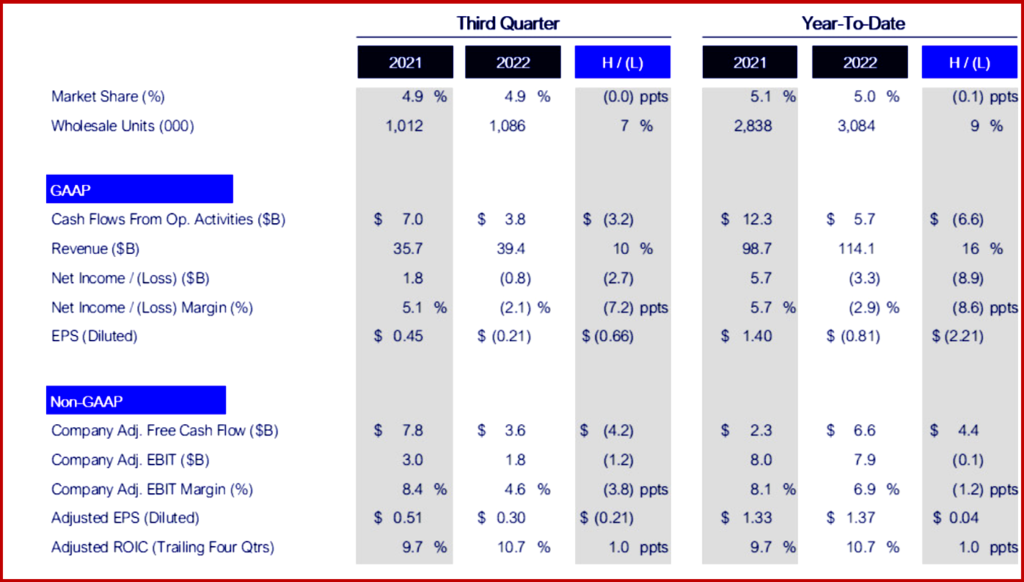

Ford Motor Company (NYSE: F) today posted Q3 2022 revenue of $39.4 billion and an $827 million net loss, a result of special items. The adjusted EBIT was $1.8 billion.

During Q3, Ford decided to shift its capital spending from the L4 advanced driver assistance systems being developed by Argo AI to internally developed L2+/L3 technology. The move was forced on Ford when Argo AI failed to attract new investors. Ford recorded a $2.7 billion non-cash, pretax impairment on its investment in Argo AI, resulting in an $827 million net loss for Q3. Adjusted earnings before interest and taxes were $1.8 billion, higher than the $1.4 billion to $1.7 billion the company estimated in September. Quarterly revenue was $39.4 billion, up 10% from a year ago. (AutoInformed.com on: Ford Motor Q3 Earnings to Take $1B Cost Hit; Ford Motor Posts Good Earnings But Weak Net Income)

The weak results were influenced by two things Ford warned about in mid-September:

- Supply shortages that left about 40,000 “vehicles on wheels” built, but awaiting needed parts – in inventory at the end of September. Ford claims it will complete the vehicles and sell them to dealers during Q4.

- ~$1 billion in higher-than-expected supplier payments.

Nonetheless, a fourth-quarter regular dividend of 15 cents per share was authorized today by Ford’s board of directors. The dividend is payable on Dec. 1 to shareholders of record at the close of business on Nov. 15. The company is also resuming a repurchase program “to offset the dilutive (sic) effect of stock-based compensation.”

Click for more information.

Ford North America achieved EBIT of $1.3 billion and a 5% EBIT margin, both down from a year ago because of higher commodity costs, inflationary pressure and unfavorable mix, with the un-shipped vehicles largely high-margin trucks and SUVs. The margin is expected to return to double digits in Q4.

Through the first nine months of the year, Ford was No. 2 in retail sales of EVs in the United States, a position it will have a tough time holding given the growing number of direct competitors, specifically GM, Toyota and perhaps Stellantis. General Motors yesterday posted Q3 earnings of $4.3 billion on global sales 966,000 vehicles. This came from record revenue and double-digit EBIT-adjusted margins. GM expects to double company revenue to $275 to 315 billion by 2030. (AutoInformed.com on: GM Earns $4.3 Billion in Q3 2022)

- Ford’s overall business in Europe was profitable in the third quarter as supply chain constraints began to ease and wholesale vehicle shipments were up 23% from Q2.

- Ford’s International Markets Group and South America units sustained their profitability following restructurings to de-risk the businesses and play to their strengths. IMG – which has launched the all-new Ranger at three of its four plants, with Silverton, South Africa, following soon – has gained more than a point of mid-size-pickup market share through the first nine months of the year.

- In China, Ford posted a loss in the quarter, attributable to investments in EVs. The Lincoln brand gained sequential share in the premium internal combustion engine segment.

- Ford Credit delivered a strong quarter, with earnings before taxes of~$600 million.

Ford Outlook

Ford now predicts full-year adjusted EBIT of ~$11.5 billion. That would be about 15% higher than in 2021. Such a performance implies ~10% year-over-year growth in wholesale shipments. Significantly higher earnings in North America and aggregate profitability in the rest of the world;and strong, but lower, EBT from Ford Credit.

Other assumptions include:

• No further deterioration in the supply chain.

• Continued strong pent-up demand and orders for Ford’s newest products.

• Persistent strength in pricing.

• Higher commodity and broad-based inflationary costs of about $9.0 billion.

• Strong, though lower, auction values at Ford Credit, along with higher borrowing costs.

• Continuation of a strong dollar.

Ford has raised its goal for full-year adjusted free cash flow to between $9.5 billion and $10 billion – up from $5.5 billion to $6.5 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Posts Q3 Net Loss of $827 Million

Ford Motor Company (NYSE: F) today posted Q3 2022 revenue of $39.4 billion and an $827 million net loss, a result of special items. The adjusted EBIT was $1.8 billion.

During Q3, Ford decided to shift its capital spending from the L4 advanced driver assistance systems being developed by Argo AI to internally developed L2+/L3 technology. The move was forced on Ford when Argo AI failed to attract new investors. Ford recorded a $2.7 billion non-cash, pretax impairment on its investment in Argo AI, resulting in an $827 million net loss for Q3. Adjusted earnings before interest and taxes were $1.8 billion, higher than the $1.4 billion to $1.7 billion the company estimated in September. Quarterly revenue was $39.4 billion, up 10% from a year ago. (AutoInformed.com on: Ford Motor Q3 Earnings to Take $1B Cost Hit; Ford Motor Posts Good Earnings But Weak Net Income)

The weak results were influenced by two things Ford warned about in mid-September:

Nonetheless, a fourth-quarter regular dividend of 15 cents per share was authorized today by Ford’s board of directors. The dividend is payable on Dec. 1 to shareholders of record at the close of business on Nov. 15. The company is also resuming a repurchase program “to offset the dilutive (sic) effect of stock-based compensation.”

Click for more information.

Ford North America achieved EBIT of $1.3 billion and a 5% EBIT margin, both down from a year ago because of higher commodity costs, inflationary pressure and unfavorable mix, with the un-shipped vehicles largely high-margin trucks and SUVs. The margin is expected to return to double digits in Q4.

Through the first nine months of the year, Ford was No. 2 in retail sales of EVs in the United States, a position it will have a tough time holding given the growing number of direct competitors, specifically GM, Toyota and perhaps Stellantis. General Motors yesterday posted Q3 earnings of $4.3 billion on global sales 966,000 vehicles. This came from record revenue and double-digit EBIT-adjusted margins. GM expects to double company revenue to $275 to 315 billion by 2030. (AutoInformed.com on: GM Earns $4.3 Billion in Q3 2022)

Ford Outlook

Ford now predicts full-year adjusted EBIT of ~$11.5 billion. That would be about 15% higher than in 2021. Such a performance implies ~10% year-over-year growth in wholesale shipments. Significantly higher earnings in North America and aggregate profitability in the rest of the world;and strong, but lower, EBT from Ford Credit.

Other assumptions include:

• No further deterioration in the supply chain.

• Continued strong pent-up demand and orders for Ford’s newest products.

• Persistent strength in pricing.

• Higher commodity and broad-based inflationary costs of about $9.0 billion.

• Strong, though lower, auction values at Ford Credit, along with higher borrowing costs.

• Continuation of a strong dollar.

Ford has raised its goal for full-year adjusted free cash flow to between $9.5 billion and $10 billion – up from $5.5 billion to $6.5 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.