An automotive “going out of business sale” is now underway at American Suzuki. The slogan “Small Cars for a Big Future” won’t apply in the U.S.

American Suzuki Motor Corporation today said that it has received Bankruptcy Court approval to allow Ally Financial to continue providing dealer and buyer financing while it sells off its remaining inventory of small cars. The irony here is that a bankrupt Japanese company is being helped by a U.S. company that was previously bankrupt but bailed out. The U.S. Treasury, courtesy of taxpayer funding, currently holds about 74% of Ally common stock after a bailout that allowed it to survive. Taxpayers also hold $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%, so it’s not all bad since taxpayers have made a profit from the Troubled Assets Relief Program.

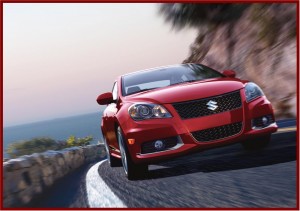

ASMC entered Chapter 11 protection for its U.S. auto business earlier this month with the intention of stopping the sale of vehicles in the U.S. In October of 2012, Suzuki sold just 2,039 of small cars and light trucks or 0.018 % of the U.S. retail auto market. Year-to-date fewer than 22,000 Suzuki vehicles were sold.

Moreover on 7 November 2012, ASMC was given the right to continue its financing deals with GE Capital’s Retail Finance and Commercial Distribution Finance businesses, which provide motorcycle and ATV consumer financing programs, as well as motorcycle, ATV and marine dealer inventory financing. By court approval of these motions, dealers and consumers of Suzuki products will continue to have access to wholesale and retail financing, as they did before Suzuki’s bankruptcy filing. The bankruptcy Court also approved the continuation of existing agreements with Sheffield Financial for consumer financing for motorcycle and ATV products.

Suzuki entered the U.S. market with its ill-fated and rollover prone Samurai mini-SUV in the mid-1980s. Suzuki was never to able to sell its vehicles in large numbers here because of their small size and dubious safety image. Elsewhere in the world, notably Japan, India and Asia, Suzuki remains a strong factor in the mini-vehicle market, as well in the motorcycle and mini-cycle business. However, margins in the U.S. were not high enough on Suzuki vehicles to promote the brand effectively against global automotive giants with larger and more profitable lineups and therefore huge advertising and marketing budgets.

Suzuki intends to redirect its U.S. business to motorcycles, ATVs and marine products. Suzuki had debt of $346 million at the end of September, of which $173 million is owed to Suzuki group companies held by Suzuki Motor Corporation. Capitalization was a slim $64 million.

In a statement, ASMC said it is working with its current U.S. automotive dealers to help structure a “smooth transition” from new automobile sales to one where only parts and service operations are offered. ASMC intends to market and sell its remaining U.S. automobile inventory through its dealers as long as cars legally certified remain available. Through and after the restructuring, all warranties will be honored and automobile parts and services will be provided to consumers through the dealer network ASMC claimed.

See: