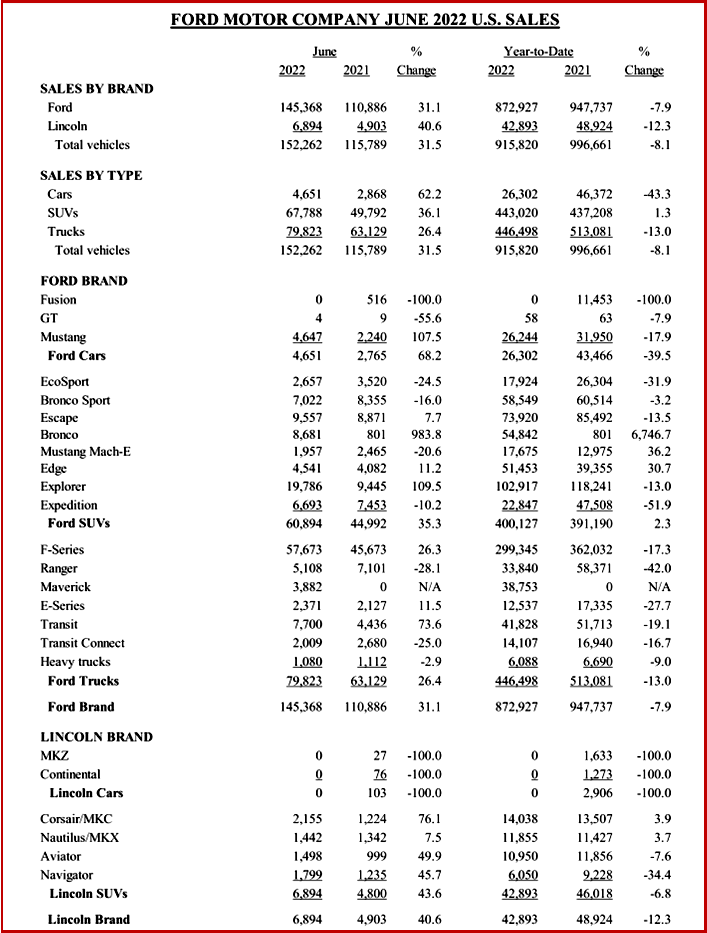

Ford Motor Company said today that it was better than the overall industry in June with sales up 31% on a good mix of F-Series and SUV sales. The F-150 Lightning was the best-selling electric truck in June as EV Vehicle Sales increase 77% and Lincoln SUV sales rose 44%. However, both of those numbers reflect an extremely small base when compared year-over-year.

Thus far high gasoline prices, rising interest rates and declining to non-existent incentives have not had the expected negative effect on demand. Passenger cars sales at Ford dropped again by -43.3% at 26,302.

Click to Enlarge.

The year-over year comparison did not mention Ford Motor was among the most negatively affected automakers, as shortage-related plant shutdowns left its facilities running at just 55% of total capacity through May of 2021. Ford’s estimated volume loss in the first half of that year is more than 50% greater than production losses recorded by the next manufacturer on the list – the largest in North America – GM, according to consultancy LMC Automotive. (AutoInformed: Ford Leads NA Production Cuts from Semiconductor Shortage)

However, this year GM outsold Toyota year-to-date at 1,095,247 vehicles to Toyota’s 1,045,697. Ford is at 915,820 or -8.1%. Toyota is struggling with production because of chip shortages and COVID shut downs, particularly in China.

Ford said on Wednesday 30 June 2021 that its pickup truck factories in Michigan, Kentucky and Missouri would reduce or stop production for almost all of July of 2021. The Explorer plant in Chicago shut for the entire month. Production of several other models also were reduced or canceled, including the Escape SUV and Mustang sports car.

“If we dig a little deeper into the lost volume, there are clear disparities. When looking at volume lost in the high-profit Full-size Pickup and SUV segments – which include lucrative models like the Ford F-150, Ram 1500, Chevrolet Silverado, GMC Yukon and Ford Expedition – the impact on Ford’s output is far more alarming, with an estimated 37% of the volume losses stemming from those segments, compared with 13% for Stellantis and only 1% for GM,” according to Bill Rinna of LMC Automotive last June.

We will see how it plays out fore the balance of 2022. (AutoInformed: Ford Motor Blues – 2022 Q1 Loss of $3.1 Billion)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford June US Sales Up 31%, YTD -8%

Ford Motor Company said today that it was better than the overall industry in June with sales up 31% on a good mix of F-Series and SUV sales. The F-150 Lightning was the best-selling electric truck in June as EV Vehicle Sales increase 77% and Lincoln SUV sales rose 44%. However, both of those numbers reflect an extremely small base when compared year-over-year.

Thus far high gasoline prices, rising interest rates and declining to non-existent incentives have not had the expected negative effect on demand. Passenger cars sales at Ford dropped again by -43.3% at 26,302.

Click to Enlarge.

The year-over year comparison did not mention Ford Motor was among the most negatively affected automakers, as shortage-related plant shutdowns left its facilities running at just 55% of total capacity through May of 2021. Ford’s estimated volume loss in the first half of that year is more than 50% greater than production losses recorded by the next manufacturer on the list – the largest in North America – GM, according to consultancy LMC Automotive. (AutoInformed: Ford Leads NA Production Cuts from Semiconductor Shortage)

However, this year GM outsold Toyota year-to-date at 1,095,247 vehicles to Toyota’s 1,045,697. Ford is at 915,820 or -8.1%. Toyota is struggling with production because of chip shortages and COVID shut downs, particularly in China.

Ford said on Wednesday 30 June 2021 that its pickup truck factories in Michigan, Kentucky and Missouri would reduce or stop production for almost all of July of 2021. The Explorer plant in Chicago shut for the entire month. Production of several other models also were reduced or canceled, including the Escape SUV and Mustang sports car.

“If we dig a little deeper into the lost volume, there are clear disparities. When looking at volume lost in the high-profit Full-size Pickup and SUV segments – which include lucrative models like the Ford F-150, Ram 1500, Chevrolet Silverado, GMC Yukon and Ford Expedition – the impact on Ford’s output is far more alarming, with an estimated 37% of the volume losses stemming from those segments, compared with 13% for Stellantis and only 1% for GM,” according to Bill Rinna of LMC Automotive last June.

We will see how it plays out fore the balance of 2022. (AutoInformed: Ford Motor Blues – 2022 Q1 Loss of $3.1 Billion)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.