Click to Enlarge.

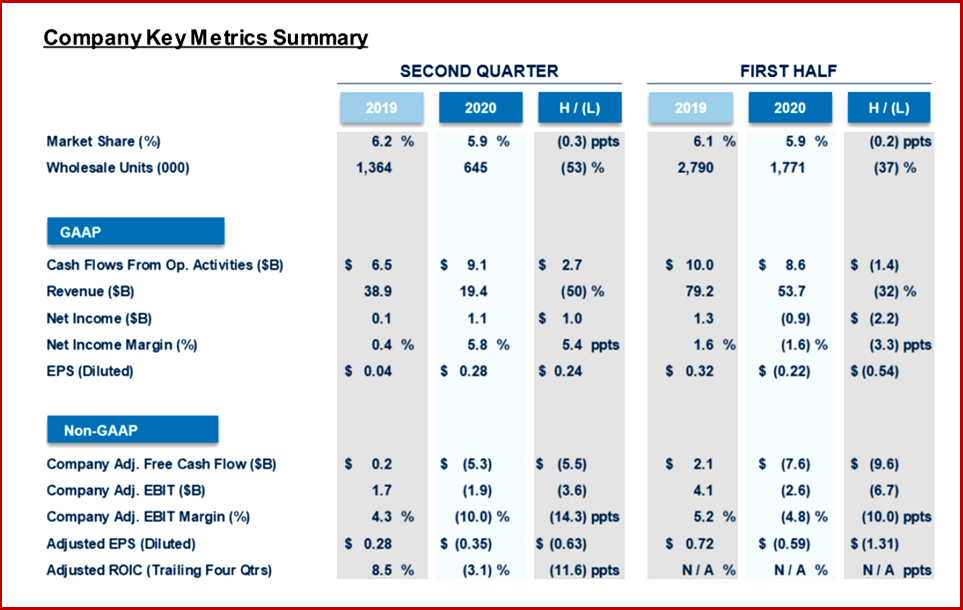

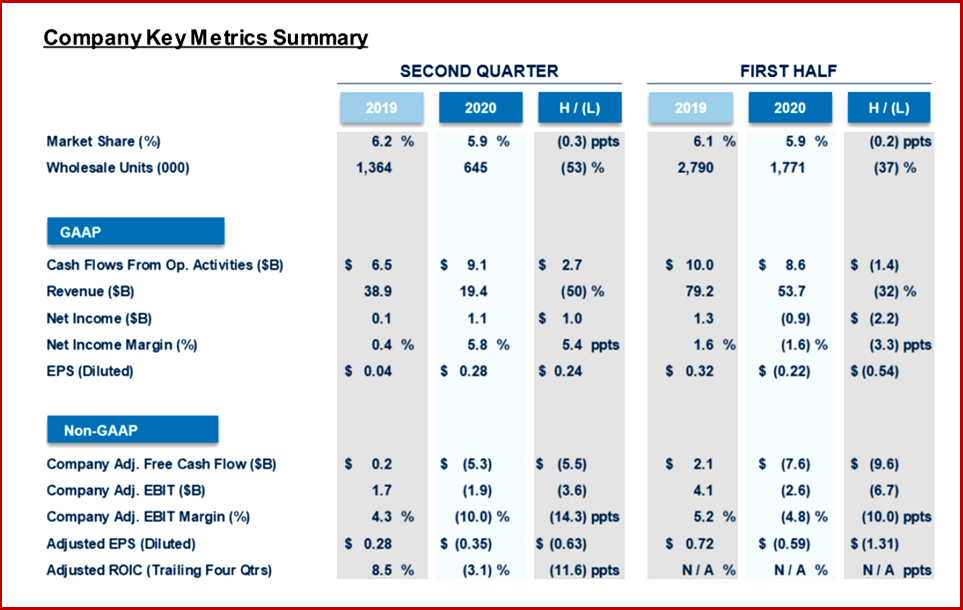

Ford Motor Company posted Q2 results that saw sales drop to 645,000 or -53% because of COVID-related lower industry volume and suspended production through May 17. Adjusted Earnings Before Interest and Taxes was down -$1.9B, because of lower volume, new-model material cost and warranty, offset partially by higher net pricing, and lower structural cost arising from suspended production, reduced marketing activity and other one-time cost actions.

Analysts, a mysterious species to AutoInformed, were surprised and delighted? AutoInformed noted an ongoing warranty cost disaster, which is a management failure not a Covid issue. It remains troubling as Ford is introducing increasingly complex but profitable SUV, EVs and Trucks.

Here’s the Snapshot:

- Q2 wholesale units down 53%, reflecting chiefly COVID-related lower industry volume and suspended production for most of the quarter.

- Revenue at $19.4B dropped -50%, driven by lower volume and weaker currencies, offset partially by higher net pricing.

- EBIT fell only -10% at -1.9B, despite a significant wholesale reduction; higher net pricing, cost performance and favorable vehicle mix more than offset inflationary cost increases.

- The automotive results dropped in all regions – except for China and South America which broke even.

- Ford made a gain of $3.5B in its Argo Autonomous vehicle subsidiary.

Better than expected?

See AutoInformed.com on:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Pingback: Ford Pickup Truck Sales Best Q3 in 15 Years. Cars Dead | AutoInformed

Pingback: Ford Motor Changes CEO from Jim Hackett to Jim Farley | AutoInformed

Based on responses collected July 9 through July 14, the Household Pulse Survey estimates that during the COVID-19 pandemic:

51.1% of American adults live in households which have experienced a loss in employment income

35.2% of American adults expect to experience a loss in employment income

12.1% of Americans lived in households where there was either sometimes or often not enough to eat in the previous 7 days

40.1% of adults had delayed getting medical care in the previous 4 weeks

26.2% of respondents reported having little interest or pleasure in doing things more than half the days/nearly every day last week

24.8% of respondents reported feeling down more than half the days/nearly every day last week

33.9% of respondents reported feeling anxious or nervous more than half the days/nearly every day last week

On average, households spent $211.34 a week to buy food at supermarkets, grocery stores, online, and other places to be prepared and eaten at home

26.5% of adults either missed last month’s rent or mortgage payment, or had slight or no confidence that their household could make the next payment on time