Italy was the only major market in decline, bad news as Fiat tries to complete the Chrysler takeover.

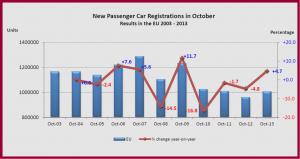

During October the economically challenged European Union recorded total light vehicle sales in EU markets of 1,004,935 for a +4.7% increase year-over-year. This was the first time since September 2011 that demand for new cars was up in two consecutive months.

Nonetheless from January to October, new car registrations amounted to 10,006,807 units, or -3.1% fewer than in the same period last year as the austerity policies of European politicians continue to wreak havoc on a weak economy that is experiencing five straight years of light vehicle sales declines. The October results were the second lowest level to date for the month of October.

Italy was the only major market to face a downturn (-5.6%) in October. This is bad news for Fiat as it tries to integrate Chrysler Group into the company so it can use Chrysler’s positive cash flows and reserves to shore up its balance sheet as it tries to move upmarket and buy out the United Autoworkers large holdings of Chrysler common stock. (Chrysler Group October Sales Up 27%. Comeback Continues, Chrysler Group Up, General Motors Down in Q3 Earnings, Fiat SpA Q2 Profit at $188 Million – all from Chrysler)

All other major Western European markets contributed positively to the overall +4.7%, with mostly anemic growths ranging from +2.3% in Germany, to +2.6% in France, +4.0% in the UK and +34.4% in Spain.

From January to October, major markets performed diversely. Germany (-5.2%), France (-7.4%) and Italy (-8.0%) saw their demand for new cars decline, while Spain (+1.1%) and the UK (+10.2%) registered more vehicles than in the first ten months of last year. Overall, the EU counted 10,006,807 new vehicles, or -3.1% fewer than in January-October 2012 period.