Ford generated positive cash flow of $900 million in the first quarter, the eighth consecutive quarter of positive performance.

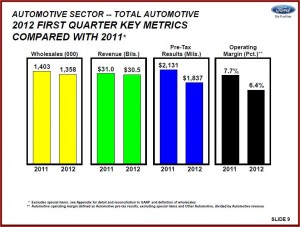

Ford Motor Company (NYSE: F) today reported a 2012 Q1 profit of $2.3 billion, or 39 cents per share, and net income of $1.4 billion, or 35 cents per share – virtually all of it from North America. Sales, revenues, pre-tax profits and operating margin all declined year-over-year.

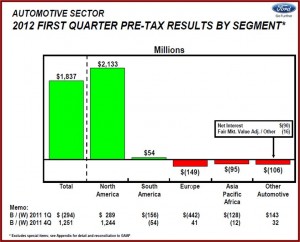

The first quarter 2012 results compare unfavorably to 2011 Q1 net income of $2.6 billion, or 61 cents per share, and pre-tax operating profit of $2.8 billion, or 47 cents per share. International operations and Ford Europe results as well as higher taxes adversely hurt shareholders. Europe alone lost $149 million, a large -$449 million swing compared to 2011. Asia Pacific and Africa lost $95 million as it launches new plants with a sales decline of 25,000 vehicles in the quarter.

Ford China sold 121,393 vehicles in the first quarter based on wholesale results, down from 140,566 sold from January to March in 2011, a decline of -14% in the world’s largest auto market, which is off 1.7% for the same period. Other automotive operations lost $102 million.

With successful businesses in North America ($ 2.1 billion profit) and Ford Credit ($452 million profit), Ford has now made money on a pre-tax operating basis for 11 consecutive quarters. The North American operating margin was 11.5% compared to overall results of a 6.4% margin. Ford said its North American share would decline this year because of new product launches and a lack of capacity given the market that looks to be heading for more than 14 million units.

International operations and Ford Europe results adversely hurt shareholders. Europe is a long standing Ford problem.

Ford generated positive cash flow of $900 million in the first quarter, the eighth consecutive quarter of positive performance. First quarter liquidity actions also included the successful amendment and extension of the company’s revolving credit facility, resulting in commitments of $9 billion through November 2015 and an additional $300 million through November 2013.

Ford took another step today to solve its huge problem with unfunded global pension plans, by announcing that it will offer to about 90,000 eligible U.S. salaried retirees and U.S. salaried former employees the option to receive a voluntary lump-sum pension payment.

If a person takes the lump-sum payment, the company’s pension obligation to the individual will end. This is uncharted territory, likely the first time a program of this type and magnitude has been offered by a U.S. company for ongoing pension plans, so no financial estimates of the costs and benefits of the program were given.

In his usual candid way, Bob Shanks, now Ford executive vice president and chief financial officer with the retirement of Lewis Booth said that the company has assumptions, but he has no idea if they are valid, so he will wait to discuss the impact. Payouts will start later this year and will be funded from existing pension plan assets. This is in addition to the lump-sum pension payout option available to U.S. salaried future retirees as of July 1, 2012.