Ford Motor (NYSE: F) after the markets closed on Thursday reported a 2022 full-year net loss of $2.0 billion. During Q4 Ford posted an adjusted EBIT $10.4 billion, and operating cash flow $1.2 billion for the quarter, $6.9 billion for the year. This was in stark contrast to GM, which reported a record $14.5 billion in earnings for 2022 earlier this week. (autoinformed.com: GM Posts Record $14.5 Billion in Earnings During 2022)

“We should have done much better last year,” said CEO Jim Farley. “We left about $2 billion in profits on the table that were within our control, and we’re going to correct that with improved execution and performance.”

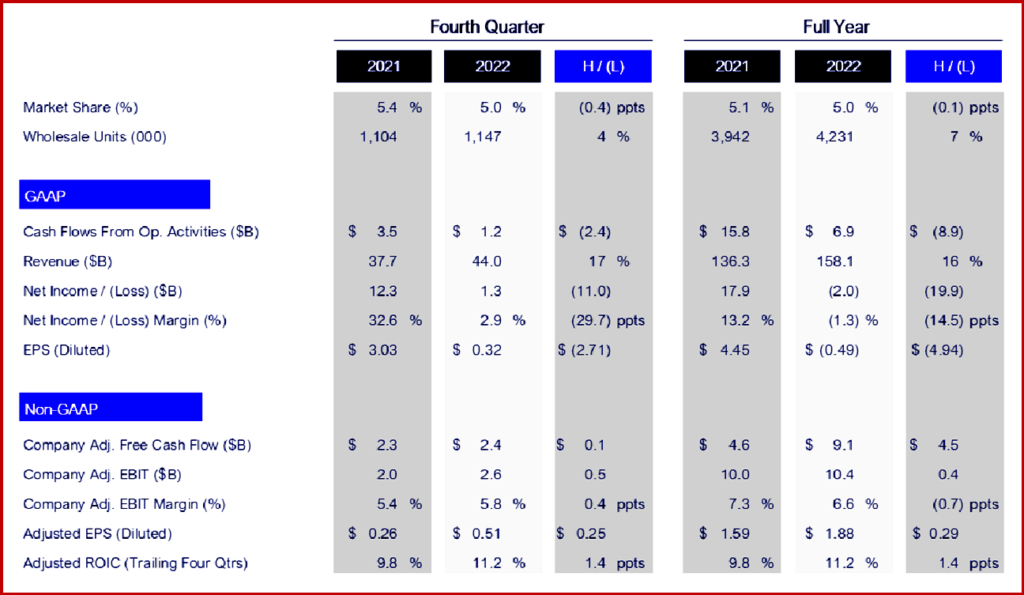

Click chart to enlarge.

Ford revenue for Q4 and all of 2022 reached $44.0 billion and $158.1 billion, respectively. For the same periods, the company had net income of $1.3 billion and a net loss of $2.0 billion, and adjusted EBIT of $2.6 billion and $10.4 billion. The results were below Ford’s expectations, “attributable, in part, to execution issues in an environment with supply chain and production instability, resulting in higher costs and lower-than-planned volumes,” Ford said. (autoinformed.com: Ford Changes Supply Chain and Product Development Execs)

Operating cash flow for the year 2022 was $6.9 billion; full-year adjusted free cash flow was $9.1 billion. The company ended 2022 with a balance sheet: $32 billion in cash and $48 billion of liquidity.

Nevertheless, Ford declared a regular dividend of 15 cents per share, plus supplemental dividend of 65 cents per share, enabled in part by the “nearly complete monetization of stake in Rivian Company.” Ford anticipates full-year 2023 adjusted EBIT of $9 billion to $11 billion and adjusted free cash flow of about $6 billion.

With the start of 2023, Ford is now organized by and will report operating performance based on the three new customer–centered business segments – Ford Blue, Ford Model e and Ford Pro – rather than as a single automotive business with regional details, a shift the company first announced last March.

“This goes way beyond how we account for the business,” said CFO John Lawler. “This is a fundamental change in how we think, make decisions and run the company – so we’re creating great experiences and value for customers and fulfilling the huge promise of Ford+.” (AutoInformed.com: Ford Motor Structure Threatens Viability. Vast Reorg Coming)

On 23 March Ford will hold a “teach in” (following GM’s practice of “Investors’ Day”) about the new structure and reporting for investors and other stakeholders. At the event, which will be held at the New York Stock Exchange and also webcast “live,” Ford will explain how revenue, products and assets are assigned to each segment, and show recast financials for 2021 and 2022. (autoinformed.com: GM Raises 2022 Earnings, Offers 2023-25 Performance Goals)

“We have great flexibility to invest in the Ford+ growth plan and return capital to shareholders at the same time,” said Lawler. “Going forward, we intend to target distributions of 40% to 50% of free cash flow.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Misses Q4 and Full Year 2022 Forecasts. Loses $2B

Ford Motor (NYSE: F) after the markets closed on Thursday reported a 2022 full-year net loss of $2.0 billion. During Q4 Ford posted an adjusted EBIT $10.4 billion, and operating cash flow $1.2 billion for the quarter, $6.9 billion for the year. This was in stark contrast to GM, which reported a record $14.5 billion in earnings for 2022 earlier this week. (autoinformed.com: GM Posts Record $14.5 Billion in Earnings During 2022)

“We should have done much better last year,” said CEO Jim Farley. “We left about $2 billion in profits on the table that were within our control, and we’re going to correct that with improved execution and performance.”

Click chart to enlarge.

Ford revenue for Q4 and all of 2022 reached $44.0 billion and $158.1 billion, respectively. For the same periods, the company had net income of $1.3 billion and a net loss of $2.0 billion, and adjusted EBIT of $2.6 billion and $10.4 billion. The results were below Ford’s expectations, “attributable, in part, to execution issues in an environment with supply chain and production instability, resulting in higher costs and lower-than-planned volumes,” Ford said. (autoinformed.com: Ford Changes Supply Chain and Product Development Execs)

Operating cash flow for the year 2022 was $6.9 billion; full-year adjusted free cash flow was $9.1 billion. The company ended 2022 with a balance sheet: $32 billion in cash and $48 billion of liquidity.

Nevertheless, Ford declared a regular dividend of 15 cents per share, plus supplemental dividend of 65 cents per share, enabled in part by the “nearly complete monetization of stake in Rivian Company.” Ford anticipates full-year 2023 adjusted EBIT of $9 billion to $11 billion and adjusted free cash flow of about $6 billion.

With the start of 2023, Ford is now organized by and will report operating performance based on the three new customer–centered business segments – Ford Blue, Ford Model e and Ford Pro – rather than as a single automotive business with regional details, a shift the company first announced last March.

“This goes way beyond how we account for the business,” said CFO John Lawler. “This is a fundamental change in how we think, make decisions and run the company – so we’re creating great experiences and value for customers and fulfilling the huge promise of Ford+.” (AutoInformed.com: Ford Motor Structure Threatens Viability. Vast Reorg Coming)

On 23 March Ford will hold a “teach in” (following GM’s practice of “Investors’ Day”) about the new structure and reporting for investors and other stakeholders. At the event, which will be held at the New York Stock Exchange and also webcast “live,” Ford will explain how revenue, products and assets are assigned to each segment, and show recast financials for 2021 and 2022. (autoinformed.com: GM Raises 2022 Earnings, Offers 2023-25 Performance Goals)

“We have great flexibility to invest in the Ford+ growth plan and return capital to shareholders at the same time,” said Lawler. “Going forward, we intend to target distributions of 40% to 50% of free cash flow.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.