Click for more and to enlarge.

“We have a slowing economy with high interest rates,” said Jonathan Smoke,** Chief Economist at Cox Automotive. “We are seeing the slowing consumer spending. The conundrum is in the details as some metrics like inflation have moved down in the short term, indicating a resilient economy, possibly tipping into reheating. However, other data like retail sales and consumer spending suggest inflation has finally caused consumers to pause on spending. Meanwhile, the Fed made what sounded like a dovish decision in the last week, reiterating that rates would be cut likely three times before the year end. But not yet. We also in the new vehicle market see a normalizing new vehicle supply and that I would call out is the biggest change in the auto market – what we saw last year and is likely to continue in 2024. Namely, that new vehicle inventories will continue to build and new vehicle supply will be close to what it was in 2019. Deliveries are growing as production is normalized, but demand appears to be limited, or at least not keeping up. It is not one thing, but several with affordability limiting; and what’s possibly satiated pent up demand and growing EV supply.”

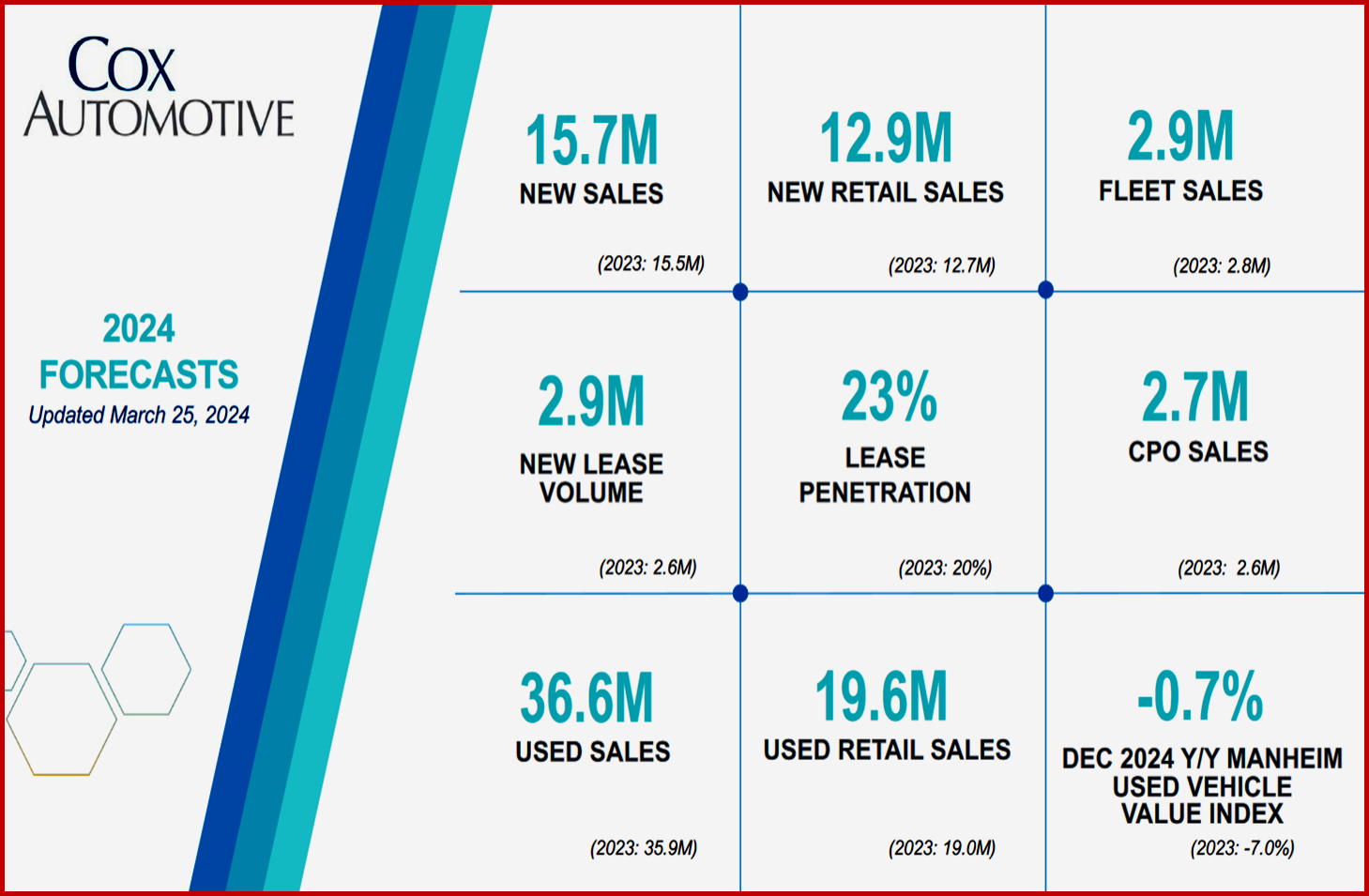

The data suggest that healthy sales are being supported by significantly improved new-vehicle inventory levels. At the beginning of March, the total supply of available new vehicles was up more than 50% compared to last March, according to the latest vAuto Live Market View data. The March seasonally adjusted annual rate (SAAR), or selling pace, is expected to finish near 15.5 million, up 0.6 million over last year’s pace but down slightly from February’s surprisingly strong 15.8 million level. This March has 27 sales days, the same as last year but two more than last month. Through Q1, the SAAR is forecast at 15.4 million, up from 15.0 million, or a 2.7% increase, compared to Q1 2023.