Can Hackett, well, hack it any longer?

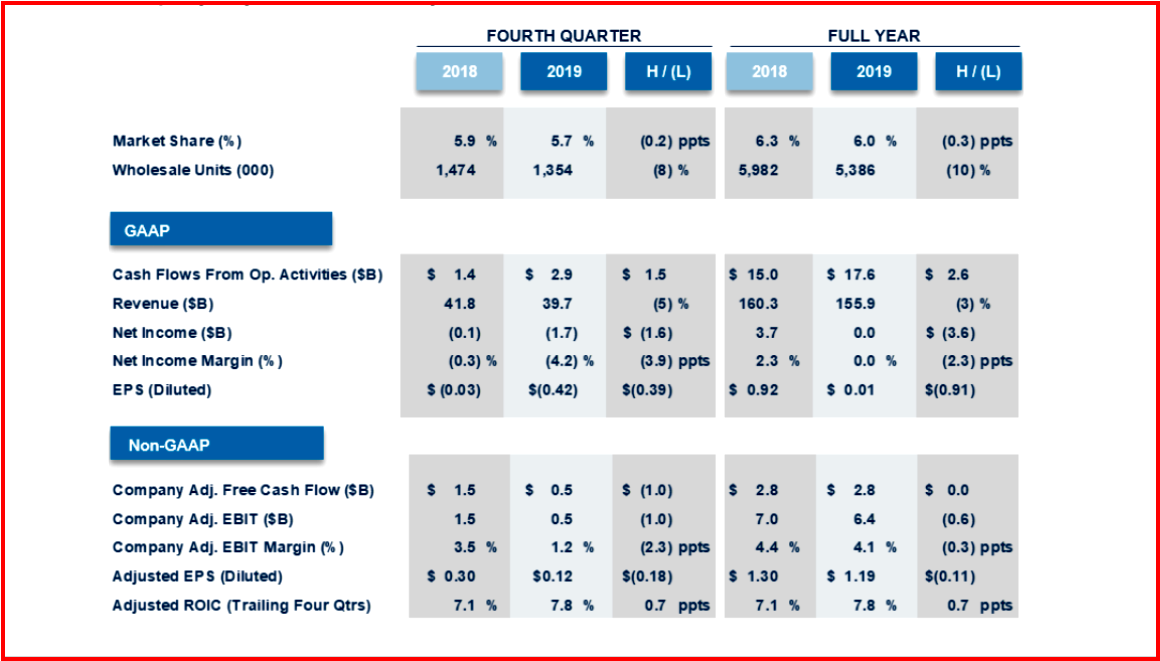

Ford Motor Company lost $1.7 billion (42 cents a share) during Q4 2019 compared to a loss of $100 million, or 3 cents a share, year-over-year. This included a previously disclosed $2.2 billion charge for underfunded pensions. Adjusted for one-time items, Ford said it gained 12 cents a share during the year, compared with 30 cents a share a year ago.

Revenue fell 5% to $39.7 billion from $41.8 billion a year ago. Global sales, share, earnings, and profits all decreased. Warranty costs reached $5 billion in 2019, up $1.5 billion in recent years — and fixing vehicle launch problems that have also cost an estimated $1 billion.

Click to Enlarge.

“Financially, the company’s 2019 performance was short of our original expectations, mostly because our operational execution, which we usually do very well, wasn’t nearly good enough,” said Chief Executive Jim Hackett in an understatement.

Ford declined to discuss the financial impact of the growing coronavirus epidemic in China on its earnings this year. It did, however, warn that during Q1 2020 it expects adjusted earnings dive more than $1.1 billion from the first quarter of 2019 because of it longstanding issues with higher warranty costs, lower vehicle volumes with concomitant lower results from Ford Credit. The ongoing autonomous vehicle investments remain a growing black hole for shareholders.

For full-year 2020, Ford predicts an adjusted free cash flow of $2.4 billion to $3.4 billion, and adjusted EBIT of $5.6 billion to $6.6 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Posts Weak Q4 Earnings Losing $1.7 Billion

Can Hackett, well, hack it any longer?

Ford Motor Company lost $1.7 billion (42 cents a share) during Q4 2019 compared to a loss of $100 million, or 3 cents a share, year-over-year. This included a previously disclosed $2.2 billion charge for underfunded pensions. Adjusted for one-time items, Ford said it gained 12 cents a share during the year, compared with 30 cents a share a year ago.

Revenue fell 5% to $39.7 billion from $41.8 billion a year ago. Global sales, share, earnings, and profits all decreased. Warranty costs reached $5 billion in 2019, up $1.5 billion in recent years — and fixing vehicle launch problems that have also cost an estimated $1 billion.

Click to Enlarge.

“Financially, the company’s 2019 performance was short of our original expectations, mostly because our operational execution, which we usually do very well, wasn’t nearly good enough,” said Chief Executive Jim Hackett in an understatement.

Ford declined to discuss the financial impact of the growing coronavirus epidemic in China on its earnings this year. It did, however, warn that during Q1 2020 it expects adjusted earnings dive more than $1.1 billion from the first quarter of 2019 because of it longstanding issues with higher warranty costs, lower vehicle volumes with concomitant lower results from Ford Credit. The ongoing autonomous vehicle investments remain a growing black hole for shareholders.

For full-year 2020, Ford predicts an adjusted free cash flow of $2.4 billion to $3.4 billion, and adjusted EBIT of $5.6 billion to $6.6 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.