Click to Enlarge.

Analysts at J.D. Power Valuation Services claim that Class 8 conditions were generally stabilized in July, signifying June’s recovery was not solely based on pent-up demand.

“Pricing is solidifying, customers are buying more used trucks and new truck orders and deliveries are heading back in the right direction,” said Chris Visser, commercial truck senior analyst at Valuation Services.

“When a massive black swan event blows up everyone’s forecasting models, the human gut becomes the main driver of decisions. Fleets waited to see what would happen to freight volumes once the stockpiling effect shook out, and they seem to be OK with what they are seeing.”

Major findings:

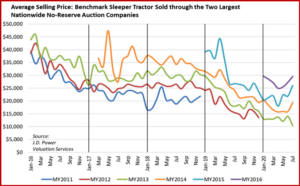

- Class 8 auction results were solid for another month

- >Late-model sleepers returned to their highest average pricing in 12 months

- Class 8 retail pricing was stable

- >Sales volume was the highest in almost 2 years

- Medium duty segments were flat-to-downward

- >Sales volume was down in lighter-GVW segments that small businesses use.

“When a massive black swan event blows up everyone’s forecasting models, the human gut becomes the main driver of decisions. Fleets waited to see what would happen to freight volumes once the stockpiling effect shook out, and they seem to be OK with what they are seeing,” Visser claimed.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Results of Phase 1 of the Small Business Pulse Survey – 215,000 small businesses across the country responded to Phase 1 of the U.S. Census Bureau’s Small Business Pulse Survey.

Which sectors fared better in Phase 1? Utilities and construction fared reasonably well over the nine weeks of the survey and respondents reported already being almost back to normal and had the largest percentage reporting no change in revenue.

Which sectors fared worse in Phase 1? Education & services; health care & social assistance; arts, entertainment, & recreation; and accommodation and food services saw significant disruptions based on initial responses and this persisted over the 9 weeks of the survey.

Phase 1 responses varied by geography: in Salt Lake City, 20% of businesses reported little or no impact & 17% reported no change in operations year-over-year. However, in New York City, 7% of businesses reported little or no impact and 7% also reported no change in operations year-over-year.