From January to April, Germany (+1.8%) and the UK (+1.4%) barely increased demand in the region, while the rest of the major markets faced contractions ranging from -7.0% in Spain to -17.5% in France and -20.2% in Italy.

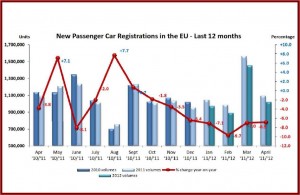

In April, 1,017,912 new passenger cars were registered in the EU, or 6.9% fewer than in the same month of 2011. For the first four months of the year, new registrations were 7.5% lower in the EU than a year earlier at 4,332,342 units. This means the EU remains on track for the fifth straight year of sales declines, an economic disaster that has potential negative effects on Fiat, Ford Motor and General Motors in North America.

As usual, the markets were uneven. The UK (+3.3%) and Germany (+2.9%) were the only major countries to post growth, while France contracted by 1.9%. Italy at -18.0% and Spain at -21.7% posted devastating double-digit downturns.

From January to April, Germany (+1.8%) and the UK (+1.4%) barely increased demand in the region, while the rest of the major markets faced contractions ranging from -7.0% in Spain to -17.5% in France and -20.2% in Italy.

Once again, Volkswagen group proved its relative strength in April by capturing almost 25% of the market, a slight gain year-over-year. PSA Group was second at 13% share, also a gain y-o-y. Renault Group followed in third place at 8.6%, off almost a full percentage point y-o-y.

Of interest to GM shareholders, the Opel/Vauxhall regional brand continued its sales decline at 66,160 vehicles for a 6.5% share, while Chevrolet – GM’s self-anointed global brand – increased its sales to 17,574 vehicles for a 1.7% share. This means that together, GM Group sales were ahead of Ford Motor with GM’s 8.2% share or 84,000 vehicles and 7.6% or 77,000 vehicles for Ford.

Fiat Group, the owner of Chrysler, managed a 7.3% share at 74,000 vehicles in spite of the collapse of the Italian government and auto market.