Click to Enlarge.

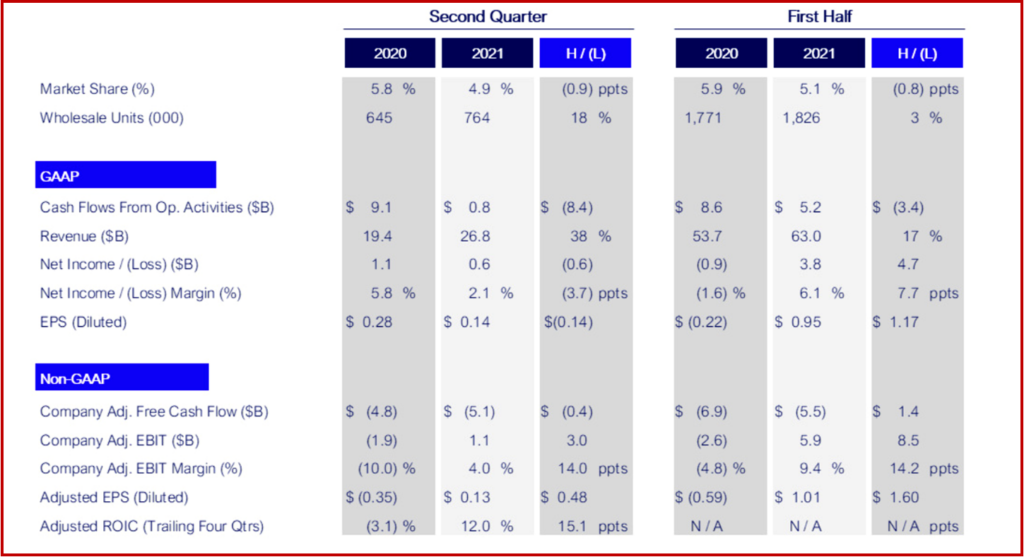

Ford posted acceptable operating results in Q2 of 2021 – selling 764,00 vehicles – while further rolling out its reorganization plan dubbed Ford+. It earned 14-cents/share. Ford also to some degree limited the ongoing damages from semiconductor supply shortages. As a result, it raised projected full-year 2021 adjusted EBIT and adjusted free cash flow, respectively, to between $9 billion and $10 billion and between $4 billion and $5 billion.

During April with the semiconductor situation worsening, Ford said it expected to lose about 50% of its planned second-quarter production, which would have resulted in a loss in the period. Ford did better than that using the strong demand from the Biden Administration economic boom to improve revenue and profits through lower incentives and a more expensive and profitable mix of vehicles. These generated company-wide adjusted earnings of $1.1 billion before interest and taxes. (AutoInformed.com on Ford Leads NA Production Cuts from Semiconductor Shortage; Ford Posts Q1 Income of $3.3B. Semiconductors Still Difficult; Ford Follows GM: Q2 2021 Earnings to Exceed Its Expectations; Billion Dollar Oops – Ford F-150s, Edges Without Electronics)

With effectively all of the auto industry’s worldwide manufacturing shut down by the Covid pandemic for much of Q2 2020 during the now voted-out Trump Administration, Ford’s automotive business grew in comparison during this Q2 2021 against main financial measures on a year-over-year basis.

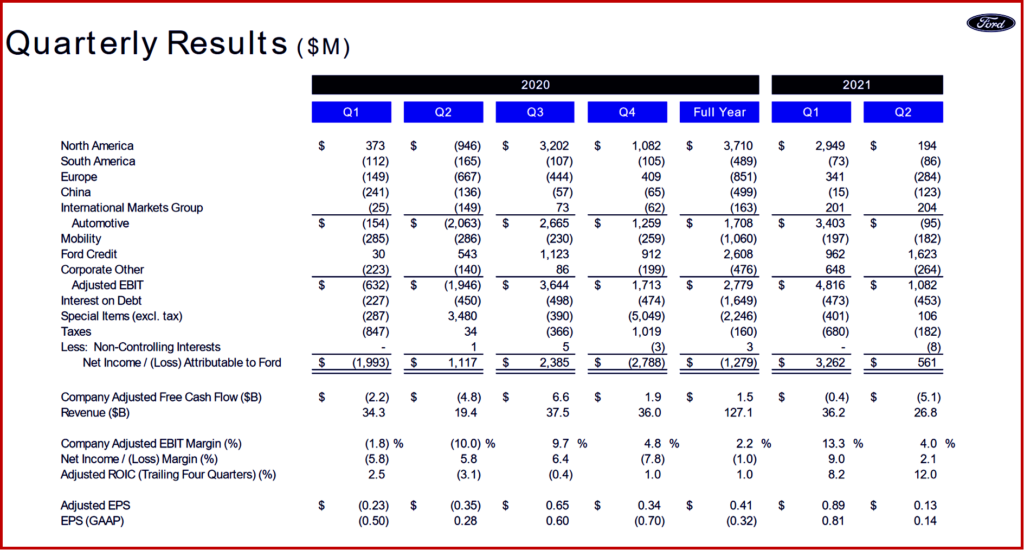

Second-quarter cash flow from operations was $756 million. Adjusted free cash flow for the period was negative $5.1 billion from the expected greater effect of semiconductor-related volume losses on FCF than EBIT because of adverse working capital and timing differences. Cash and liquidity remain strong, though – $25.1 billion and $41.0 billion, respectively, at the end of the quarter. Ford will continue to need improved its cash flow and earnings given the high stakes electrification game it came late to. (AutoInformed.com on Ford to Up Electrification Spend to $30B by 2025. Wants 40% All-Electric Global Volume By 2030)

Click to Enlarge.

“We’re on a new path, with the Ford+ plan, financial flexibility and a resolve to make us an even stronger company,” claimed CFO John Lawler with some justification. Ford’s auto business in North America delivered positive EBIT in the quarter on a year-over-year increase of $1.1 billion.

Exiting the second quarter, the combined U.S. customer-sold retail order bank for Mustang Mach-E and other Ford vehicles was seven times larger than at the same point in 2020. With additional current and anticipated demand for models including the Bronco SUV and, later, Maverick and F-150 Lightning pickups, CEO Jim Farley claimed the business is “spring loaded” for a rebound when semiconductor supplies stabilize and more closely match demand. (AutoInformed.com on EV Pickup! Ford is Betting Lightning Can Strike Twice; Ford Bronco Production Underway at Michigan Assembly Plant; Mexican-Built 2022 Ford Maverick Hybrid Shrinks Size, Price; Ford Introduces All-Electric F-150 Lightning Pro – Bring Money)

Turnarounds of company business units outside of North America appear on track thus far – except for endemic quality problems scattered through all operations. (AutoInformed.com on Off the Roof Rails – Ford Recalls 616,967 Explorer SUVs; Ford Motor Recalls 2020-21 Lincoln Aviators for Bad Software)

Aggregate second-quarter EBIT in those regions improved by $828 million year-over-year but was down cialis online india from Q1. The sequential drop was primarily attributable to a 35% sequential decline in wholesales in Europe related to semiconductor availability.

Ford’s reorganization in Europe is supported by growing strength with commercial customers, now through Ford Pro, and major investments in electric vehicles. The spending on EVs includes $1 billion for a new manufacturing center in Cologne, the planned spring 2022 regional launch of E-Transit commercial vans, and a forthcoming all-electric light commercial vehicle that will be built in Romania. (AutoInformed.com on Ford Europe is Planning on Shifting Passenger Cars to All EVs by 2030, Commercial Vehicles Will Eventually Follow)

The Lincoln brand continued to survive with improved company performance in China, recording its highest ever quarterly retail sales in Q2. Ninety-seven percent of Lincoln’s volume is now made in-country, lowering production costs. Lincoln ranked No. 1 in JD Power’s 2021 China Sales Satisfaction Index Study, unseating Audi, which had held the top spot for 11 years. (AutoInformed.com on Ford Motor Recalls 2020-21 Lincoln Aviators for Bad Software)

Ford’s appeal with commercial customers in China also continues to grow. Commercial vehicles accounted for 52% of overall sales mix. Later this year, Ford China will introduce a locally built version of the Mustang Mach-E.

In South America, Ford is working a transformation plan announced there in January. The high-risk plan is based on reducing business hazards in the region with an asset-light model centered on strengths with Ranger pickups, Transit commercial vans, and selected imported vehicles like the Bronco Sport and Mustang Mach 1. The company’s International Markets Group delivered a good Q2 on the strengths of Ranger pickups and Everest SUVs. (AutoInformed.com on Ford Exec Re-shuffle in Struggling India, South America, China)

In addition to the new collaboration with Argo AI and Lyft, Ford’s Mobility business expects to benefit from Argo’s recent introduction of its own Lidar technology. Farley said capabilities of the Argo Lidar are expected to enable the expansion of autonomous-vehicle services beyond dense urban areas, in the process creating a competitive advantage for Argo and Ford.

Ford Credit delivered record quarterly earnings before taxes of $1.6 billion. Among new capabilities inspired by Ford+, the business is launching Ford Pro Fin Simple to provide commercial customers with bundled financing for vehicles, services and EV charging. (AutoInformed.com on Ford Buys Electriphi to Provide Ford Pro Commercial Customers with Charging and Energy Management)

Outlook

Lawler said that Ford has raised its expectation for full-year adjusted EBIT by about $3.5 billion, to between $9 billion and $10 billion. Volume is expected to increase by about 30% sequentially from the first to the second half of the year, driving an improvement in market factors net of production costs.

But – big but – the volume benefit is anticipated to be offset by higher commodity costs, investments in the Ford+ plan and lower earnings by Ford Credit, among other factors, with second-half adjusted EBIT lower than in the first half. The half-to-half comparison is also affected by a $902 million non-cash gain on Ford’s investment in Rivian that was booked in first-quarter 2021.

Ford has lifted its target for full-year adjusted free cash flow to between $4 billion and $5 billion, supported by expected favorable second-half working capital as vehicle production increases with anticipated improvement in availability of semiconductors.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Posts Q2 Revenue $26.8B, Net Income $56M, Earnings $1.1B as Market Share Drops

Click to Enlarge.

Ford posted acceptable operating results in Q2 of 2021 – selling 764,00 vehicles – while further rolling out its reorganization plan dubbed Ford+. It earned 14-cents/share. Ford also to some degree limited the ongoing damages from semiconductor supply shortages. As a result, it raised projected full-year 2021 adjusted EBIT and adjusted free cash flow, respectively, to between $9 billion and $10 billion and between $4 billion and $5 billion.

During April with the semiconductor situation worsening, Ford said it expected to lose about 50% of its planned second-quarter production, which would have resulted in a loss in the period. Ford did better than that using the strong demand from the Biden Administration economic boom to improve revenue and profits through lower incentives and a more expensive and profitable mix of vehicles. These generated company-wide adjusted earnings of $1.1 billion before interest and taxes. (AutoInformed.com on Ford Leads NA Production Cuts from Semiconductor Shortage; Ford Posts Q1 Income of $3.3B. Semiconductors Still Difficult; Ford Follows GM: Q2 2021 Earnings to Exceed Its Expectations; Billion Dollar Oops – Ford F-150s, Edges Without Electronics)

With effectively all of the auto industry’s worldwide manufacturing shut down by the Covid pandemic for much of Q2 2020 during the now voted-out Trump Administration, Ford’s automotive business grew in comparison during this Q2 2021 against main financial measures on a year-over-year basis.

Second-quarter cash flow from operations was $756 million. Adjusted free cash flow for the period was negative $5.1 billion from the expected greater effect of semiconductor-related volume losses on FCF than EBIT because of adverse working capital and timing differences. Cash and liquidity remain strong, though – $25.1 billion and $41.0 billion, respectively, at the end of the quarter. Ford will continue to need improved its cash flow and earnings given the high stakes electrification game it came late to. (AutoInformed.com on Ford to Up Electrification Spend to $30B by 2025. Wants 40% All-Electric Global Volume By 2030)

Click to Enlarge.

“We’re on a new path, with the Ford+ plan, financial flexibility and a resolve to make us an even stronger company,” claimed CFO John Lawler with some justification. Ford’s auto business in North America delivered positive EBIT in the quarter on a year-over-year increase of $1.1 billion.

Exiting the second quarter, the combined U.S. customer-sold retail order bank for Mustang Mach-E and other Ford vehicles was seven times larger than at the same point in 2020. With additional current and anticipated demand for models including the Bronco SUV and, later, Maverick and F-150 Lightning pickups, CEO Jim Farley claimed the business is “spring loaded” for a rebound when semiconductor supplies stabilize and more closely match demand. (AutoInformed.com on EV Pickup! Ford is Betting Lightning Can Strike Twice; Ford Bronco Production Underway at Michigan Assembly Plant; Mexican-Built 2022 Ford Maverick Hybrid Shrinks Size, Price; Ford Introduces All-Electric F-150 Lightning Pro – Bring Money)

Turnarounds of company business units outside of North America appear on track thus far – except for endemic quality problems scattered through all operations. (AutoInformed.com on Off the Roof Rails – Ford Recalls 616,967 Explorer SUVs; Ford Motor Recalls 2020-21 Lincoln Aviators for Bad Software)

Aggregate second-quarter EBIT in those regions improved by $828 million year-over-year but was down cialis online india from Q1. The sequential drop was primarily attributable to a 35% sequential decline in wholesales in Europe related to semiconductor availability.

Ford’s reorganization in Europe is supported by growing strength with commercial customers, now through Ford Pro, and major investments in electric vehicles. The spending on EVs includes $1 billion for a new manufacturing center in Cologne, the planned spring 2022 regional launch of E-Transit commercial vans, and a forthcoming all-electric light commercial vehicle that will be built in Romania. (AutoInformed.com on Ford Europe is Planning on Shifting Passenger Cars to All EVs by 2030, Commercial Vehicles Will Eventually Follow)

The Lincoln brand continued to survive with improved company performance in China, recording its highest ever quarterly retail sales in Q2. Ninety-seven percent of Lincoln’s volume is now made in-country, lowering production costs. Lincoln ranked No. 1 in JD Power’s 2021 China Sales Satisfaction Index Study, unseating Audi, which had held the top spot for 11 years. (AutoInformed.com on Ford Motor Recalls 2020-21 Lincoln Aviators for Bad Software)

Ford’s appeal with commercial customers in China also continues to grow. Commercial vehicles accounted for 52% of overall sales mix. Later this year, Ford China will introduce a locally built version of the Mustang Mach-E.

In South America, Ford is working a transformation plan announced there in January. The high-risk plan is based on reducing business hazards in the region with an asset-light model centered on strengths with Ranger pickups, Transit commercial vans, and selected imported vehicles like the Bronco Sport and Mustang Mach 1. The company’s International Markets Group delivered a good Q2 on the strengths of Ranger pickups and Everest SUVs. (AutoInformed.com on Ford Exec Re-shuffle in Struggling India, South America, China)

In addition to the new collaboration with Argo AI and Lyft, Ford’s Mobility business expects to benefit from Argo’s recent introduction of its own Lidar technology. Farley said capabilities of the Argo Lidar are expected to enable the expansion of autonomous-vehicle services beyond dense urban areas, in the process creating a competitive advantage for Argo and Ford.

Ford Credit delivered record quarterly earnings before taxes of $1.6 billion. Among new capabilities inspired by Ford+, the business is launching Ford Pro Fin Simple to provide commercial customers with bundled financing for vehicles, services and EV charging. (AutoInformed.com on Ford Buys Electriphi to Provide Ford Pro Commercial Customers with Charging and Energy Management)

Outlook

Lawler said that Ford has raised its expectation for full-year adjusted EBIT by about $3.5 billion, to between $9 billion and $10 billion. Volume is expected to increase by about 30% sequentially from the first to the second half of the year, driving an improvement in market factors net of production costs.

But – big but – the volume benefit is anticipated to be offset by higher commodity costs, investments in the Ford+ plan and lower earnings by Ford Credit, among other factors, with second-half adjusted EBIT lower than in the first half. The half-to-half comparison is also affected by a $902 million non-cash gain on Ford’s investment in Rivian that was booked in first-quarter 2021.

Ford has lifted its target for full-year adjusted free cash flow to between $4 billion and $5 billion, supported by expected favorable second-half working capital as vehicle production increases with anticipated improvement in availability of semiconductors.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.