Click to Enlarge and more info.

Stellantis (NYSE: MTA. Euronext Paris: STLA) and GME Resources (ASX: GME) announced today signed a MoU on the sale of of battery nickel and cobalt sulphate from Western Australia. (AutoInformed – Stellantis Claims Record First Year with €13.4B Net Profit)

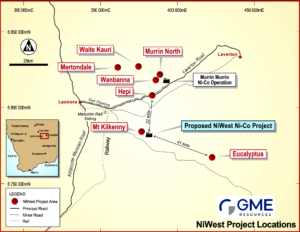

NiWest is an advanced nickel-cobalt development project in Western Australia that hopes to produce ~90,000 tpa (tons per annum) of battery grade nickel and cobalt sulphate for the electric vehicle market. To date, more than AU$30 million has been invested into drilling, metallurgical test work and development studies.

A Definitive Feasibility Study for NiWest is due to begin this month. The proposed location of the processing facility for NiWest is within ~30 kilometers of Glencore-owned Murrin Murrin operation, the largest nickel-cobalt operation in Australia.

“Stellantis is a partner of the highest caliber and GME is delighted to have signed this MOU in what we hope is the first step in a long-term partnership,” said GME Managing Director, Paul Kopejtka. “We’re very pleased with how our discussions have progressed and we now look forward to progressing more detailed negotiations in parallel with the start of the Definitive Feasibility Study for the NiWest Nickel-Cobalt Project. A Definitive Agreement with Stellantis would be a critical step in being able to progress the NiWest Project through to commercial operations.” (the non-binging agreement is subject to customary closing conditions, including regulatory approvals.- editor)

Stellantis strengthened its supply of low-carbon lithium hydroxide earlier this year, signing agreements with Vulcan Energy and Controlled Thermal Resources for Europe and North America, respectively. (AutoInformed.com – Stellantis Gets Lithium Supply for NA EVs; Stellantis Has Lithium Supply Deal with Vulcan Energy)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EV Battery Gold Rush Persists with Stellantis and GME

Click to Enlarge and more info.

Stellantis (NYSE: MTA. Euronext Paris: STLA) and GME Resources (ASX: GME) announced today signed a MoU on the sale of of battery nickel and cobalt sulphate from Western Australia. (AutoInformed – Stellantis Claims Record First Year with €13.4B Net Profit)

NiWest is an advanced nickel-cobalt development project in Western Australia that hopes to produce ~90,000 tpa (tons per annum) of battery grade nickel and cobalt sulphate for the electric vehicle market. To date, more than AU$30 million has been invested into drilling, metallurgical test work and development studies.

A Definitive Feasibility Study for NiWest is due to begin this month. The proposed location of the processing facility for NiWest is within ~30 kilometers of Glencore-owned Murrin Murrin operation, the largest nickel-cobalt operation in Australia.

“Stellantis is a partner of the highest caliber and GME is delighted to have signed this MOU in what we hope is the first step in a long-term partnership,” said GME Managing Director, Paul Kopejtka. “We’re very pleased with how our discussions have progressed and we now look forward to progressing more detailed negotiations in parallel with the start of the Definitive Feasibility Study for the NiWest Nickel-Cobalt Project. A Definitive Agreement with Stellantis would be a critical step in being able to progress the NiWest Project through to commercial operations.” (the non-binging agreement is subject to customary closing conditions, including regulatory approvals.- editor)

Stellantis strengthened its supply of low-carbon lithium hydroxide earlier this year, signing agreements with Vulcan Energy and Controlled Thermal Resources for Europe and North America, respectively. (AutoInformed.com – Stellantis Gets Lithium Supply for NA EVs; Stellantis Has Lithium Supply Deal with Vulcan Energy)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.