U.S. Treasury converted $5.5 billion of its $11.4 billion in securities issued by Ally into common stock at the end of last year in preparation for an IPO.

Ally Financial Inc. today reported net income of $79 million for the fourth quarter of 2010, compared to a net loss of $5.0 billion for the fourth quarter of 2009.

For full-year 2010, Ally (formerly GMAC and now taxpayers own a majority) reported net income of $1.1 billion, compared to a net loss of $10.3 billion in 2009. Core pre-tax income in 2010 totaled $2.5 billion, compared to a core pre-tax loss of $5.8 billion in the prior year.

Ally’s automotive finance business is one of the leading lenders of U.S. auto loans, and is the leading retail provider of vehicle finance. Ally’s taxpayer financed bailout was and is key to the thus far successful reorganizations of General Motors and Chrysler. U.S. and Canadian taxpayers have large interests in those recovering automakers as well.

The U.S. Treasury is maneuvering to clean up Ally’s books by moving liabilities to other entities and converting bonds into stock, in what critics call financial engineering. However, Treasury supporters say this is required if taxpayer money is to be recouped.

On 30 December 2010, Ally Financial and the U.S. Treasury agreed to convert $5.5 billion of the $11.4 billion of mandatory convertible preferred (MCP) securities issued by Ally and owned by the U.S. Treasury into common equity.

More controversial was a Fannie Mae Settlement. Here the U.S. Federal Government moved Ally liabilities of approximately $292 billion for mortgages that were not written correctly at a cost of $462 million to Ally.

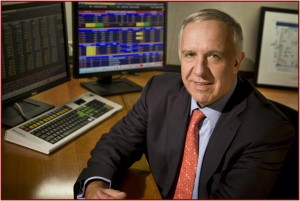

This year is “all about paying back the U.S. Treasury,” Michael A. Carpenter, Ally’s CEO, said on a conference call Tuesday. An initial public stock offering (IPO) is possible sometime this year as the first step toward paying back a $17.2 billion taxpayer bailout.

Ally said the losses reported for the 2009 fourth quarter and full year were largely affected by losses related to “legacy assets” in the mortgage operations.

This was the result of what critics call reckless lending practices in the home mortgage markets, which caused huge Ally losses when the housing bubble burst in 2009.

The U.S. housing market remains in trouble with prices continuing to trend downward and foreclosures at historical highs.

Ally “significantly strengthened the company,” by reducing mortgage risk,” said Carpenter. “This will enable repayment of the U.S. Treasury’s investment over time.”