The UAW GM strike is now a serious economic problem for the overall U.S. economy.

Many estimates of the cost of the UAW strike focus on how much the work stoppage is costing GM, but few have estimated the broader costs of the strike to the U.S. economy or individual states, writes Kristin Dziczek, Vice President – Industry, Labor, & Economics at the Center for Automotive Research.

“The UAW-GM strike is sufficiently large to not only affect many sectors of the U.S. economy but also to reach beyond the borders of the nine states that are hosts to UAW-represented GM manufacturing facilities. GM, the UAW, GM suppliers, federal, state, and local governments, and many other businesses incur losses each day the strike continues,” says Dziczek.

CAR puts the cost of the UAW-GM strike to the company at roughly $450 million a week and the strike pay costs to the UAW strike fund at as much as $12 million a week.

While costs of the strike can be comparatively small if the work stoppage is short since the automaker has sufficient inventory. Sales revenue impacts can both recover from lost production and partially replace lost wages with overtime once workers return.

However, when a strike lasts longer, it becomes more challenging to make up lost production and costs begin to mount for both the company and the union. The longer a strike lasts, the more it impacts companies and workers in the supply chain as well as the broader economy.

However, when a strike lasts longer, it becomes more challenging to make up lost production and costs begin to mount for both the company and the union. The longer a strike lasts, the more it impacts companies and workers in the supply chain as well as the broader economy.

CAR used a so-called dynamic input-output model of the U.S. economy to estimate the effect of the UAW-GM strike. It adjusted UAW-GM workers’ compensation to reflect the $250 per week strike benefits and modified the effects of GM purchasing to consider only the reduction in production parts, materials, and services that are not needed while GM’s U.S. plants are not producing a product.

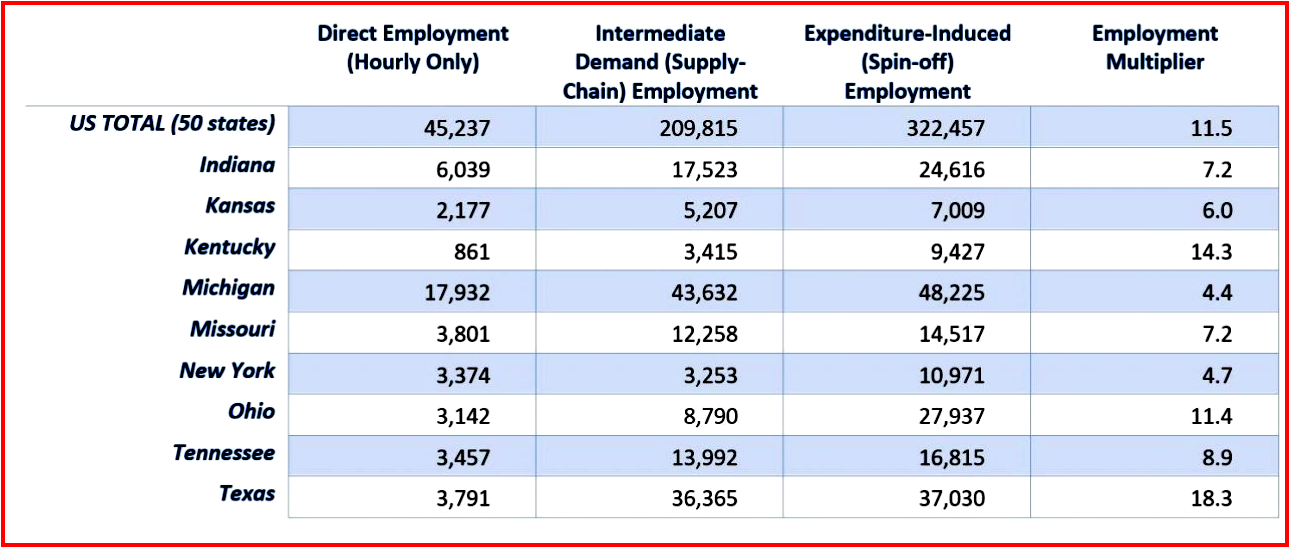

CAR estimates the U.S. employment multiplier for UAW-GM jobs is 11.5.This means that when UAW-GM workers are at work producing vehicles, engines, transmissions, stampings, parts, and components, every UAW-GM job supports 10.5 other jobs in the U.S. economy, with 3.2 of those jobs in the production-focused U.S. supplier sector.

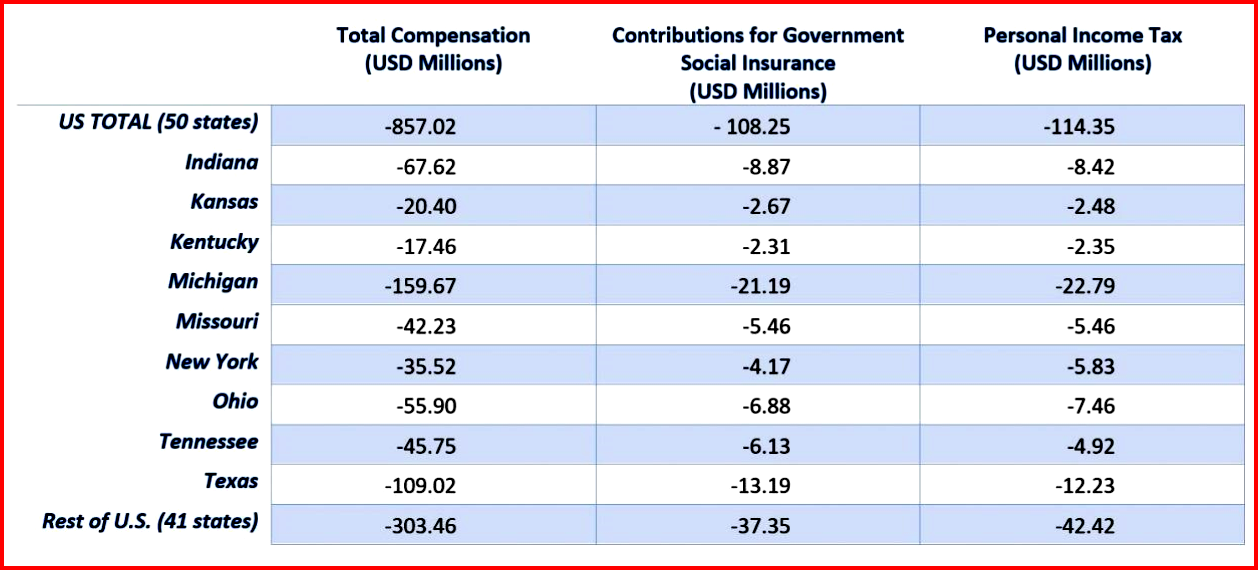

Car says that overall weekly worker compensation is $857 million lower for each week that the strike lasts. That lower compensation is coupled with a $108 million reduction in tax payments to support government social insurance programs (unemployment insurance, Medicare, Medicaid, and workers’ compensation insurance) and a $114 million reduction in personal income taxes paid to state and federal treasuries.

UAW-GM Compensation and Tax Effects

Compensation and tax revenue also vary by state, with nearly two-thirds of the impacts occurring in the nine states in which GM has UAW-represented manufacturing operations. Just over 40% of the effects are concentrated in only three states – Michigan, Texas, and Indiana- the three states where GM builds full-size pickup trucks and SUVs, the company’s most profitable products.

- Michigan, with 40% of the UAW-GM workforce, is hardest hit by the strike. Weekly compensation in Michigan is estimated to decline by $160 million while the strike lasts. Weekly social insurance tax collections are expected to be $21 million lower, and weekly personal income taxes are expected to be $23 million lower.

- Texas, with 8 percent of the UAW-GM workforce, has the second-largest economic strike impacts. Weekly compensation in Texas is estimated to fall $109 million while the strike lasts. Weekly social insurance tax collections are expected to be $13 million lower, and weekly personal income taxes are expected to be $12 million lower.

- Indiana, with 13 percent of the UAW-GM workforce, has the third-largest economic strike impacts. Weekly compensation in Indiana is estimated to fall $ 68 million while the strike lasts. Weekly social insurance tax collections are expected to be $ 9 million lower, and weekly personal income taxes are expected to be $ 8 million lower.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

CAR – Estimated Costs of the UAW-GM Strike are Low

The UAW GM strike is now a serious economic problem for the overall U.S. economy.

Many estimates of the cost of the UAW strike focus on how much the work stoppage is costing GM, but few have estimated the broader costs of the strike to the U.S. economy or individual states, writes Kristin Dziczek, Vice President – Industry, Labor, & Economics at the Center for Automotive Research.

“The UAW-GM strike is sufficiently large to not only affect many sectors of the U.S. economy but also to reach beyond the borders of the nine states that are hosts to UAW-represented GM manufacturing facilities. GM, the UAW, GM suppliers, federal, state, and local governments, and many other businesses incur losses each day the strike continues,” says Dziczek.

CAR puts the cost of the UAW-GM strike to the company at roughly $450 million a week and the strike pay costs to the UAW strike fund at as much as $12 million a week.

While costs of the strike can be comparatively small if the work stoppage is short since the automaker has sufficient inventory. Sales revenue impacts can both recover from lost production and partially replace lost wages with overtime once workers return.

CAR used a so-called dynamic input-output model of the U.S. economy to estimate the effect of the UAW-GM strike. It adjusted UAW-GM workers’ compensation to reflect the $250 per week strike benefits and modified the effects of GM purchasing to consider only the reduction in production parts, materials, and services that are not needed while GM’s U.S. plants are not producing a product.

CAR estimates the U.S. employment multiplier for UAW-GM jobs is 11.5.This means that when UAW-GM workers are at work producing vehicles, engines, transmissions, stampings, parts, and components, every UAW-GM job supports 10.5 other jobs in the U.S. economy, with 3.2 of those jobs in the production-focused U.S. supplier sector.

Car says that overall weekly worker compensation is $857 million lower for each week that the strike lasts. That lower compensation is coupled with a $108 million reduction in tax payments to support government social insurance programs (unemployment insurance, Medicare, Medicaid, and workers’ compensation insurance) and a $114 million reduction in personal income taxes paid to state and federal treasuries.

UAW-GM Compensation and Tax Effects

Compensation and tax revenue also vary by state, with nearly two-thirds of the impacts occurring in the nine states in which GM has UAW-represented manufacturing operations. Just over 40% of the effects are concentrated in only three states – Michigan, Texas, and Indiana- the three states where GM builds full-size pickup trucks and SUVs, the company’s most profitable products.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.