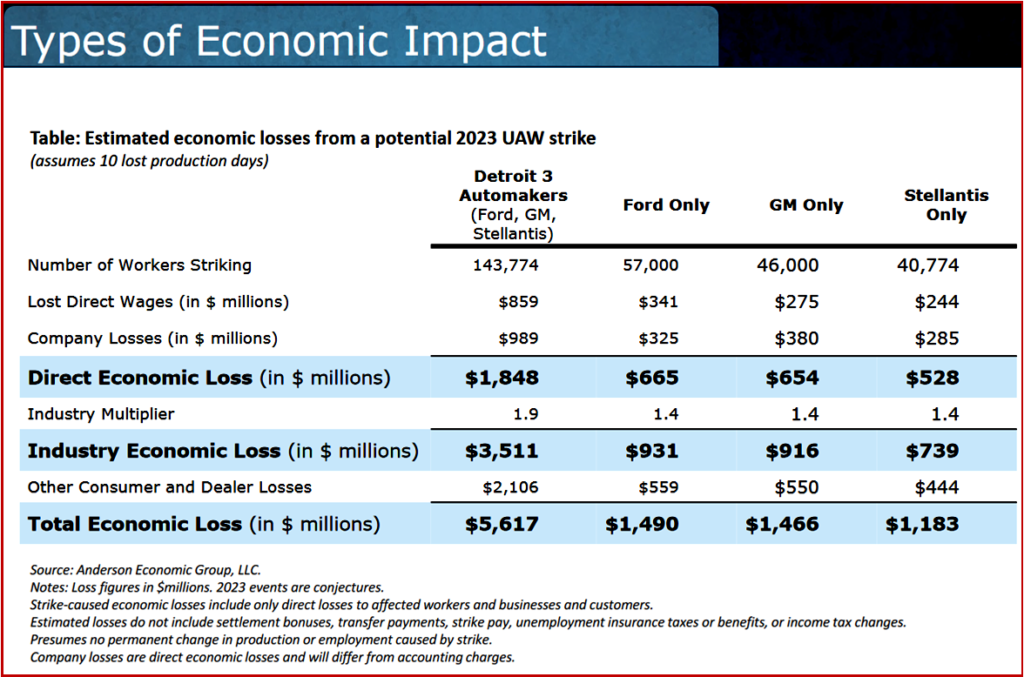

A new analysis presented to the Automotive Press Association today by consulting firm Anderson Economic Group (AEG)* estimates that a strike on all three automakers by 143,000 United Auto Workers (UAW) members could result in a total economic loss of more than $5 billion after 10 full days. The UAW contract expires on 14 Sept, and it covers 150,000 autoworkers at Ford, General Motors and Stellantis. Wage losses if a strike occurs are at ~$859 million. AEG calculated the total economic loss by estimating potential losses to UAW workers, the manufacturers, and to the auto industry more broadly if negotiations are not successful before the current contract expires in September.

“When the UAW went on strike against GM in 2019, Michigan experienced a single quarter recession,” said Patrick Anderson, AEG’s principal and CEO. That strike, which involved 48,000 workers at more than 50 plants, lasted six weeks. In 2023, there appears that at the moment there is the potential that a strike could involve more manufacturers, workers and plants, which makes theoretical comparisons difficult until there are more data points. “If that (all makers are struck) happens, even a short strike would impact economies throughout Michigan and across the nation,” said Anderson.*

“Consumer and dealer losses are typically somewhat insulated in the event of a very short strike,” said Tyler Theile, vice president at AEG. “However, with current inventories hovering around only 55 days, the industry looks different than it did in during the last UAW strike.” She noted that automakers now have “about one-fifth of the inventory that was on-hand in 2019, so a strike in current conditions would likely affect dealers and customers much sooner.”

Vehicle inventory, which was at record lows during the pandemic, has been slowly trending upward to reach 162,000 units in June. However, it is still well below September 2019’s 649,000 units, the time of GM’s infamous strike. That UAW strike lasted 40 days, becoming the longest national walkout against the automaker since a 67-day strike in 1970. Almost 50,000 workers became involved, and it shut down 33 manufacturing plants across the US, which GM reported cost it 300,000 units of production and $4 billion. GM’s Silao and Ramos Arizpe plants in Mexico as well as its Oshawa plant in Canada were also impacted due to a parts shortage from the strike. As a result of the halted production, GM’s inventory fell from 795,000 units in August 2019 to 649,000 units in October 2019 and consequently, YoY sales dropped in September and October, according to an analysis by the consultancy GlobalData

This time around, AEGs consultants followed its proven, accurate methodology used to estimate impacts from the 2019 UAW strike, the threatened 2022 rail union strike, the threatened 2023 UPS strike, two West Coast port shutdowns, the 2003 East Coast electrical blackout, the 2022 Türkiye-Syria Earthquake, and other significant events in the firm’s 27-year history. *

Categories of Loss

To determine the economic impact of a UAW strike, AEG estimated losses that include:

- Lost wages to workers, including striking workers and others who are temporarily laid off or forced to decrease work hours. AEG estimates cover both UAW and non-union auto workers, along with workers employed by impacted suppliers. Estimates were made based on the number of UAW workers in the U.S, average daily wages, and lost health care benefits. Because a strike would reduce demand for automotive parts and components, the firm included estimates for lost supplier wages.

- Lost earnings for the Big Three auto manufacturers. AEG estimates company losses, considering wages that would not be paid to striking workers.

- Auto industry losses. Automotive suppliers and auto dealers would both see losses in the short and long term.

Loss estimates do not include strike pay or assessments for strike pay; unemployment benefits or unemployment taxes; income taxes on wages; any settlement bonuses (which are transfers from shareholders to workers and do not represent U.S. income lost); or any reputational damage to the union or the employer(s).*

The real question here Anderson observed – in the midst of all the inflated rhetoric and coming off of a successful four-year previous agreement – is “Do they have a sustainable contract? At the end of the day you need to get an agreement.”

Inevitable Footnote

*AEG methodology was calibrated by comparing recorded losses in GDP and earnings in affected states after major past events. For example, after the 2019 UAW strike, Anderson Economic Group compared their earlier estimates with later reported GDP in Michigan, Ohio, and the U.S. Further evidence of the firm’s accuracy showed up in accounting losses reported by General Motors in early 2020. Anderson Economic Group – in words we agree with based on AutoInformed’s experience – “produces meticulous studies that illuminate economic trends in Michigan and across the U.S. AEG’s practice areas include public policy and economic analysis, market and industry analysis, and strategy and business valuation.” For more information about the East Lansing and Chicago-based company, now in its 27th year, see AndersonEconomicGroup.com.

AutoInformed on

- UAW and Big Three Makers – Biden Wants a Fair Deal

- UAW Publicly Pans Stellantis Contract Proposal

- UAW Wants 40% Wage Increase in 2023 Contract Negotiations

- New Pattern Bargaining – UAW and Unifor Strike All Makers?

- UAW Dumps Traditional Negotiation Opening Handshake

- UAW Say GM’s Lordstown JV Battery Plant Dangerous

- UAW Blasts Biden and Inflation Reduction Act

- EV Politics – Biden versus the UAW

Michigan’s unemployment rate remained at 3.6% in July for the second consecutive month, the lowest unemployment rate in 23 years. The labor force participation rate increased, the labor force grew by 23,000, and the economy added 63,000 jobs year over year.

“Michigan’s strong economic momentum continues, said Governor Gretchen Whitmer. “More Michiganders are working month after month. Our unemployment rate remains at its lowest level in 23 years, our labor force participation rate increased yet again, and the economy added 63,000 jobs year-over-year.

“Michiganders are getting to work to provide for themselves and their families. Our responsibility is to have their backs. That’s why I recently signed a bipartisan budget making record investments in workforce programs, powering economic development, building housing, and lowering costs of school meals, housing, pre-K, higher education, and more. “Let’s keep growing our economy to help anyone ‘make it’ in Michigan.”

July 2023 Jobs Report

• Unemployment rate remained at 3.6% in July, staying at the lowest rate in 23 years.

• Since the mid-1970s, the unemployment rate only fell below 4.0% during three periods: periodically from 1998-2000, from November 2019 to March 2020 (during the Governor’s first year in office), and now, from April 2023-present.

• Michigan recorded 4,439,000 payroll jobs, an increase of 63,000 over the year.

• Labor force rose by 23,000 over the month and 96,000 over the year.

• Labor force participation rate climbed to 61.0 percent this month.