.S. Treasury, via taxpayers, currently holds about 74% of Ally common equity, and $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%, after a more than $17 billion bailout. Ally has repaid Treasury $5.8 billion thus far. Ally at the end of Q3 2012 had about $182 billion in assets, so it increasingly looks like taxpayers have a chance of getting their money back. One large caveat here: this doesn’t include the cost of the losses that Ally is allowed to carry forward and avoid taxes as it returns to profitability even with government assistance. The Fed should have been tougher with what was known as GMAC at the time. It looks like it left too much money on the table.

Last October, Ally announced it was selling its Mexican insurance subsidiary, as well as its auto finance and deposit businesses in Canada. With the agreement to sell the operations in Europe, Latin America and the joint venture stake in China to General Motors Financial, Ally will be out international markets when all the transactions close in steps during 2013. In total, these deals are expected to generate proceeds of approximately $9.2 billion, based on third quarter 2012 book value of $7.6 billion, which reflects a premium of approximately $1.6 billion, or 21%.

The GM deal includes auto finance operations in Germany, the U.K., Austria, France, Italy, Switzerland, Sweden, Belgium, the Netherlands, Luxembourg, Brazil, Mexico, Colombia and Chile, as well as a 40% equity stake in a joint venture in China. The combined operations in Europe and Latin America represented ~$16.1 billion in assets at the end of the third quarter 2012.

Ally will receive an approximately $550 million premium to book value, the company claimed, which for the third quarter of 2012 was approximately $3.7 billion. Currently, GM owns 9.9% of the common equity of Ally through an independent trust. Ally had historically provided most of the financing for GM’s dealers and a significant portion of the financing for its customers in the U.S. and Canada and other major international markets. Ally has been GM’s exclusive financing partner for incentivized retail financing programs in its major markets.

GM says that with the addition of Ally’s international operations, GM Financial will be able to provide credit for customers and dealers in markets that make up about 80% of GM’s global sales. In essence, GM is recreating GMAC as Ally goes its own way.

See: