Click for more information.

The Federal Open Market Committee’s (FOMC) efforts to restore price stability to the US was under discussion today at the Hutchins Center on Fiscal and Monetary Policy.

“The report must begin by acknowledging the reality that inflation remains far too high,” said Federal Reserve Chair Jerome Powell. “My colleagues and I are acutely aware that high inflation is imposing significant hardship, straining budgets and shrinking what paychecks will buy. This is especially painful for those least able to meet the higher costs of essentials like food, housing, and transportation.”

The remarks today are important to the US auto industry since it is responsible for a total of 10.3 million American jobs, or about 8% of private-sector employment as well as $650 billion in direct, indirect, and induced paychecks, according to the Alliance for Automotive Innovation*. More than $272 billion annually is contributed in the form of federal, state, and local tax revenues. This includes more than $70 billion in income taxes and $10 billion in corporate profit taxes. (AutoInformed’s Conclusion is Below+)

The central economic policy debate is how hard-hitting the Federal Reserve should be in its attempt to reduce inflation. Traditional thinking has it higher interest rates reduce demand. But, big but, there are dire consequences or collateral damages as the Republican Great Recession of December 2007 and the years following proved.** There are trade-offs, at least in the near term. Harsh monetary policy can cause an unnecessary recession or depression, destroying billions in potential economic output and killing jobs.

However, loose money allows inflation to endure. Worse, worker and corporate expectations integrate this, creating demand for higher wages and corporations imposing higher prices in anticipation of wage increases. And even casual observers of pricing realize that higher prices are sticky – they resist coming down even if and when the economy improves.

Price stability is the responsibility of the Federal Reserve, of course. “It serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all,” said Federal Reserve Chair Jerome Powell.

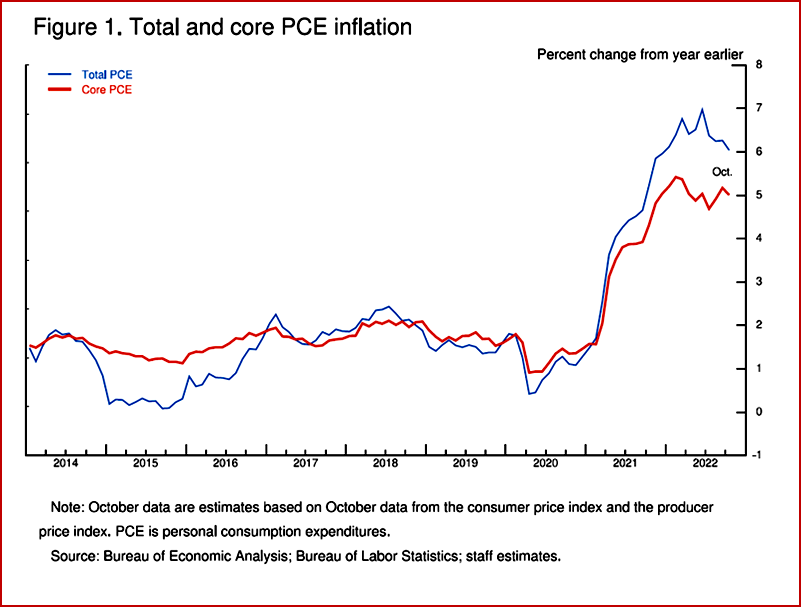

“I will focus my comments on core PCE inflation, which omits the food and energy inflation components, which have been lower recently but are quite volatile. Our inflation goal is for total inflation, of course, as food and energy prices matter a great deal for household budgets. But core inflation often gives a more accurate indicator of where overall inflation is headed. Twelve-month core PCE inflation stands at 5.0% in our October estimate, approximately where it stood last December when policy tightening was in its early stages. Over 2022, core inflation rose a few tenths above 5% and fell a few tenths below, but it mainly moved sideways. So when will inflation come down?,” said Powell.

Well, that is not the pertinent question for automakers, AutoInformed opines. The question here is at what level of a Fed induced recession or depression will it take to get inflation under control?

Brookings puts the problem thus: the U.S. labor market has been impressively resilient; unemployment is at 3.7%, the lowest it has been in decades under the Biden Administration. But in several ways the impact of the pandemic on the labor market endures. Labor force participation is not yet fully back to pre-pandemic levels. While some employers are laying off workers, many others say they are finding it hard to hire workers.

Powell’s views are nuanced, sophisticated and humanitarian, so much so it’s hard to believe that he was appointed by George Bush and served under the Obama, Trump and Biden Administrations and ***. Given his record and attitude, AutoInformed thinks it’s easy to see why he has survived at the Fed under so many Administrations of varying degrees of competence, notably Republican incompetence in economic and other policy areas, which breaks down to cut the taxes on the rich and run up the budget deficit while doing so. To hell with everybody else. A humble nod here to Paul Krugman of the New York Times who calls these Zombie theories – long dead but still walking around Republican circles as if they were alive and real in AutoInformed’s view.

So where are we?

“I could answer this question by pointing to the inflation forecasts of private-sector forecasters or of FOMC participants, which broadly show a significant decline over the next year. But forecasts have been predicting just such a decline for more than a year, while inflation has moved stubbornly sideways. The truth is that the path ahead for inflation remains highly uncertain. For now, let’s put aside the forecasts and look instead to the macroeconomic conditions we think we need to see to bring inflation down to 2% over time,” Powell said.

“For starters, we need to raise interest rates to a level that is sufficiently restrictive to return inflation to 2%. There is considerable uncertainty about what rate will be sufficient, although there is no doubt that we have made substantial progress, raising our target range for the federal funds rate by 3.75 percentage points since March.

“We are tightening the stance of policy in order to slow growth in aggregate demand. Slowing demand growth should allow supply to catch up with demand and restore the balance that will yield stable prices over time. Restoring that balance is likely to require a sustained period of below-trend growth.

“Last year, the ongoing reopening of the economy boosted real gross domestic product (GDP) growth to a very strong 5.7%. This year, GDP was roughly flat through the first three quarters, and indicators point to modest growth this quarter, which seems likely to bring the year in with very modest growth overall… We can say that demand growth has slowed, and we expect that this growth will need to remain at a slower pace for a sustained period,” Powell said.

“Early in the pandemic, goods prices began rising rapidly, as abnormally strong demand was met by pandemic-hampered supply. Reports from businesses and many indicators suggest that supply chain issues are now easing. Both fuel and non-fuel import prices have fallen in recent months, and indicators of prices paid by manufacturers have moved down. While 12-month core goods inflation remains elevated at 4.6%, it has fallen nearly 3 percentage points from earlier in the year. It is far too early to declare goods inflation vanquished, but if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months,” Powell said.

Click for more information.

Powell’s Closing

“Let’s sum up this review of economic conditions that we think we need to see to bring inflation down to 2%.

- Growth in economic activity has slowed to well below its longer-run trend, and this needs to be sustained.

- Bottlenecks in goods production are easing and goods price inflation appears to be easing as well, and this, too, must continue.

- Housing services inflation will probably keep rising well into next year, but if inflation on new leases continues to fall, we will likely see housing services inflation begin to fall later next year.

- Finally, the labor market, which is especially important for inflation in core services ex housing, shows only tentative signs of re-balancing, and wage growth remains well above levels that would be consistent with 2 percent inflation over time.

“Despite some promising developments, we have a long way to go in restoring price stability,” Powell said. However, he also said that easing might come as soon as the next Federal Reserve meeting in December. “Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.” He said it could be only half-point increase. The Fed has raised its benchmark rate six times since last March.

+Auto companies in our view need to demonstrate a degree of flexibility and speed of analysis and reaction that – much like the Covid Pandemic and Putin’s war against Ukraine – were not part of the usual operating procedures.

*Alliance for Automotive Innovation is an industry trade group comprised of the manufacturers producing ~98% of the new cars and light trucks sold in the US, as well as original equipment suppliers, technology and other automotive-related companies, and trade associations. Moreover, each job for an auto manufacturer in the United States creates ~11 other positions in industries across the economy. Auto manufacturing supplies ~$1.1 trillion into the economy each year through the sales and servicing of autos and flows through the economy, from revenue to parts suppliers to paychecks for assembly plant workers, from income for auto-related small business to revenue for government.

** The 2007-09 economic crisis was deep and long. It became known as “the Great Recession.” It was followed by a long and unusually slow recovery. In the view of critics of Republican policy and actions, the refusal to expand the money supply and stimulate the economy during Democratic Administrations made the crisis worse.

*** Powell served as an assistant secretary and as undersecretary of the Treasury under President George H.W. Bush. He was responsible for policy on financial institutions, the Treasury debt market, and related areas. Jerome Powell took office as chairman of the Board of Governors of the Federal Reserve System in February 2018. He was sworn in on May 23, 2022 for a second term as Chair ending May 15, 2026.

Federal Reserve Chair Powell Says Inflation Remains Too High

Click for more information.

The Federal Open Market Committee’s (FOMC) efforts to restore price stability to the US was under discussion today at the Hutchins Center on Fiscal and Monetary Policy.

“The report must begin by acknowledging the reality that inflation remains far too high,” said Federal Reserve Chair Jerome Powell. “My colleagues and I are acutely aware that high inflation is imposing significant hardship, straining budgets and shrinking what paychecks will buy. This is especially painful for those least able to meet the higher costs of essentials like food, housing, and transportation.”

The remarks today are important to the US auto industry since it is responsible for a total of 10.3 million American jobs, or about 8% of private-sector employment as well as $650 billion in direct, indirect, and induced paychecks, according to the Alliance for Automotive Innovation*. More than $272 billion annually is contributed in the form of federal, state, and local tax revenues. This includes more than $70 billion in income taxes and $10 billion in corporate profit taxes. (AutoInformed’s Conclusion is Below+)

The central economic policy debate is how hard-hitting the Federal Reserve should be in its attempt to reduce inflation. Traditional thinking has it higher interest rates reduce demand. But, big but, there are dire consequences or collateral damages as the Republican Great Recession of December 2007 and the years following proved.** There are trade-offs, at least in the near term. Harsh monetary policy can cause an unnecessary recession or depression, destroying billions in potential economic output and killing jobs.

However, loose money allows inflation to endure. Worse, worker and corporate expectations integrate this, creating demand for higher wages and corporations imposing higher prices in anticipation of wage increases. And even casual observers of pricing realize that higher prices are sticky – they resist coming down even if and when the economy improves.

Price stability is the responsibility of the Federal Reserve, of course. “It serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all,” said Federal Reserve Chair Jerome Powell.

“I will focus my comments on core PCE inflation, which omits the food and energy inflation components, which have been lower recently but are quite volatile. Our inflation goal is for total inflation, of course, as food and energy prices matter a great deal for household budgets. But core inflation often gives a more accurate indicator of where overall inflation is headed. Twelve-month core PCE inflation stands at 5.0% in our October estimate, approximately where it stood last December when policy tightening was in its early stages. Over 2022, core inflation rose a few tenths above 5% and fell a few tenths below, but it mainly moved sideways. So when will inflation come down?,” said Powell.

Well, that is not the pertinent question for automakers, AutoInformed opines. The question here is at what level of a Fed induced recession or depression will it take to get inflation under control?

Brookings puts the problem thus: the U.S. labor market has been impressively resilient; unemployment is at 3.7%, the lowest it has been in decades under the Biden Administration. But in several ways the impact of the pandemic on the labor market endures. Labor force participation is not yet fully back to pre-pandemic levels. While some employers are laying off workers, many others say they are finding it hard to hire workers.

Powell’s views are nuanced, sophisticated and humanitarian, so much so it’s hard to believe that he was appointed by George Bush and served under the Obama, Trump and Biden Administrations and ***. Given his record and attitude, AutoInformed thinks it’s easy to see why he has survived at the Fed under so many Administrations of varying degrees of competence, notably Republican incompetence in economic and other policy areas, which breaks down to cut the taxes on the rich and run up the budget deficit while doing so. To hell with everybody else. A humble nod here to Paul Krugman of the New York Times who calls these Zombie theories – long dead but still walking around Republican circles as if they were alive and real in AutoInformed’s view.

So where are we?

“I could answer this question by pointing to the inflation forecasts of private-sector forecasters or of FOMC participants, which broadly show a significant decline over the next year. But forecasts have been predicting just such a decline for more than a year, while inflation has moved stubbornly sideways. The truth is that the path ahead for inflation remains highly uncertain. For now, let’s put aside the forecasts and look instead to the macroeconomic conditions we think we need to see to bring inflation down to 2% over time,” Powell said.

“For starters, we need to raise interest rates to a level that is sufficiently restrictive to return inflation to 2%. There is considerable uncertainty about what rate will be sufficient, although there is no doubt that we have made substantial progress, raising our target range for the federal funds rate by 3.75 percentage points since March.

“We are tightening the stance of policy in order to slow growth in aggregate demand. Slowing demand growth should allow supply to catch up with demand and restore the balance that will yield stable prices over time. Restoring that balance is likely to require a sustained period of below-trend growth.

“Last year, the ongoing reopening of the economy boosted real gross domestic product (GDP) growth to a very strong 5.7%. This year, GDP was roughly flat through the first three quarters, and indicators point to modest growth this quarter, which seems likely to bring the year in with very modest growth overall… We can say that demand growth has slowed, and we expect that this growth will need to remain at a slower pace for a sustained period,” Powell said.

“Early in the pandemic, goods prices began rising rapidly, as abnormally strong demand was met by pandemic-hampered supply. Reports from businesses and many indicators suggest that supply chain issues are now easing. Both fuel and non-fuel import prices have fallen in recent months, and indicators of prices paid by manufacturers have moved down. While 12-month core goods inflation remains elevated at 4.6%, it has fallen nearly 3 percentage points from earlier in the year. It is far too early to declare goods inflation vanquished, but if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months,” Powell said.

Click for more information.

Powell’s Closing

“Let’s sum up this review of economic conditions that we think we need to see to bring inflation down to 2%.

“Despite some promising developments, we have a long way to go in restoring price stability,” Powell said. However, he also said that easing might come as soon as the next Federal Reserve meeting in December. “Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.” He said it could be only half-point increase. The Fed has raised its benchmark rate six times since last March.

+Auto companies in our view need to demonstrate a degree of flexibility and speed of analysis and reaction that – much like the Covid Pandemic and Putin’s war against Ukraine – were not part of the usual operating procedures.

*Alliance for Automotive Innovation is an industry trade group comprised of the manufacturers producing ~98% of the new cars and light trucks sold in the US, as well as original equipment suppliers, technology and other automotive-related companies, and trade associations. Moreover, each job for an auto manufacturer in the United States creates ~11 other positions in industries across the economy. Auto manufacturing supplies ~$1.1 trillion into the economy each year through the sales and servicing of autos and flows through the economy, from revenue to parts suppliers to paychecks for assembly plant workers, from income for auto-related small business to revenue for government.

** The 2007-09 economic crisis was deep and long. It became known as “the Great Recession.” It was followed by a long and unusually slow recovery. In the view of critics of Republican policy and actions, the refusal to expand the money supply and stimulate the economy during Democratic Administrations made the crisis worse.

*** Powell served as an assistant secretary and as undersecretary of the Treasury under President George H.W. Bush. He was responsible for policy on financial institutions, the Treasury debt market, and related areas. Jerome Powell took office as chairman of the Board of Governors of the Federal Reserve System in February 2018. He was sworn in on May 23, 2022 for a second term as Chair ending May 15, 2026.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.