US Budgetary Effects of the 2020 Coronavirus Pandemic: Revenues collected since late March have been much weaker than those collected during the same period last year and much weaker than CBO projected earlier this year. The lower revenues result in part from the economic disruption caused by the pandemic, which has reduced wages and other taxable income, and in part from the government’s actions to address that disruption.

The federal government’s response included a variety of changes to tax rules. Some of them reduce the amount of taxes that businesses and individuals owe; others just allow taxpayers to defer paying taxes. CBO anticipates that most of the revenues affected by those deferrals will be collected in July, some will be collected in later years, and some will be permanently lost. CBO does not have an estimate of the amounts that fall in each of those categories.

Payroll Taxes. The Coronavirus Aid, Relief, and Economic Security (CARES) Act allows employers to delay their payments of payroll taxes— until 2021 and 2022—on wages paid from March 27, 2020, through December 31, 2020. That delay provides additional liquidity to businesses that may be facing reduced revenues or increased costs because of the pandemic. In effect, those firms have been provided an interest-free loan that equals a fraction of their payroll. The firms are obligated to pay half of the deferred payroll taxes on December 31, 2021, and the remainder on December 31, 2022.

The staff of the Joint Committee on Taxation (JCT) has estimated that the delay will reduce tax revenues in 2020 by over $200 billion. But by JCT’s estimate, most of the payroll taxes deferred under the CARES Act will be paid in future fiscal years, so the net loss from the delay will be $12 billion. The reason for that loss is that some of the affected firms will cease operations before they can make their payments, so some of the deferred taxes will not be paid.

Effect of Business Losses on Tax Liability. The CARES Act also temporarily modified the rules governing the use of business losses in determining tax liability. One change allows losses to result in the refund of income taxes paid for earlier years, not just for the following year, and another allows losses to reduce tax liability more than would have otherwise been the case. By allowing losses to be applied now rather than against future taxes, the changes give businesses liquidity now and increase the income taxes that they will pay in the future. As with other types of deferral of tax liability, if a business ceases to exist, its deferred taxes may not be paid.

Other Taxes. Deadlines for filing returns and paying taxes have been delayed for many other taxes. The Administration delayed the tax filing and payment deadlines for individual and corporate income taxes from April 15 to July 15, and it also delayed the due dates for estimated payments during that period. For excise taxes on wine, beer, distilled spirits, tobacco products, firearms, and ammunition that were originally due during the period from March 1, 2020, through July 1, 2020, the Administration delayed due dates by 90 days. And the Administration is allowing customs duties on some imports to be deferred for 90 days for businesses facing significant financial hardship.

CBO expects that most of the revenues that would have otherwise been paid when taxes were originally due will be paid by the new deadlines. In particular, CBO expects that most of the income tax revenues that would otherwise have been collected in the period from April through June, when taxpayers would ordinarily have filed their 2019 returns and made estimated payments of taxes for 2020, will be paid in July of this year. However, because some individuals or businesses may become insolvent and fail to make those payments, the government may not collect all the deferred taxes.

Projected US Federal Deficits for 2020 and 2021: CBO anticipates the federal deficit will be in fiscal year 2020. In late April, CBO provided preliminary projections of federal deficits in fiscal years 2020 and 2021, which considered recent events and the enactment of pandemic-related legislation. According to those projections, if laws currently in place governing spending and revenues generally remained unchanged and no significant additional emergency funding was provided, the federal deficit would be roughly $3.7 trillion in fiscal year 2020 and $2.1 trillion next year. (In CBO’s March baseline projections, deficits were just over $1 trillion in each of those years.)

UK: New figures released today by the Finance & Leasing Association (FLA) show that new business volumes in the consumer car finance market fell in April 2020 by 94% compared with the same month in 2019, and by 33% in the first four months of 2020.

The UK consumer new car finance market reported new business volumes 97% lower in April 2020 compared with the same month in 2019, and a fall of 37% in the first four months of 2020. The percentage of private new car sales financed by FLA members was 94.5% in the twelve months to April 2020. (to be continued)

The consumer used car finance market reported a fall in new business volumes of 92% in April 2020 compared with the same month in 2019, and a contraction of 30% in the first four months of 2020.

“While the motor finance market has been the hardest hit of FLA markets, the industry has been innovative in its use of click and collect during the lockdown,” said Geraldine Kilkelly, Head of Research and Chief Economist at the FLA. “With the welcome opening of showrooms from the beginning of June, the motor finance market is ready to meet the demand for new finance from households and businesses.” (Graveyard Whistling? UK Auto Calls to Re-Open Showrooms*)

“The FLA calls on the Government and Bank of England to take immediate action to open up financial support schemes to all lenders, including non-banks, so that they can meet this pent-up demand for finance and the huge ongoing requests for forbearance.”

The Data aren’t in yet on the negative health effects and additional deaths caused by the premature reopening…

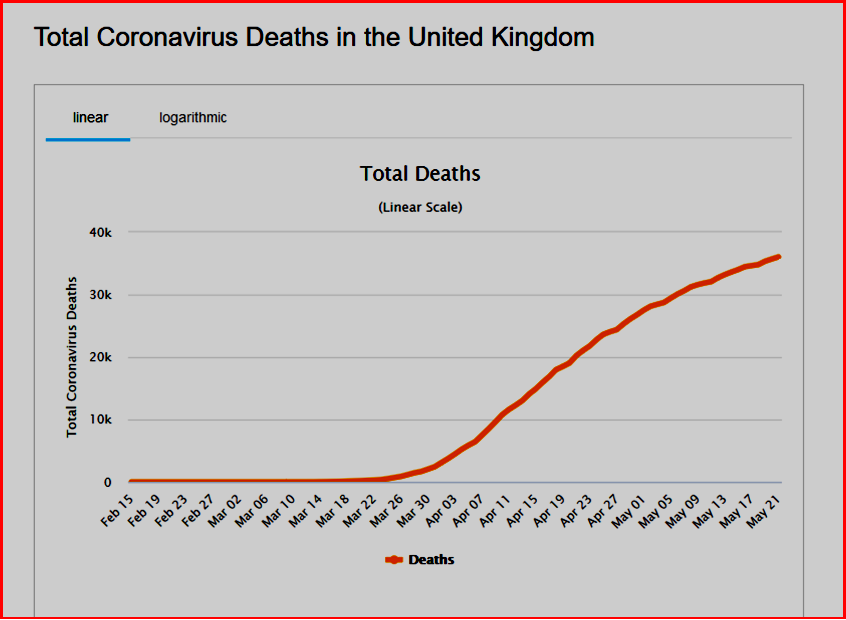

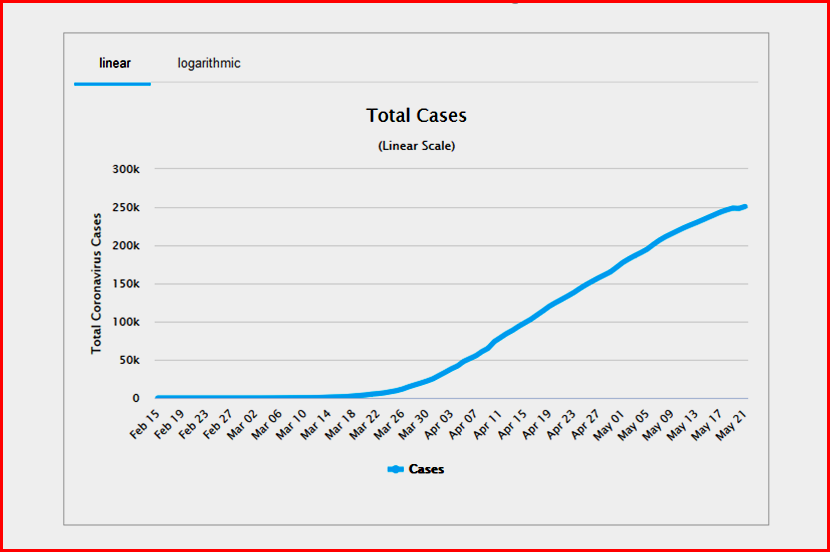

The move at first glance appears to a bad one given the scope of the COVID-19 crisis in the UK and the ineptness of the response from 10 Downing street. Coronavirus Cases are currently listed at 254,195, with 36,393 Deaths. These numbers are most assuredly understated given the disarray of policy, confusing government briefings, complications at the National Health Service, and perhaps political interference in the reporting system – a global problem. (Government scientist admits March halt on community testing and tracing for coronavirus was due to limited capacity)

However money is trumping health policy here: The annual taxes harvested from VAT, VED and other taxes on new car sales to private buyers alone amounts to some £5.4 billion. However, lock-down restrictions that forced showrooms to shut up shop will, by the end of the month, have cut this figure by almost a quarter (23%), with every additional day of closure costing £20 million.1 So there is substantial economic pressure to put a price on a human life. UK automotive retail employs 590,000, who together work to drive a sector worth £200 billion.

1. Calculation based on VAT, first year VED and IPT on new cars registered to private buyers in the UK using average vehicle price, applied to year-on-year market losses during lockdown period.

Ugh…

Ditto…

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

COVID-nomics – Plague Meets the Dreary Science

US Budgetary Effects of the 2020 Coronavirus Pandemic: Revenues collected since late March have been much weaker than those collected during the same period last year and much weaker than CBO projected earlier this year. The lower revenues result in part from the economic disruption caused by the pandemic, which has reduced wages and other taxable income, and in part from the government’s actions to address that disruption.

The federal government’s response included a variety of changes to tax rules. Some of them reduce the amount of taxes that businesses and individuals owe; others just allow taxpayers to defer paying taxes. CBO anticipates that most of the revenues affected by those deferrals will be collected in July, some will be collected in later years, and some will be permanently lost. CBO does not have an estimate of the amounts that fall in each of those categories.

Payroll Taxes. The Coronavirus Aid, Relief, and Economic Security (CARES) Act allows employers to delay their payments of payroll taxes— until 2021 and 2022—on wages paid from March 27, 2020, through December 31, 2020. That delay provides additional liquidity to businesses that may be facing reduced revenues or increased costs because of the pandemic. In effect, those firms have been provided an interest-free loan that equals a fraction of their payroll. The firms are obligated to pay half of the deferred payroll taxes on December 31, 2021, and the remainder on December 31, 2022.

The staff of the Joint Committee on Taxation (JCT) has estimated that the delay will reduce tax revenues in 2020 by over $200 billion. But by JCT’s estimate, most of the payroll taxes deferred under the CARES Act will be paid in future fiscal years, so the net loss from the delay will be $12 billion. The reason for that loss is that some of the affected firms will cease operations before they can make their payments, so some of the deferred taxes will not be paid.

Effect of Business Losses on Tax Liability. The CARES Act also temporarily modified the rules governing the use of business losses in determining tax liability. One change allows losses to result in the refund of income taxes paid for earlier years, not just for the following year, and another allows losses to reduce tax liability more than would have otherwise been the case. By allowing losses to be applied now rather than against future taxes, the changes give businesses liquidity now and increase the income taxes that they will pay in the future. As with other types of deferral of tax liability, if a business ceases to exist, its deferred taxes may not be paid.

Other Taxes. Deadlines for filing returns and paying taxes have been delayed for many other taxes. The Administration delayed the tax filing and payment deadlines for individual and corporate income taxes from April 15 to July 15, and it also delayed the due dates for estimated payments during that period. For excise taxes on wine, beer, distilled spirits, tobacco products, firearms, and ammunition that were originally due during the period from March 1, 2020, through July 1, 2020, the Administration delayed due dates by 90 days. And the Administration is allowing customs duties on some imports to be deferred for 90 days for businesses facing significant financial hardship.

CBO expects that most of the revenues that would have otherwise been paid when taxes were originally due will be paid by the new deadlines. In particular, CBO expects that most of the income tax revenues that would otherwise have been collected in the period from April through June, when taxpayers would ordinarily have filed their 2019 returns and made estimated payments of taxes for 2020, will be paid in July of this year. However, because some individuals or businesses may become insolvent and fail to make those payments, the government may not collect all the deferred taxes.

Projected US Federal Deficits for 2020 and 2021: CBO anticipates the federal deficit will be in fiscal year 2020. In late April, CBO provided preliminary projections of federal deficits in fiscal years 2020 and 2021, which considered recent events and the enactment of pandemic-related legislation. According to those projections, if laws currently in place governing spending and revenues generally remained unchanged and no significant additional emergency funding was provided, the federal deficit would be roughly $3.7 trillion in fiscal year 2020 and $2.1 trillion next year. (In CBO’s March baseline projections, deficits were just over $1 trillion in each of those years.)

UK: New figures released today by the Finance & Leasing Association (FLA) show that new business volumes in the consumer car finance market fell in April 2020 by 94% compared with the same month in 2019, and by 33% in the first four months of 2020.

The UK consumer new car finance market reported new business volumes 97% lower in April 2020 compared with the same month in 2019, and a fall of 37% in the first four months of 2020. The percentage of private new car sales financed by FLA members was 94.5% in the twelve months to April 2020. (to be continued)

The consumer used car finance market reported a fall in new business volumes of 92% in April 2020 compared with the same month in 2019, and a contraction of 30% in the first four months of 2020.

“While the motor finance market has been the hardest hit of FLA markets, the industry has been innovative in its use of click and collect during the lockdown,” said Geraldine Kilkelly, Head of Research and Chief Economist at the FLA. “With the welcome opening of showrooms from the beginning of June, the motor finance market is ready to meet the demand for new finance from households and businesses.” (Graveyard Whistling? UK Auto Calls to Re-Open Showrooms*)

“The FLA calls on the Government and Bank of England to take immediate action to open up financial support schemes to all lenders, including non-banks, so that they can meet this pent-up demand for finance and the huge ongoing requests for forbearance.”

The Data aren’t in yet on the negative health effects and additional deaths caused by the premature reopening…

The move at first glance appears to a bad one given the scope of the COVID-19 crisis in the UK and the ineptness of the response from 10 Downing street. Coronavirus Cases are currently listed at 254,195, with 36,393 Deaths. These numbers are most assuredly understated given the disarray of policy, confusing government briefings, complications at the National Health Service, and perhaps political interference in the reporting system – a global problem. (Government scientist admits March halt on community testing and tracing for coronavirus was due to limited capacity)

However money is trumping health policy here: The annual taxes harvested from VAT, VED and other taxes on new car sales to private buyers alone amounts to some £5.4 billion. However, lock-down restrictions that forced showrooms to shut up shop will, by the end of the month, have cut this figure by almost a quarter (23%), with every additional day of closure costing £20 million.1 So there is substantial economic pressure to put a price on a human life. UK automotive retail employs 590,000, who together work to drive a sector worth £200 billion.

1. Calculation based on VAT, first year VED and IPT on new cars registered to private buyers in the UK using average vehicle price, applied to year-on-year market losses during lockdown period.

Ugh…

Ditto…

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.