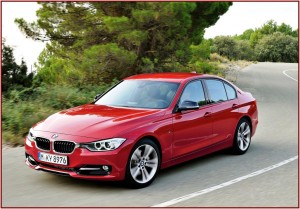

The 328i Sedan is priced starting at $35,795 in the U.S. It remains the gold standard in compact sports sedans. .

The BMW Group increased revenues during 2012 by 11.7% to €76.8 billion (~$99.7 billion) based on sales of 1,845,186 of BMW, Mini and Rolls-Royce brand vehicles delivered to customers worldwide, making it the largest maker of luxury automobiles. The Group also sold more than 117,000 motorcycles.

Despite higher spending on new models and technologies, as well as increased labor costs coming from 105,876 employees (+5.6%), earnings also climbed to record levels. Earnings before interest and taxes rose by 3.5% to €8.3 billion or (2011: €8 billion), while earnings before tax amounted to €7.8 billion (€7.4 billion), an improvement of 5.9%. BMW Group net profit for the year rose 4.4% to €5.1 billion from €4.9 billion. Between the end of 2007 and the end of 2012, the price of BMW common stock rose by more than 70%.

“We have achieved or surpassed all of our targets for 2012 in the face of very challenging market conditions,” said Norbert Reithofer, the Chairman of the Board of Management of BMW AG at the earnings press conference.

As a result, BMW will propose that the dividend be increased to €2.50 (€2.32) per share of common stock and €2.52 (2011: € 2.32) per share of preferred stock. Based on these figures, the total distribution will rise to €1.640 billion (2011: €1.5 billion), a distribution ratio of 32% (30.7%).

“The increased dividend reflects the BMW Group’s excellent performance in 2012 as well as the underlying strength of its earnings and financial position,” said Friedrich Eichiner, member of the Board of Management responsible for Finance.

The BMW, Mini and Rolls-Royce brands all posted sales records in 2012. Automotive segment revenues went up by 11% to €70 billion (€ 63.2 million). However, segment EBIT was up slightly to €7.6 million (€7.5 million or +2%), giving an EBIT margin of 10.9%. Profit before tax amounted to €7.2 million (2011 €6.8 million), an increase of 5.5% compared to 2011.

Sales of BMW brand cars increased by 11.6% to 1.54 million units (2011 at 1.4 million units), surpassing the mark of 1.5 million units for the first time in a single financial year. A major factor for this success was apparently the performance of the tiny BMW 1 Series, sales of which rose by 28.6% to 226,829 units (176,418 units), making it the best-selling car in its own segment.

The BMW 3 Series remains a formidable entry, with sales volume rising by 5.8% in 2012 to 406,752 units (384,464 units). With a sales volume of 359,016 units sold (332,501), the BMW 5 Series also retained its leadership in its segment. (Read AutoInformed on BMW Shows a “Concept” 4-Series at NAIAS)

The various models of the BMW X family of crossovers also sold well in 2012. Sales of the BMW X1 grew by 16.9% to 147,776 units (126,429 units), making it the best-selling model in its segment. The BMW X3 also registered sharp growth (+27.1%) at 149,853 units sold. The BMW X5 and BMW X6 posted sales volumes of 108,544 units (104,827) and 43,689 units (40,822 units) respectively. (Read Ken Zino on Milestones – Compact BMW X1 SUV Reaches 300,000 in Sales)

The Mini brand also surpassed the sales volume threshold of 300,000 units for the first time in a single year with the number of cars sold up by 5.8% to 301,526 units (2011: 285,060 units). The Mini Countryman put in an extremely strong performance and recorded a 14.9% increase to 102,271 units (89,036 units). Sales of the Mini Coupé rose to 11,311 units (3,799 units), almost tripling the volume recorded one year earlier. In terms of model mix, 44.5% of customers opted for the Mini Cooper, 35.7% for the Mini Cooper S and 19.8% for the Mini One.

Rolls-Royce appeared to be the clear market leader in the ultra-luxury segment in 2012. In total, 3,575 units were sold during the year (2011: 3,538 units /+1.0%), with demand particularly strong for the Phantom and Ghost models.

More than 117,000 BMW and Husqvarna brand motorcycles were sold worldwide during the past year (2011 113,572 units/+3.1%), a new sales volume record for the segment.

The Financial Services segment increased revenues by 11.7% to €19.6 million (2011: €17.5million). However, profit before tax amounted to €1.6 million (€1.8 million or -12.8%). BMW claimed the decrease in segment earnings is primarily a reflection of the previous year’s extremely high figures based on income of €439 million, resulting from the reduction in provisions for residual value and bad debt risks taken during the Great Recession.

“We are aiming to achieve a further rise in unit sales in the current year and hence a new sales volume record”, said Reithofer. However, profits will remain about the same as in 2012. BMW Group will continue to invest in more capacity in 2013. Development costs for new technologies and vehicle concepts will also continue to rise, as 2013 alone will see the launch of eleven new models. By the end of 2014, some 25 new models will have been added to the range, ten of them totally new models.