Ford Motor (NYSE: F) late today said that during Q2 of 2022 it had revenue of $40.2 billion because of a 35% increase in wholesale shipments together with “favorable pricing and vehicle mix.” Operating cash flow was $2.9 billion and adjusted free cash flow was $3.6 billion, with automotive EBIT of $3.3 billion. Ford ended the quarter with $29 billion in cash, $45 billion in total liquidity.

However, Ford’s net income was $667 million, a margin of 1.7%, which included a mark-to-market loss of, gulp, $2.4 billion on Ford’s stake in Rivian. Ford is also in the process of slashing costs under its latest restructuring plan, but refused to comment on pending job cuts, which are being reported by Bloomberg as around 8000 white collar positions in a bid to cut $3 billion in costs, other than to say there are too many people.

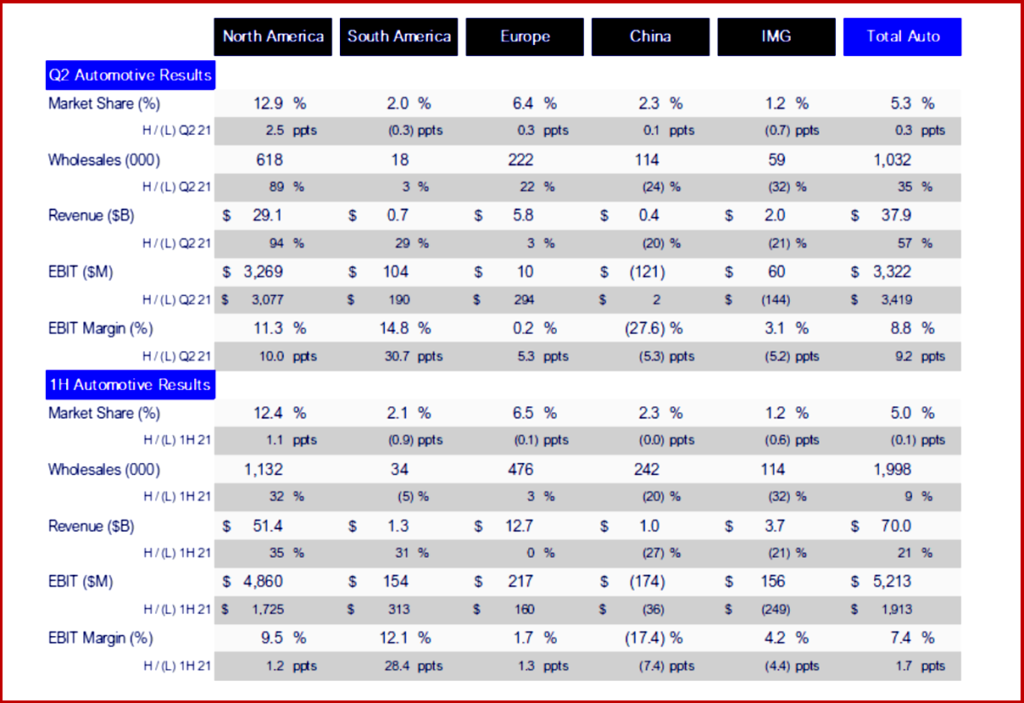

Click to Enlarge.

Ford quality problems and ongoing recalls remain an expensive and reputation damaging trends. [General Motors Co. (NYSE: GM) yesterday reported second-quarter net income attributable to stockholders of $1.7 billion and EBIT-adjusted of $2.3 billion. AutoInformed: GM Q2 Earnings at $2.3B Off -$1.1B YoY]

Ford Credit had good quarterly results, with earnings before taxes of $939 million, from what Ford said were “healthy lease residuals and credit-loss performance.”

“We’re moving with purpose and speed into the most promising period for growth in Ford’s history – to innovate and deliver great products and connected services, raise quality and lower costs,” claimed CEO Jim Farley.

Starting next year, Ford will operate and report financial results around:

- Ford Blue – Building out the company’s iconic portfolio of internal-combustion vehicles and optimizing related operations to drive growth and profitability

- Ford Model e – Accelerating development of breakthrough electric vehicles at scale, along with software and connected vehicle technologies and services that will be applied to all of the company’s products, and

- Ford Pro – Which is providing new levels of productivity to business and government customers through work-ready ICE and electric products, along with services to best manage their fleets and broader operations.

Farley said that Ford Pro provides a comprehensive and vivid example today of how Ford+ will benefit customers and, in turn, the company and its other stakeholders over time.

While commercial customers still overwhelmingly rely on Ford’s industry-leading ICE vans and pickup trucks, he claimed that they’re increasingly evaluating and adopting EV technology. According to Motor Intelligence, through the second quarter, Ford E-Transit accounted for 95% of full-size electric vans sold in the U.S. In Europe, the company already has more than 8,000 orders for its two-ton E-Transit, with a one-ton version scheduled for introduction next year.

CFO John Lawler said that Ford’s outlook for full-year 2022 financial performance has not changed: adjusted EBIT of $11.5 billion to $12.5 billion, which would take 15% to 25% growth from last year, and adjusted free cash flow of $5.5 billion to $6.5 billion.

Lawler said once again that Ford is targeting a total company adjusted EBIT margin of 10% – and an 8% EBIT margin from its EVs – by 2026. Ford sold 5000 EVs in July as the company is preparing to invest $50 billion in EVs, which it needs to do to survive.

The company’s full-year 2022 guidance continues to assume:

- 10% to 15% growth in vehicle wholesales from 2021;

- along with significantly higher profits in North America;

- collective profitability from other regional markets;

- strong earnings before taxes, though lower than last year, from Ford Credit;

- and modest improvement in Mobility and Corporate Other.

Lawler said that demand and the resulting order bank for Ford’s internal combustion and mainstream electric vehicles is – and is expected to remain – strong.

Other assumptions include:

- Continued strong pricing, including benefits from actions taken during the year, as the relationship between product volume and pricing remains dynamic

- About $4 billion in headwinds from commodity prices, which Ford anticipates offsetting with improvements in net pricing and mix

- Other inflationary pressures continuing to affect a broad range of costs – now expected to total about $3 billion for the year, up roughly $1 billion from what the company envisioned a quarter ago, with the team actively looking at opportunities to offset increases, and

- Solid, but lower, full-year EBT from Ford Credit of about $3 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Posts Good Earnings But Weak Net Income

Ford Motor (NYSE: F) late today said that during Q2 of 2022 it had revenue of $40.2 billion because of a 35% increase in wholesale shipments together with “favorable pricing and vehicle mix.” Operating cash flow was $2.9 billion and adjusted free cash flow was $3.6 billion, with automotive EBIT of $3.3 billion. Ford ended the quarter with $29 billion in cash, $45 billion in total liquidity.

However, Ford’s net income was $667 million, a margin of 1.7%, which included a mark-to-market loss of, gulp, $2.4 billion on Ford’s stake in Rivian. Ford is also in the process of slashing costs under its latest restructuring plan, but refused to comment on pending job cuts, which are being reported by Bloomberg as around 8000 white collar positions in a bid to cut $3 billion in costs, other than to say there are too many people.

Click to Enlarge.

Ford quality problems and ongoing recalls remain an expensive and reputation damaging trends. [General Motors Co. (NYSE: GM) yesterday reported second-quarter net income attributable to stockholders of $1.7 billion and EBIT-adjusted of $2.3 billion. AutoInformed: GM Q2 Earnings at $2.3B Off -$1.1B YoY]

Ford Credit had good quarterly results, with earnings before taxes of $939 million, from what Ford said were “healthy lease residuals and credit-loss performance.”

“We’re moving with purpose and speed into the most promising period for growth in Ford’s history – to innovate and deliver great products and connected services, raise quality and lower costs,” claimed CEO Jim Farley.

Starting next year, Ford will operate and report financial results around:

Farley said that Ford Pro provides a comprehensive and vivid example today of how Ford+ will benefit customers and, in turn, the company and its other stakeholders over time.

While commercial customers still overwhelmingly rely on Ford’s industry-leading ICE vans and pickup trucks, he claimed that they’re increasingly evaluating and adopting EV technology. According to Motor Intelligence, through the second quarter, Ford E-Transit accounted for 95% of full-size electric vans sold in the U.S. In Europe, the company already has more than 8,000 orders for its two-ton E-Transit, with a one-ton version scheduled for introduction next year.

CFO John Lawler said that Ford’s outlook for full-year 2022 financial performance has not changed: adjusted EBIT of $11.5 billion to $12.5 billion, which would take 15% to 25% growth from last year, and adjusted free cash flow of $5.5 billion to $6.5 billion.

Lawler said once again that Ford is targeting a total company adjusted EBIT margin of 10% – and an 8% EBIT margin from its EVs – by 2026. Ford sold 5000 EVs in July as the company is preparing to invest $50 billion in EVs, which it needs to do to survive.

The company’s full-year 2022 guidance continues to assume:

Lawler said that demand and the resulting order bank for Ford’s internal combustion and mainstream electric vehicles is – and is expected to remain – strong.

Other assumptions include:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.