Truck/SUVs are on pace to account for 76.1% of new-vehicle retail sales in April.

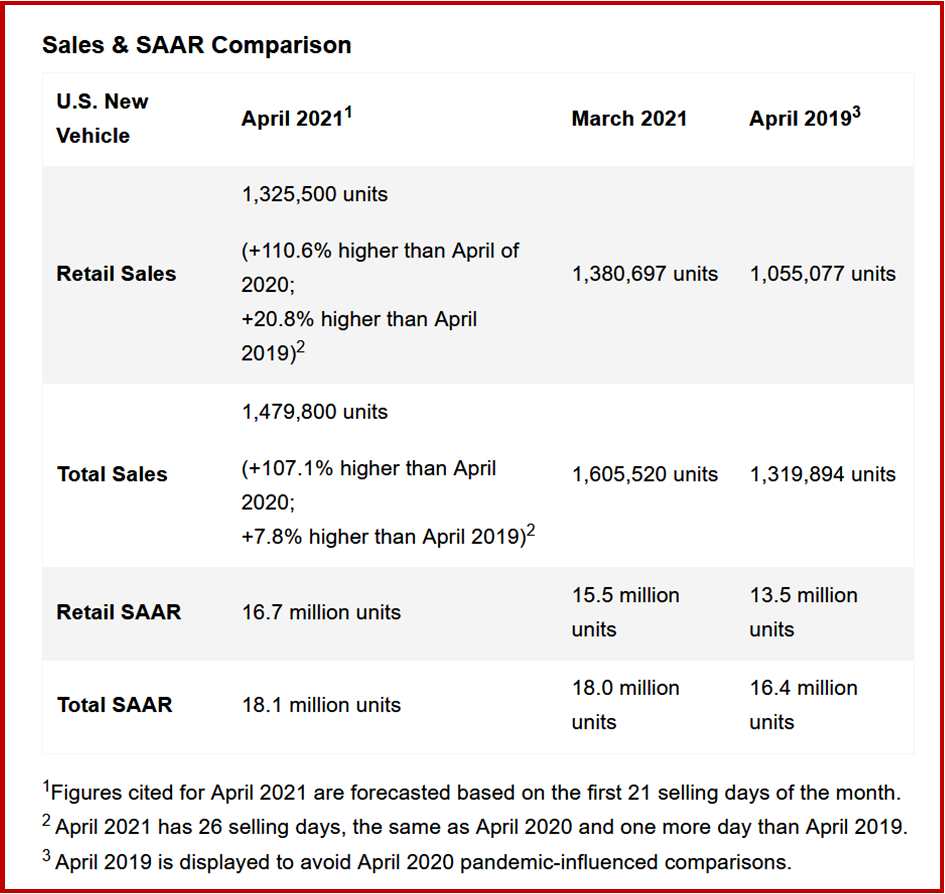

New-vehicle retail sales for April 2021 are expected to be the highest ever recorded for the month of April, according to a joint forecast from J.D. Power and LMC Automotive just issued. Retail sales for new vehicles are projected to reach 1,325,500 units, a 110.6% increase compared with April 2020, and an 20.8% increase compared with April 2019, when adjusted for selling days.*

Total new-vehicle sales for April 2021, including retail and non-retail transactions, are forecast to reach 1,479,800 units, a 107.1% increase from April 2020 and a 7.8% increase from April 2019 when adjusted for selling days. Reporting the same numbers without controlling for the number of selling days translates to a 107.1% increase from April 2020 and a 12.1% increase from April 2019. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 18.1 million units, up 9.4 million units from 2020 and up 1.7 million units from 2019.

“Despite low inventory, April 2021 will be another record-breaking month for the U.S. auto industry. Building on the strength that began in Q4 2020 and continued through Q1 2021, the industry will set records for April sales volumes, transaction prices, consumer expenditure and retailer profitability, said Thomas King, president of the data and analytics division at J.D. Power.

“However, with the sales pace exceeding the rate at which vehicles are being produced, compounded by significant production disruption due to microchip shortages, there is a growing risk to the industry’s ability to sustain the current sales pace in the coming months,” said King.

Trends

- The average new-vehicle retail transaction price in April is expected to reach a monthly record $37,572. The previous high for any month, $37,966, was set in December 2020.

- Average incentive spending per unit in April is expected to fall to $3,191, down from $4,953 in April 2020 and $3,573 in April 2019. Spending as a percentage of the average MSRP is expected to fall to 7.5%, down 4.2 percentage points from April 2020 and down 1.5 percentage points from April 2019.

- Average incentive spending per unit on trucks and SUVs combined in April is expected to be $3,173, down $1,989 from a year ago and down $445 from 2019, while the average spending on cars is expected to be $3,219, down $1,049 from a year ago and down $247 from 2019.

- Consumers are on pace to spend $49.8 billion on new vehicles, the highest ever for the month of April, and up $27.7 billion from April 2020 and up $14.2 billion from April 2019.

- Truck/SUVs are on pace to account for 76.1% of new-vehicle retail sales in April.

- Fleet sales are expected to total 154,400 units in April, up 81% from April 2020 and down 44% from April 2019 on a selling day adjusted basis. Fleet volume is expected to account for 10% of total light-vehicle sales, down from 12% a year ago.

- China’s Passenger Vehicle (PV) sales (i.e., wholesales) rose by 75.3% year-on-year (YoY) to 1.93 mn units in March 2021. The Light Commercial Vehicle (LCV) segment also performed well, posting growth of 55.5% YoY to 0.42 mn units, according to LMC.

*April 2021 contains the same number of selling days as April 2020 and one more selling day than April 2019. Comparing the same sales volume without adjusting for the number of selling days translates to a year-over-year increase of 110.6% from 2020 and a 25.6% increase from 2019.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

April US Auto Sales About to be Highest Ever. Blip or Trend?

Truck/SUVs are on pace to account for 76.1% of new-vehicle retail sales in April.

New-vehicle retail sales for April 2021 are expected to be the highest ever recorded for the month of April, according to a joint forecast from J.D. Power and LMC Automotive just issued. Retail sales for new vehicles are projected to reach 1,325,500 units, a 110.6% increase compared with April 2020, and an 20.8% increase compared with April 2019, when adjusted for selling days.*

Total new-vehicle sales for April 2021, including retail and non-retail transactions, are forecast to reach 1,479,800 units, a 107.1% increase from April 2020 and a 7.8% increase from April 2019 when adjusted for selling days. Reporting the same numbers without controlling for the number of selling days translates to a 107.1% increase from April 2020 and a 12.1% increase from April 2019. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 18.1 million units, up 9.4 million units from 2020 and up 1.7 million units from 2019.

“Despite low inventory, April 2021 will be another record-breaking month for the U.S. auto industry. Building on the strength that began in Q4 2020 and continued through Q1 2021, the industry will set records for April sales volumes, transaction prices, consumer expenditure and retailer profitability, said Thomas King, president of the data and analytics division at J.D. Power.

“However, with the sales pace exceeding the rate at which vehicles are being produced, compounded by significant production disruption due to microchip shortages, there is a growing risk to the industry’s ability to sustain the current sales pace in the coming months,” said King.

Trends

*April 2021 contains the same number of selling days as April 2020 and one more selling day than April 2019. Comparing the same sales volume without adjusting for the number of selling days translates to a year-over-year increase of 110.6% from 2020 and a 25.6% increase from 2019.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.