Q2 vehicle sales outside North America increased 58% from Q2 2011 to 70,000, including 19,000 vehicles made by Chrysler Group and sold by Fiat. Chrysler badly needs to increase its exports to become a global player.

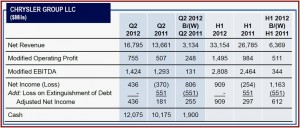

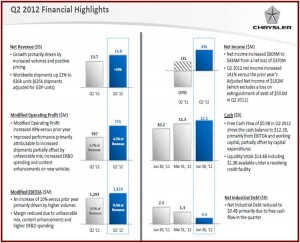

Chrysler Group today reported preliminary Q2 financial results with a so called modified operating profit (1) of $755 million, or 4.5% of revenue, up 49% from the $507 million reported in the prior year. Net profit was $436 million. Revenue for Q2 was $16.8 billion, up 23% from $13.7 billion in the second quarter of 2011, the result of a 22% period-over-period increase in shipments. (We learned a day later that in Q2 Fiat lost 246 million euros with the Chrysler contribution backed out of the results. The irony of once bankrupt but increasingly healthy Chrysler now bailing out Fiat is noted here. Among the bigger problems Chrysler now faces is the sickly state of its Italian parent company.)

For the first six months, Chrysler Group posted net income of $909 million on revenue of $33.2 billion.

The increase was attributable to what the Italian controlled company said were strong sales volume and pricing, partially offset by an unfavorable sales mix as Chrysler increased sales of cars versus more profitable trucks and SUVs. Average incentives of $3,100 per vehicle harmed results. Research and development spending for new models –the price of survival – also hurt returns. The modified operating profit for the first half of the year was $1.5 billion. (1)

As stated, net income or profit was $436 million, an $806 million improvement from the $370 million net loss in the Q2 last year that included a $551 million charge for repayment of Chrysler’s Canadian and U.S. taxpayer subsidized loans. The loans allowed a bankruptcy restructuring in 2009 that ultimately saved thousands upon thousands of jobs at Chrysler and its suppliers. Combined with taxpayer money pumped into General Motors, Ford and Nissan, under various stimulus actions, the bailouts or subsidized loans saved the U.S. auto industry.

All but dead after the corrupt practices of Wall Street sent global economies into a deep recession, Chrysler was saved but at the cost of transferring controlling ownership to Fiat.

Excluding the charge Chrysler took in Q2 of last year, Chrysler net income increased $255 million, or 141%, period over period, as Chrysler Group continues to improve sales across all its brands.

Worldwide vehicle sales for Q2 totaled 582,000, up 20% from a year ago. U.S. market share increased to 11.2% for the second quarter, up from 10.6% a year ago, the consequence of a 32% increase in U.S. retail sales. Market share in Canada was 14.5%.

Worldwide vehicle sales were 1.1 million for the first half of the year, up from 880,000 in the prior year. Chrysler Group’s June 2012 U.S. sales saw 27 consecutive months of year-over-year sales gains as it continued its sales comeback with U.S. sales up 20% (145,000). With cytd sales at 834,000 increasing 30% compared with the same period in 2011, Chrysler Group is outperforming the market.

Catching Toyota or Ford for Number Three during 2012, nevertheless appears out of the question, but two new volume cars – the Dodge Dart compact just shipping and a resurging Fiat 500 at 21,000 ytd and 4,000 in June – are adding sales in segments Chrysler has not competed in for years, if ever. Combined with Ram pickup, all of the Jeep line and the segment dominating sales of the Dodge Caravan and Chrysler Town & Country minivans, the group had its best June since 2007.

2012 Guidance

The targets for 2012 (which CEO Sergio Marchionne said were “conservative”) are:

- Worldwide vehicle shipments of 2.3-2.4 million

- Net revenue of ~ $65 billion

- Modified Operating Profit of ≥ $3.0 billion (1)

- Net income of ~ $1.5 billion

- Free Cash Flow of ≥ $1 billion

(1) Modified Operating Profit is computed starting with net income and then adjusting the amount to add back income tax expense and exclude income tax benefits, add back net interest expense (excluding interest expense related to financing activities from Gold Key Leases), add back all pension and other post-retirement benefit obligations.