The pre-existing financial crisis at Daimler required drastic steps, which were underway and served it well when Covid struck.

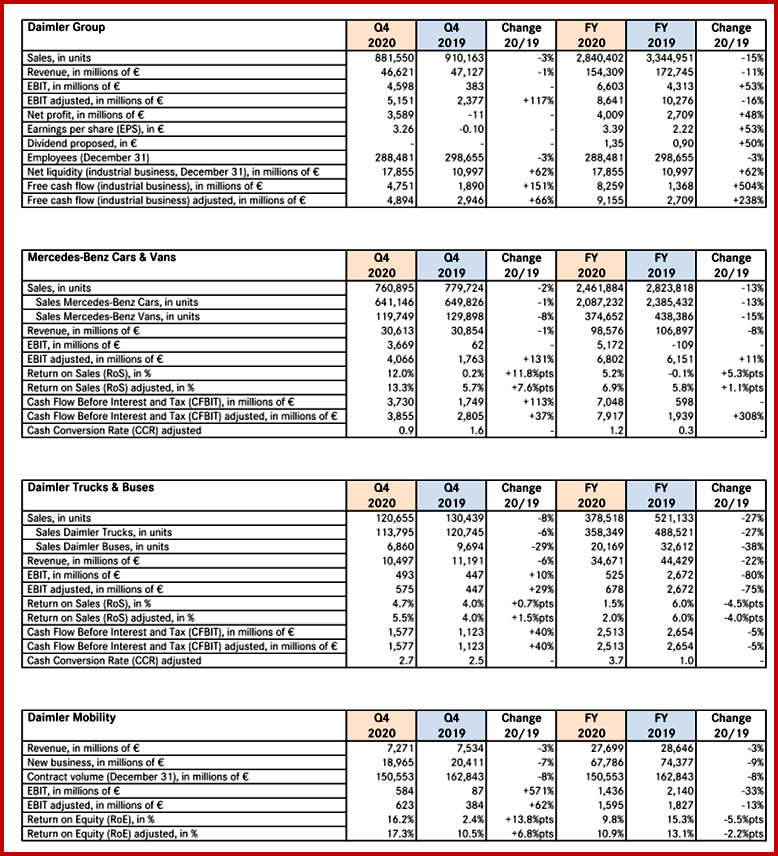

Daimler AG (ticker: DAI) reports that net profit increased by 48% to €4.0 billion for the fiscal year 2020 while proposing a dividend of €1.35 per share (2019: €0.90). The Group’s total sales of passenger cars and commercial vehicles decreased by -15%, to 2.84 million (2019: 3.34 million). Revenue was down at €154.3 billion (2019: €172.7 billion), a reduction of 11%. Due to extensive cost and cash preservation action and good performances across all divisions, EBIT of the Daimler Group increased by 53% to €6.6 billion (2019: €4.3 billion).

Adjusted EBIT, reflecting the underlying business, was €8.6 billion down from €10.3 billion in 2019. The numbers are based on audited financial statements. The reporting structure and previous year’s figures have been adjusted to reflect the newly formed Group divisions. (read AutoInformed.com on Daimler to Spin-Off Daimler Truck into Separate Compan, Daimler Q3 Covid Results – Sales, Revenue Down. Earnings Up)

Click to Enlarge.

“Our financial results are significantly above market expectations reflecting substantial progress on cost-efficiencies. In addition, we have achieved a significant margin improvement based on strong product mix and pricing – especially in the second half of the year. We proved our ability to generate substantial cash flow and to drive the ongoing transformation on our own – even under the adverse circumstances of a pandemic,” claimed Ola Källenius, Chairman of the Board of Management of Daimler AG and Mercedes-Benz AG.

During 2020, net profit improved to €4.0 billion (2019: €2.7 billion). Net profit attributable to the shareholders of Daimler AG amounted to €3.6 billion (2019: €2.4 billion), leading to an increase in earnings per share to €3.39 (2019: €2.22). At the Annual General Meeting on 31March 31, 2021 the Board of Management and the Supervisory Board will propose a dividend of €1.35 per share (2019: €0.90). Total payout will amount to €1.4 billion (2019: €1.0 billion).

“We are confident that we can maintain positive momentum if current market conditions prevail, accelerating our strategic plans and further enhancing our financial robustness. The intended separation of our industrial businesses is designed to unlock the full potential for Mercedes-Benz as the world’s pre-eminent luxury car business, committed to leading in electric drive and car software, and Daimler Truck as the world’s largest truck and bus producer and technology leader,” said Källenius.

Daimler plans to spin-off and list Daimler Truck as previously noted in AutoInformed. It is said that a significant majority stake in Daimler Truck will be distributed to Daimler shareholders. Daimler Truck will have a fully independent management, stand-alone corporate governance, including an independent Chairman of the Supervisory Board, and is targeted to qualify for listing on Germany’s blue-chip DAX index. The transaction and the listing of Daimler Truck on the Frankfurt stock exchange could be completed before year-end 2021.

In addition, it is also Daimler’s intention to rename itself as Mercedes-Benz at the “appropriate” time. All further details about the intended spin-off will be presented to shareholders at an extra-ordinary shareholder meeting in Q3 2021 in order to obtain their mandatory approval for the plan.

AutoInformed.com on Daimler

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Daimler Earns €4.0 billion in 2020

The pre-existing financial crisis at Daimler required drastic steps, which were underway and served it well when Covid struck.

Daimler AG (ticker: DAI) reports that net profit increased by 48% to €4.0 billion for the fiscal year 2020 while proposing a dividend of €1.35 per share (2019: €0.90). The Group’s total sales of passenger cars and commercial vehicles decreased by -15%, to 2.84 million (2019: 3.34 million). Revenue was down at €154.3 billion (2019: €172.7 billion), a reduction of 11%. Due to extensive cost and cash preservation action and good performances across all divisions, EBIT of the Daimler Group increased by 53% to €6.6 billion (2019: €4.3 billion).

Adjusted EBIT, reflecting the underlying business, was €8.6 billion down from €10.3 billion in 2019. The numbers are based on audited financial statements. The reporting structure and previous year’s figures have been adjusted to reflect the newly formed Group divisions. (read AutoInformed.com on Daimler to Spin-Off Daimler Truck into Separate Compan, Daimler Q3 Covid Results – Sales, Revenue Down. Earnings Up)

Click to Enlarge.

“Our financial results are significantly above market expectations reflecting substantial progress on cost-efficiencies. In addition, we have achieved a significant margin improvement based on strong product mix and pricing – especially in the second half of the year. We proved our ability to generate substantial cash flow and to drive the ongoing transformation on our own – even under the adverse circumstances of a pandemic,” claimed Ola Källenius, Chairman of the Board of Management of Daimler AG and Mercedes-Benz AG.

During 2020, net profit improved to €4.0 billion (2019: €2.7 billion). Net profit attributable to the shareholders of Daimler AG amounted to €3.6 billion (2019: €2.4 billion), leading to an increase in earnings per share to €3.39 (2019: €2.22). At the Annual General Meeting on 31March 31, 2021 the Board of Management and the Supervisory Board will propose a dividend of €1.35 per share (2019: €0.90). Total payout will amount to €1.4 billion (2019: €1.0 billion).

“We are confident that we can maintain positive momentum if current market conditions prevail, accelerating our strategic plans and further enhancing our financial robustness. The intended separation of our industrial businesses is designed to unlock the full potential for Mercedes-Benz as the world’s pre-eminent luxury car business, committed to leading in electric drive and car software, and Daimler Truck as the world’s largest truck and bus producer and technology leader,” said Källenius.

Daimler plans to spin-off and list Daimler Truck as previously noted in AutoInformed. It is said that a significant majority stake in Daimler Truck will be distributed to Daimler shareholders. Daimler Truck will have a fully independent management, stand-alone corporate governance, including an independent Chairman of the Supervisory Board, and is targeted to qualify for listing on Germany’s blue-chip DAX index. The transaction and the listing of Daimler Truck on the Frankfurt stock exchange could be completed before year-end 2021.

In addition, it is also Daimler’s intention to rename itself as Mercedes-Benz at the “appropriate” time. All further details about the intended spin-off will be presented to shareholders at an extra-ordinary shareholder meeting in Q3 2021 in order to obtain their mandatory approval for the plan.

AutoInformed.com on Daimler

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.