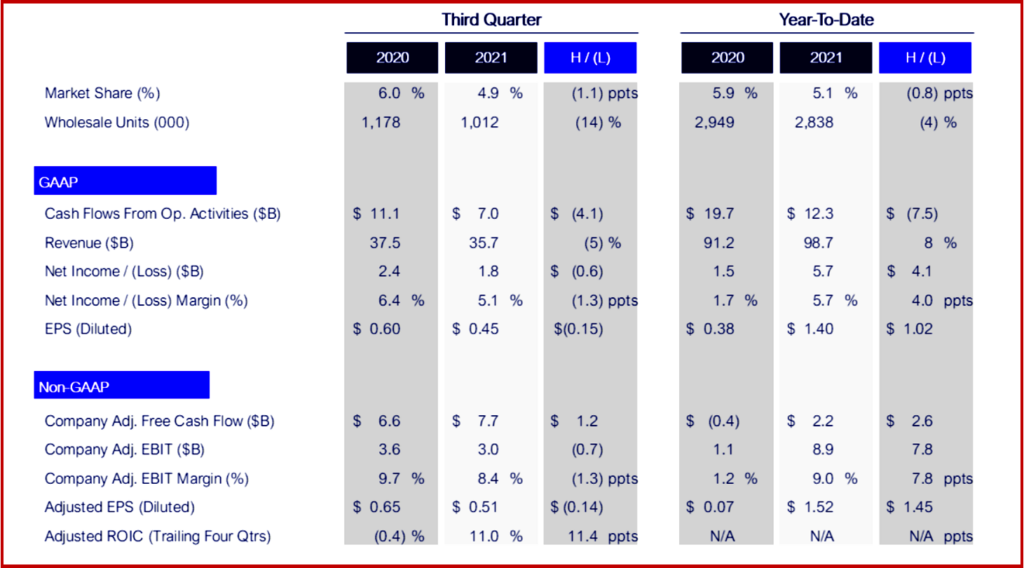

Ford Motor Company late today posted an adjusted EBIT of $3.0 billion with margin of 8.4%. Third-quarter cash flow from operations was $7.0 billion and adjusted free cash flow was $7.7 billion, both up from the second quarter largely because of the higher vehicle wholesales and profitability. The company ended Q3 with $31.5 billion of cash and $47.4 billion in total liquidity.

Once again market share slipped to 4.9% from 6% y-o-y as wholesales dropped to 1,012,000 from 1,178,000. At the end of the third quarter, new vehicle inventory for all makers in the U.S. was just under a million units or approximately 24 days of supply, says NADA. This is a 65% decrease from the start of 2021. In contrast, at the end of the third quarter in 2020, inventory was at 2.7 million units or a 50-day supply.

Third-quarter revenue of $35.7 billion was down from the same quarter a year ago. Semiconductor availability remains a challenge, but “markedly improved from the second quarter, propelling sequential increases in wholesale shipments and revenue of 32% and 33%, respectively.”

Click to Enlarge.

Executive summary: Ford’s revenue, net income, adjusted earnings before interest and taxes, cash flow from operations, and adjusted free cash flow were all higher from the second to the third quarter of 2021, because of “significant increases in semiconductor availability and wholesale vehicle shipments from Q2.”

Ford, Argo AI and Walmart last month said they are working on a “last mile” autonomous-vehicle delivery service for customers in Miami; Austin, Texas; and Washington, D.C. – cities where Ford and Argo AI already have operations. The program will use Ford self-driving test vehicles equipped with Argo AI’s self-driving system.

CEO Jim Farley said that Ford “fully supports” Argo AI’s plan to access public capital. The deal blends Argo, a self-driving technology provider, with an automotive manufacturer able to integrate that technology with mass-produced vehicles and the world’s largest retailer. The multi-city service will allow Walmart customers to place orders of groceries and other popular items online for door-to-door autonomous delivery directly to customers’ homes. (Ford, Argo AI, Walmart to Launch Autonomous Vehicle Delivery)

Ford upped guidance for full-year 2021 adjusted EBIT to between $10.5 billion and $11.5 billion. It also said it expects cash flow during the current planning period to be more than sufficient to fund growth priorities. Ford also announced the resumption of regular stock dividend in fourth quarter.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Earns $3.0 Billion in Q3

Ford Motor Company late today posted an adjusted EBIT of $3.0 billion with margin of 8.4%. Third-quarter cash flow from operations was $7.0 billion and adjusted free cash flow was $7.7 billion, both up from the second quarter largely because of the higher vehicle wholesales and profitability. The company ended Q3 with $31.5 billion of cash and $47.4 billion in total liquidity.

Once again market share slipped to 4.9% from 6% y-o-y as wholesales dropped to 1,012,000 from 1,178,000. At the end of the third quarter, new vehicle inventory for all makers in the U.S. was just under a million units or approximately 24 days of supply, says NADA. This is a 65% decrease from the start of 2021. In contrast, at the end of the third quarter in 2020, inventory was at 2.7 million units or a 50-day supply.

Third-quarter revenue of $35.7 billion was down from the same quarter a year ago. Semiconductor availability remains a challenge, but “markedly improved from the second quarter, propelling sequential increases in wholesale shipments and revenue of 32% and 33%, respectively.”

Click to Enlarge.

Executive summary: Ford’s revenue, net income, adjusted earnings before interest and taxes, cash flow from operations, and adjusted free cash flow were all higher from the second to the third quarter of 2021, because of “significant increases in semiconductor availability and wholesale vehicle shipments from Q2.”

Ford, Argo AI and Walmart last month said they are working on a “last mile” autonomous-vehicle delivery service for customers in Miami; Austin, Texas; and Washington, D.C. – cities where Ford and Argo AI already have operations. The program will use Ford self-driving test vehicles equipped with Argo AI’s self-driving system.

CEO Jim Farley said that Ford “fully supports” Argo AI’s plan to access public capital. The deal blends Argo, a self-driving technology provider, with an automotive manufacturer able to integrate that technology with mass-produced vehicles and the world’s largest retailer. The multi-city service will allow Walmart customers to place orders of groceries and other popular items online for door-to-door autonomous delivery directly to customers’ homes. (Ford, Argo AI, Walmart to Launch Autonomous Vehicle Delivery)

Ford upped guidance for full-year 2021 adjusted EBIT to between $10.5 billion and $11.5 billion. It also said it expects cash flow during the current planning period to be more than sufficient to fund growth priorities. Ford also announced the resumption of regular stock dividend in fourth quarter.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.