Worrisome was a huge charge that FCA took for the cost of safety recalls and warranty repairs in the U.S. – a whopping €200 million for Q3 alone.

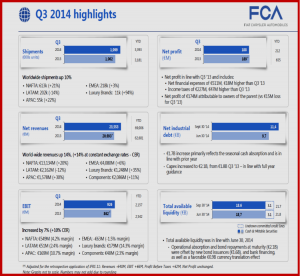

In spite of good global sales, the newly merged and now publicly listed FCA*, aka Fiat Chrysler Automobile, posted weak earnings during Q3 as it cleaned up its books and added a worrisome amount of debt. FCA said operating profit in Q3 rose 7% to €926 million (~$1.18 billion) compared with a so-called consensus analyst forecast of €940 million. Revenue increased to €23.6 billion from €20.7 billion.

However, debt rose higher than expected to €11.4 billion at the end of September, up from €9.7 billion at the end of June. This past July, the Group issued an €850 million bond at 4.75% and an 8-year term, which was subsequently reopened and increased by additional €500 million in September. Total available liquidity for the Group by the end of the quarter was €21.7 billion.

“I think some of you are concerned about the level of debt at the end of the third quarter. If you follow the historical pattern of the working capital build in FCA, you will understand this is purely due to seasonality and I would not read much into the numbers this time,” said CEO Sergio Marchionne on the earnings conference call with analysts and news organization, including AutoInformed.

Group worldwide shipments in the quarter were up 10% year-over-year to 1.1 million units, with Group revenues at €23.6 billion. Nine-month revenues were €69 billion from sales of 3.4 million vehicles. Earnings for nine months (EBIT) were €2.2 billion.

Worrisome was a huge charge that FCA took for the cost of safety recalls and warranty repairs in the U.S. – a whopping €200 million for Q3 alone. Indeed, in its latest quality gaffe, Chrysler said yesterday that it was recalling more than 33,443 light trucks in two separate U.S. safety defect actions to prevent false warnings from the tire-pressure monitor systems. Chrysler said it was unaware of any injuries or accidents related to either recall. The recall parade at FCA is now a weekly occurrence.

At the beginning of the week on Monday, Fiat finished dead last in the latest Consumer Reports Initial Quality survey – with all of its volume brands at the bottom of the list. Chrysler fired its head of quality the morning after the results were announced at the Automotive Press Association. Matthew Liddane became the Head of Quality in North America. Liddane previously was Vice President – Systems and Components for Chrysler Group. Liddane replaced Doug Betts who left the Company to “pursue other interests,” in the laughable P.R. language of the company. So far, this has not hurt buyer confidence in the U.S., but make no mistake this is a ticking bomb at FCA.

Another drama within the ongoing soap opera that is Fiat since 2008 concerns the sale of Ferrari, which. Fiat Chrysler Automobiles is going to spin off by listing its shares in New York. Ferrari in 2013 earned €364 million before taxes so there is opportunity here, but perhaps not wisdom. This impending piece of financial engineering is part of a bigger five-year expansion business plan that anlysts are so far skeptical of, which includes a $2.5 billion convertible bond issue.

FCA moved its primary share listing to New York earlier this month from Milan, and plans to invest ~$61 billion during the next five years on its Jeep, Maserati and Alfa Romeo nameplates to make them global, thereby emulating and attacking the Volkswagen Group, BMW and Mercedes-Benz in the extremely profitable, expanding premium vehicle market.

FCA will sell by the end of 2014 up to 100 million of its shares — including treasury shares and stock that will be issued to cover a share buyback from Fiat investors who opposed the merger into FCA. The other 80% of the stock held by Fiat Chrysler will be distributed to FCA shareholders, including Fiat’s founding Agnelli family that still controls 30% of FCA. IT sure looks like a significant watering of the stock to some.

Last month Luca Cordero di Montezemolo said he was stepping down after 23 years running Ferrari, the successful and extremely profitable sports car maker. Fiat Chrysler plans to offer 10% of Ferrari’s outstanding shares through a public offering and distribute the rest to Fiat Chrysler’s shareholders sometime next year.

The Ferrari sports car brand has just been fined $3.5 million for not filing “early warning reports” with the National Highway Traffic Safety Administration it said today, even though it had been required since 2011 to file quarterly safety documents because that was the year that Fiat began selling cars in the U.S. market after the notorious bankruptcy of Chrysler and subsequent takeover by Fiat. Ferrari violated the law during the three-year period, it had been exempt as a small maker until then, and it failed to report three fatal incidents, NHTSA said in a release.

* On 1 August 2014 at a shareholders meeting a cross-border merger of Fiat S.p.A. was approved with and into a wholly owned subsidiary incorporated in the Netherlands, Fiat Investments N.V. This merger became effective on 12 October. The new company was renamed as FCA and started trading on both the New York Stock Exchange and the Milan Stock Exchange on 13 October 2014. This past July, the Group issued an €850 million bond with a 4.75% coupon and an 8-year tenor, which was subsequently reopened and increased by additional €500 million in September.