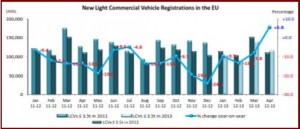

In a classic half empty or half-full interpretive dilemma, commercial vehicle sales in the EU increased 3.6% for the first time since December 2011. The uptick came mostly from demand for new vans (+5.8%). However, this year, the EU counted on average two more working days compared to the same month in 2012 because of how the Easter holiday fell.

In absolute numbers, total number registrations were 100,000 units below the pre-crisis level recorded in April 2008. Looking at the major markets, the UK significantly expanded (+29.5%), while Spain (+7.0%) and Germany (+3.7%) recorded more moderate growth. The French (-3.8%) and Italian (-20.2%) markets shrank.

Four months into the year, only the UK posted growth (+11.3%), as a downturn prevailed in France (-9.0%), Germany (-11.2%), Spain (-12.9%) and Italy (-23.9%). Overall, the EU registered 545,049 new vehicles, or -7.6% fewer than in the first four months of 2012.

Vans weighing up to 3.5 tons were the only group to post growth in April (+5.8%) at 116,657 units. The UK (+43.0%), Spain (+11.5%), and Germany (+6.6%) showed positive numbers. On the other side of the sales ledger, France (-4.0%) and Italy (-22.2%) saw demand decline.

During January to April, new van registrations were down in all major markets, except in the UK (+17.6%), falling -8.8% in France, -9.9% in Germany, -12% in Spain and -25% in Italy. A total of 449,094 vehicles were registered in the EU during the first four months of the year, or -6.3% less than in the same period a year ago.

New registrations of heavy trucks weighing over 16 tons decreased by -5.8% in April at 18,252 units. The Italian market slightly expanded (+2.7%), while the German (-2%), Dutch (-3.3%), French (-4.8%), Spanish (-17.5%) and UK (-17.9%) all contracted. Over four months, all significant markets shrank, from -13.6% in France to -13.7% in Italy, -14.0% in the UK, -14.4% in Germany, -18.1% in the Netherlands and -19.7% in Spain, leading to an overall -13.8% downturn in the EU.