Click to Enlarge.

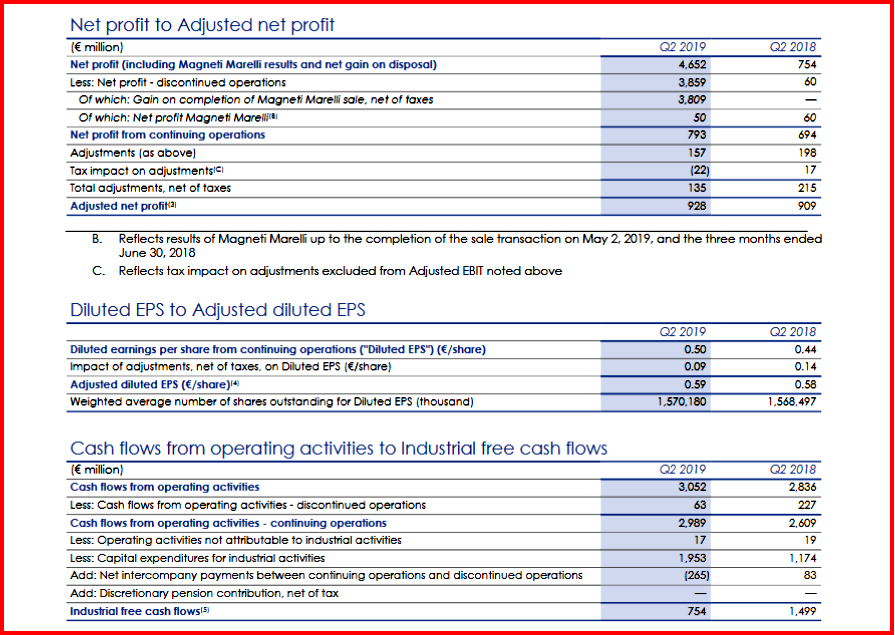

FCA Q2 2019 results continue the weakening trend at the Detroit Three and partially confirming fears of an imminent recession. FCA posted net profit from continuing operations at €0.8 billion. Worldwide combined shipments of 1,157,000 were down -11%. This made for an adjusted net profit of €0.9 billion, and a weak Adjusted EBIT of €1.5 billion, margin at 5.7%, with “significant reductions in dealer stock.”

With the first financial results since an attempt to merge with France’s Renault, FCA said its adjusted earnings before interest and tax (EBIT) would top last year’s 6.7 billion euros ($7.5 billion). It also said it continues the quest for partners. Previously it promised to deliver 2020 adjusted earnings before interest and tax (EBIT), excluding the Magneti Marelli unit it sold, of €9.2-10.4 billion.

Click to Enlarge.

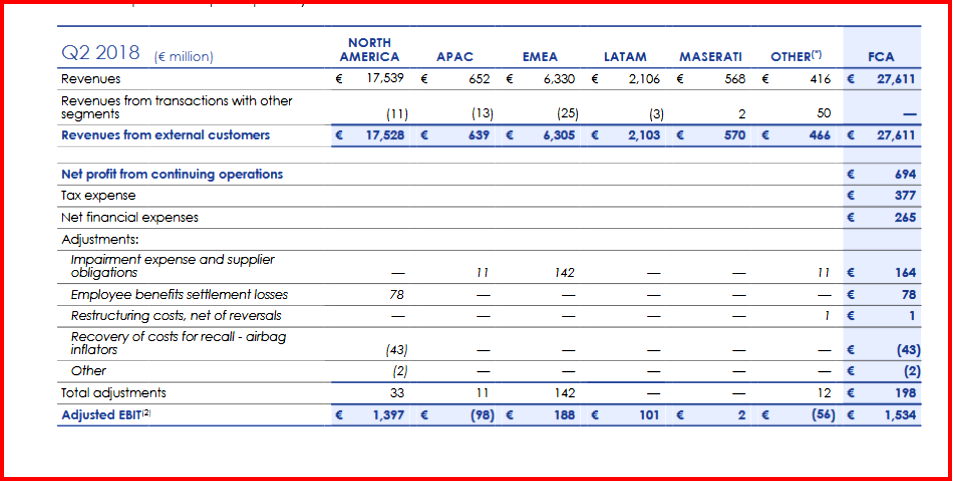

Group Adjusted EBIT in Q2 was flat with prior year. North America achieved record Q2 results despite shipments being down 12%. The successful launch of the all-new Ram heavy-duty pickup, along with the continued success of the all-new and Classic Ram 1500, resulted in a U.S. large pickup market share of 27.9% in Q2, up 7 ppts from last year.

In addition, the all-new Jeep Gladiator pickup launch has production at full run rate. Although new to the market, the Jeep Gladiator earned a 7.7% share of its U.S. segment in June.

Decent financial results in LATAM came from a strong commercial performance in Brazil where is the market leader.

Industrial free cash flows were OK at €0.8 billion, though this was down- €0.7 billion from prior year due to higher CAPEX and Q2 payments of €0.4 billion related to U.S. diesel emissions law violations accrued for in 2018.

“We have also taken a number of steps to further strengthen our fundamental business performance. Our leadership team was complemented with the addition of two members to our Group Executive Council recruited from outside the company.”

In China, a nightmare for all U.S. automakers courtesy of Trump tariffs, FCAA overhauled the leadership and structure of its joint venture. “We also continue to strengthen business disciplines around our management of costs, inventories, commercial initiatives and product planning processes.”

During the quarter FCA received local community support for the new Mack Avenue assembly plant in Detroit (Michigan) that will produce the next generation Jeep Grand Cherokee and an all-new 3-row full-size Jeep SUV. It also confirmed investment in the Mirafiori plant in Turin (Italy) to produce the all-new battery electric Fiat 500. Enel X and ENGIE joined FCA’s growing network of technology partners.

FCA says during the “second half of the year, we will continue to focus on the under-performing areas of our business, including Maserati, where we’ve reinforced our leadership team (sales and revenues down -40%); and EMEA, … restructuring actions, better management of channel mix, and targeted product strategies.”

FCA “remain confident in our ability to achieve our full-year 2019 guidance.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

FCA Q2 Earnings – Net profit at €0.8B. Trouble Ahead?

Click to Enlarge.

FCA Q2 2019 results continue the weakening trend at the Detroit Three and partially confirming fears of an imminent recession. FCA posted net profit from continuing operations at €0.8 billion. Worldwide combined shipments of 1,157,000 were down -11%. This made for an adjusted net profit of €0.9 billion, and a weak Adjusted EBIT of €1.5 billion, margin at 5.7%, with “significant reductions in dealer stock.”

With the first financial results since an attempt to merge with France’s Renault, FCA said its adjusted earnings before interest and tax (EBIT) would top last year’s 6.7 billion euros ($7.5 billion). It also said it continues the quest for partners. Previously it promised to deliver 2020 adjusted earnings before interest and tax (EBIT), excluding the Magneti Marelli unit it sold, of €9.2-10.4 billion.

Click to Enlarge.

Group Adjusted EBIT in Q2 was flat with prior year. North America achieved record Q2 results despite shipments being down 12%. The successful launch of the all-new Ram heavy-duty pickup, along with the continued success of the all-new and Classic Ram 1500, resulted in a U.S. large pickup market share of 27.9% in Q2, up 7 ppts from last year.

In addition, the all-new Jeep Gladiator pickup launch has production at full run rate. Although new to the market, the Jeep Gladiator earned a 7.7% share of its U.S. segment in June.

Decent financial results in LATAM came from a strong commercial performance in Brazil where is the market leader.

Industrial free cash flows were OK at €0.8 billion, though this was down- €0.7 billion from prior year due to higher CAPEX and Q2 payments of €0.4 billion related to U.S. diesel emissions law violations accrued for in 2018.

“We have also taken a number of steps to further strengthen our fundamental business performance. Our leadership team was complemented with the addition of two members to our Group Executive Council recruited from outside the company.”

In China, a nightmare for all U.S. automakers courtesy of Trump tariffs, FCAA overhauled the leadership and structure of its joint venture. “We also continue to strengthen business disciplines around our management of costs, inventories, commercial initiatives and product planning processes.”

During the quarter FCA received local community support for the new Mack Avenue assembly plant in Detroit (Michigan) that will produce the next generation Jeep Grand Cherokee and an all-new 3-row full-size Jeep SUV. It also confirmed investment in the Mirafiori plant in Turin (Italy) to produce the all-new battery electric Fiat 500. Enel X and ENGIE joined FCA’s growing network of technology partners.

FCA says during the “second half of the year, we will continue to focus on the under-performing areas of our business, including Maserati, where we’ve reinforced our leadership team (sales and revenues down -40%); and EMEA, … restructuring actions, better management of channel mix, and targeted product strategies.”

FCA “remain confident in our ability to achieve our full-year 2019 guidance.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.