China profits helped Daimler as other major markets collapsed.

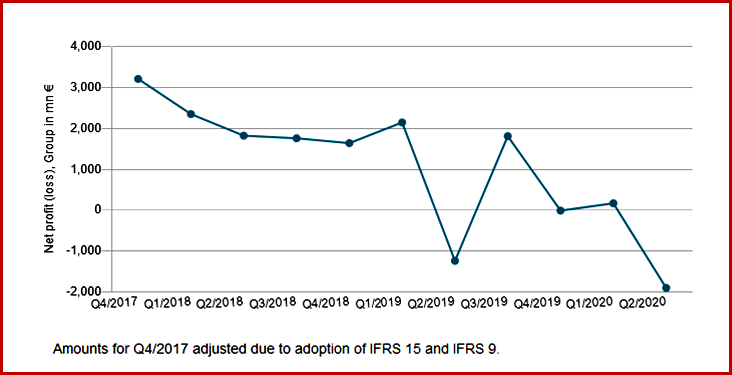

Daimler AG (ticker symbol: DAI) today reported its results for the third quarter, which ended September 30, 2020. The Group’s total unit sales decreased by -8% to 772,700 cars and commercial vehicles (Q3 2019: 839,300) and revenue dropped by -7% to €40.3 billion (Q3 2019: €43.3 billion). EBIT increased by 14% to €3,070 million (Q3 2019: €2,690 million). Adjusted EBIT, reflecting the underlying business, was €3,479 million (Q3 2019: €3,142 million) and net profit was €2,158 million (Q3 2019: €1,813 million). (Daimler Q1 2020 Net Profit Down -92% at €168m from €2149)

Daimler expects that the significant unit-sales reductions recorded in the first nine months due to the COVID-19 pandemic will only be partially offset by the end of the year. Group unit sales and Group revenue in 2020 are forecast to be significantly lower than in the previous year. (Daimler Confirms 2020 Group Sales and Revenue Will Decline, Daimler Q1 2020 Net Profit Down -92% at €168m from €2149)

Daimler was in financial trouble before Covid.

Daimler claimed that a free cash flow of around €5.1 billion in the quarter shows the continuous efforts in cost-cutting and cash-preservation measures, as well as a positive operating performance across all divisions.

Additional positive factors Daimler touted are the dividend from the Chinese joint venture BBAC of €1.2 billion, positive contributions from working capital and seasonal phasing impacts. Daimler expects EBIT for fiscal year 2020 at the prior-year level, which was weak. (Daimler Facing Profit and Sales Declines Reorganizes, Daimler Postpones Annual Shareholders’ Meeting, COVID-19- Daimler Stops Most Production in Europe, Capital Punishment Day for Auto Workers at Daimler)

“With this momentum, we are on track to make our business more weatherproof. However, the transformation of Daimler is a long-distance race. We are keeping up the pace with focus and full discipline,” said Harald Wilhelm, Member of the Board of Management of Daimler AG, responsible for Finance & Controlling/Daimler Mobility.

At the end of Q3, net liquidity of the industrial business was €13.1 billion (end of Q2 2020: €9.5 billion). The free cash flow of the industrial business was at €5,139 million (Q3 2019: €2,819 million). The adjusted free cash flow of the industrial business was €5,345 million (Q3 2019: €2,931 million).

Unit sales by the Mercedes-Benz Cars & Vans division decreased by -4% to 673,400 vehicles in the third quarter (Q3 2019: 705,000). Despite that, adjusted EBIT increased to €2,417 million (Q3 2019: €1,868 million) and adjusted return on sales to 9.4% (Q3 2019: 7.0%). Improved pricing and a significant reduction in fixed costs helped generic soma earnings. Earnings were adversely affected by restructuring expenses (€297 million), including the initiated cost-optimization program (€229 million) and expenses for the adjustment and realignment of capacities (€68 million) within the global production network in connection with the intended sale of the car plant in Hambach (France). Both initiatives will reduce fixed costs in the medium and long term.

The Daimler Trucks & Buses division showed a decrease in unit sales of -26% to 99,300 vehicles in the third quarter (Q3 2019: 134,300). Adjusted EBIT amounted to €603 million (Q3 2019: €838 million) and adjusted return on sales was 6.5% (Q3 2019: 7.3%). Earnings were negatively affected by declining volumes, primarily caused by contracting markets due to the ongoing COVID-19 pandemic. The measures introduced led to cost reductions in all functional areas. A significant reduction in fixed costs had a positive impact on earnings. The division recorded a significant increase in order intake in most key regions compared to the previous quarter, also compared to third quarter of 2019 in Europe and North America.

At Daimler Mobility, new business increased by 2% to €18.7 billion in the third quarter (Q3 2019: €18.3 billion). Adjusted EBIT amounted to €601 million (Q3 2019: €469 million) and adjusted return on equity was 16.5% (Q3 2019: 13.5%). Positive effects were recorded mainly due to the measures implemented to improve costs. Furthermore, because of the response to the COVID-19 pandemic in the first half of 2020, no further additions to credit-risk provisions were necessary in the third quarter of 2020.

Outlook

Daimler assumes that economic conditions in the most important markets continue to normalize and that no further setbacks occur because of the COVID-19 pandemic. Daimler expects that the significant unit-sales reductions recorded in the first nine months due to the COVID-19 pandemic will only be partially offset by the end of the year. The company therefore expects Group unit sales and Group revenue in 2020 to be significantly lower than in the previous year. Based on the expected market development and the current assessments of the divisions, Daimler anticipates Group EBIT in 2020 at the level of the prior year.

The divisions expect the following adjusted returns in the year 2020:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Daimler Q3 Covid Results – Sales, Revenue Down. Earnings Up

China profits helped Daimler as other major markets collapsed.

Daimler AG (ticker symbol: DAI) today reported its results for the third quarter, which ended September 30, 2020. The Group’s total unit sales decreased by -8% to 772,700 cars and commercial vehicles (Q3 2019: 839,300) and revenue dropped by -7% to €40.3 billion (Q3 2019: €43.3 billion). EBIT increased by 14% to €3,070 million (Q3 2019: €2,690 million). Adjusted EBIT, reflecting the underlying business, was €3,479 million (Q3 2019: €3,142 million) and net profit was €2,158 million (Q3 2019: €1,813 million). (Daimler Q1 2020 Net Profit Down -92% at €168m from €2149)

Daimler expects that the significant unit-sales reductions recorded in the first nine months due to the COVID-19 pandemic will only be partially offset by the end of the year. Group unit sales and Group revenue in 2020 are forecast to be significantly lower than in the previous year. (Daimler Confirms 2020 Group Sales and Revenue Will Decline, Daimler Q1 2020 Net Profit Down -92% at €168m from €2149)

Daimler was in financial trouble before Covid.

Daimler claimed that a free cash flow of around €5.1 billion in the quarter shows the continuous efforts in cost-cutting and cash-preservation measures, as well as a positive operating performance across all divisions.

Additional positive factors Daimler touted are the dividend from the Chinese joint venture BBAC of €1.2 billion, positive contributions from working capital and seasonal phasing impacts. Daimler expects EBIT for fiscal year 2020 at the prior-year level, which was weak. (Daimler Facing Profit and Sales Declines Reorganizes, Daimler Postpones Annual Shareholders’ Meeting, COVID-19- Daimler Stops Most Production in Europe, Capital Punishment Day for Auto Workers at Daimler)

“With this momentum, we are on track to make our business more weatherproof. However, the transformation of Daimler is a long-distance race. We are keeping up the pace with focus and full discipline,” said Harald Wilhelm, Member of the Board of Management of Daimler AG, responsible for Finance & Controlling/Daimler Mobility.

At the end of Q3, net liquidity of the industrial business was €13.1 billion (end of Q2 2020: €9.5 billion). The free cash flow of the industrial business was at €5,139 million (Q3 2019: €2,819 million). The adjusted free cash flow of the industrial business was €5,345 million (Q3 2019: €2,931 million).

Unit sales by the Mercedes-Benz Cars & Vans division decreased by -4% to 673,400 vehicles in the third quarter (Q3 2019: 705,000). Despite that, adjusted EBIT increased to €2,417 million (Q3 2019: €1,868 million) and adjusted return on sales to 9.4% (Q3 2019: 7.0%). Improved pricing and a significant reduction in fixed costs helped generic soma earnings. Earnings were adversely affected by restructuring expenses (€297 million), including the initiated cost-optimization program (€229 million) and expenses for the adjustment and realignment of capacities (€68 million) within the global production network in connection with the intended sale of the car plant in Hambach (France). Both initiatives will reduce fixed costs in the medium and long term.

The Daimler Trucks & Buses division showed a decrease in unit sales of -26% to 99,300 vehicles in the third quarter (Q3 2019: 134,300). Adjusted EBIT amounted to €603 million (Q3 2019: €838 million) and adjusted return on sales was 6.5% (Q3 2019: 7.3%). Earnings were negatively affected by declining volumes, primarily caused by contracting markets due to the ongoing COVID-19 pandemic. The measures introduced led to cost reductions in all functional areas. A significant reduction in fixed costs had a positive impact on earnings. The division recorded a significant increase in order intake in most key regions compared to the previous quarter, also compared to third quarter of 2019 in Europe and North America.

At Daimler Mobility, new business increased by 2% to €18.7 billion in the third quarter (Q3 2019: €18.3 billion). Adjusted EBIT amounted to €601 million (Q3 2019: €469 million) and adjusted return on equity was 16.5% (Q3 2019: 13.5%). Positive effects were recorded mainly due to the measures implemented to improve costs. Furthermore, because of the response to the COVID-19 pandemic in the first half of 2020, no further additions to credit-risk provisions were necessary in the third quarter of 2020.

Outlook

Daimler assumes that economic conditions in the most important markets continue to normalize and that no further setbacks occur because of the COVID-19 pandemic. Daimler expects that the significant unit-sales reductions recorded in the first nine months due to the COVID-19 pandemic will only be partially offset by the end of the year. The company therefore expects Group unit sales and Group revenue in 2020 to be significantly lower than in the previous year. Based on the expected market development and the current assessments of the divisions, Daimler anticipates Group EBIT in 2020 at the level of the prior year.

The divisions expect the following adjusted returns in the year 2020:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.