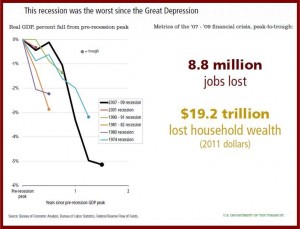

The facts say the U.S. economy is stronger today because of the bailout strategy our legislators adopted. And maybe it won’t happen again under the tepid financial reforms now being put in place under fierce opposition from the same Wall Street people responsible for the financial crisis and Great Recession. To supporters these were the crucial milestones on the road to economic recovery. Critics say the government should have stood back and let the failed markets sort themselves out in 2008, a distinctly dubious proposition bordering on fantasy given that the private capital markets were frozen.

Ally Financial today announced it has repaid $2.9 billion in debt issued under the FDIC’s Temporary Liquidity Guarantee Program (TLGP). It is the latest example of the slowly recovering U.S. economy that was severely harmed by the practices of Wall Street, the financial industry and the ratings agencies that were ignored by both political parties. The bank holding company issued this debt on 30 October 2009 with a maturity date of 30 October 2012. The final Ally debt guaranteed under the TLGP will be repaid in December 2012 and totals $4.5 billion.

“The TLGP enabled Ally to access another source of liquidity during a time when there were limited options for financial institutions,” said Ally Senior Executive Vice President of Finance and Corporate Planning Jeffrey Brown in a statement.

The Ally Financial board of directors has declared a quarterly dividend on outstanding preferred stock effective 15 November 2012. A payment of approximately $134 million, or $1.125 per share, will go to the U.S. Treasury, which has invested $17.2 billion in keeping Ally, formerly GMAC, in business as a bank holding company.

Treasury, courtesy of taxpayers, currently holds about 74% of Ally common equity, and $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%. Ally at the end of Q2 2012 had about $179 billion in assets, so it increasingly looks like taxpayers have a good chance at getting their money paid back.

However, Ally reported a net loss of -$898 million for the second quarter of 2012 because of the charges incurred by the bankruptcy of its home mortgage subsidiary ResCap, which was a full and eager participant in the housing bubble and the packaging of bundled mortgage bonds fraudulently rated as investment grade paper when they were junk. ResCap, chiefly the cause of Ally’s bankruptcy is now off Ally’s balance sheet, but a public stock offering – the way for Treasury to exit from this banking – doesn’t appear likely at this time given Ally’s history and recent results. (See GM Bids on Ally’s International Auto Lending Business)

Nonetheless, including the dividend on the Series F-2 Preferred Stock that Treasury holds, Ally will have paid a total of $5.8 billion back to the U.S. taxpayers since February 2009. This amount includes preferred stock dividends, interest payments and proceeds received by the U.S. Treasury from its sale of Ally trust preferred securities. Treasury has actually made money on its Troubled Asset Relief Program or TARP started under President Bush, which successfully prevented the complete collapse of the global economy when the marketplace failed.

“Ally continues to make significant progress in executing our strategic plans, and the announcements we have made in recent weeks will further enable us to repay the assistance from government programs,” said Brown.

(Two days later Ally Financial reported net income of $384 million for the Q3 of 2012, compared to a net loss of $898 million in the prior quarter and a net loss of $210 million for Q3 of 2011. The company reported cpre-tax income of $559 million for Q3 of 2012, compared to a pre-tax loss of $753 million in the prior quarter and pre-tax income of $119 million in the comparable prior year period. – editor 2 November 2012.)

See: