One wag suggested that it isn't surprising that pigs feeding at the taxpayer trough squeal.

The Federal Reserve late yesterday said that its latest round of bank stress tests show that the majority of the largest U.S. banks would have adequate capital under an extremely adverse hypothetical economic scenario. Flunking the test however was Ally Financial, formerly GMAC, which was subject to a huge taxpayer financed bailout of more than $17 billion.

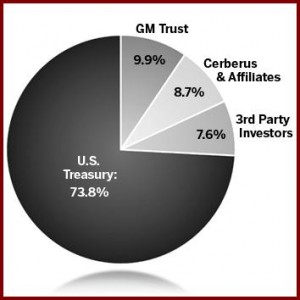

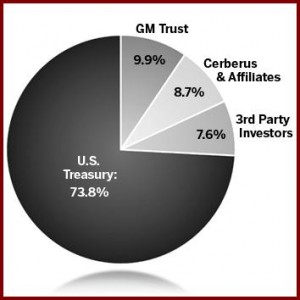

Taxpayers still own more than 70% of Ally, with the owner – the Fed – saying it does not have enough capital to endure a theoretical recession that would produce an unemployment rate of 13% percent, a 21% drop in housing prices and as economic slowdowns in Europe and Asia. This admittedly severe test – surpassing even the Bush Administration’s dismal record of economic stewardship – may or may not be anything more than an academic exercise.

Ally disputed the report in three areas saying:

- The analysis dramatically overstates potential contingent mortgage risk, especially with respect to newer vintages of loans.

- It does not reflect management’s track record or commitment to address the legacy contingent mortgage risks.

- It does not adequately contemplate contingent capital that already exists within Ally’s capital structure that could be available at the Federal Reserve’s discretion in the event there was concern about Ally’s capital adequacy.

In what I take to be a gratuitous insult to taxpayers, Ally added, “Further, the Federal Reserve has not objected to the ongoing payments of preferred dividends and interest on the trust preferred securities and subordinated debt.”

Darn right we expect you to pay interest on the loans.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.