“We haven’t suddenly fixed the issues in our automotive business…

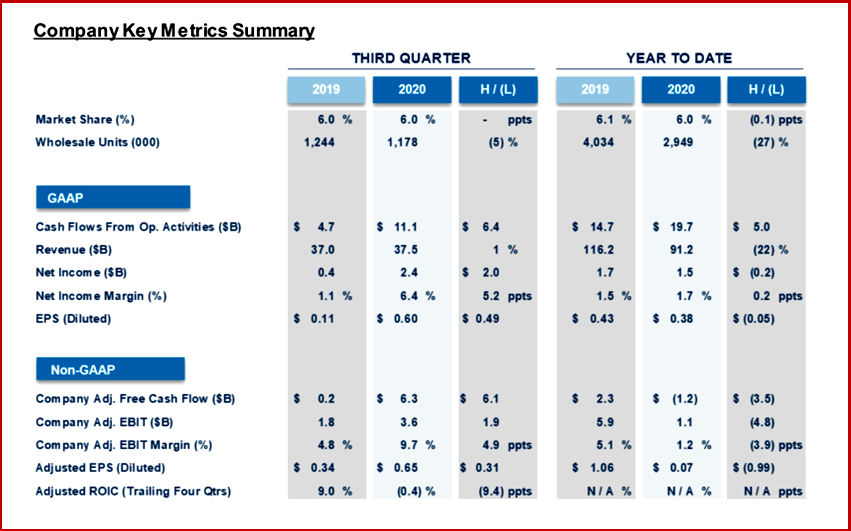

Ford Motor Company posted modest Q3 results after the market closed yesterday that continued to reflect the underlying weakness of the business compounded by ongoing negative effects of the Covid pandemic. The positives in Q3 – $2.4 billion in net income and 6.4% net income margin, on revenue of $37.5 billion were also areas of potential negatives in Q4 as Covid reappears in North America.

As a result, the Ford outlook is wobbly including a fourth quarter adjusted EBIT between break-even and a, gulp, $500 million loss. (Ford Pickup Truck Sales Best Q3 in 15 Years. Cars Dead, Ford Motor Q2- Sales Drop -53%. Debt Grows $10B, Ford Motor US Sales Down in -3% 2019 as War Worries Increase, 2019 Ford Motor US Sales Continue Slump, Ford Motor 2019 Q2 – Sales, Share, Net Income, EPS All down, Ford Motor 2018 US Sales drop -3.5% to 2.5 Million. Cars at 486,000 dive -18%. Trucks Up Again)

“We haven’t suddenly fixed the issues in our automotive business, but we have a clear turnaround plan to get that done,” said Jim Farley, Ford’s president and CEO. “That work is underway and we’re making progress.”

The latest plan among many, which Farley outlined on 1 October 2020, his first day as president and CEO, includes familiar platitudes:

- Competing like a challenger – earning business from customers by innovating and introducing great products and services, among them vehicles that are both profitable and more affordable

- Raising quality, reducing costs and improving underperforming businesses, and

- Allocating capital, talent and other resources to customer satisfaction and growth in things Ford does very well today and new businesses like electric and self-driving vehicles.

Ford generated $6.3 billion in adjusted free cash flow during the third quarter, helped, as expected, by a $4 billion rebuild of supplier payables as vehicle production reached pre-pandemic levels. The company ended the period with cash of nearly $30 billion and total liquidity of more than $45 billion after fully repaying $15 billion in revolving credit drawn down in Q1 to maintain financial flexibility in the early days of the pandemic. (Ford Motor Maxes Out Lines of Credit)

In the upcoming fourth quarter, Ford is launching the next three all-new vehicles: F-150, including a hybrid electric-powered version. This means a huge loss in profits as the changeover takes place. Ford’s recent track record of failed product launches needs to be turned around.

Bronco Sport, ahead of the return of the full-size Bronco next year; and the all-electric Mustang Mach-E.

The three vehicles are now in production, but a stark warning comes from Europe in Q3 where a supplier problem and costly fix on the Kuga. Ford’s Europe under its latest restructuring program, with a cumulative $1 billion reduction in structural costs since 2018 would have been profitable in the third quarter excluding effects associated with an unspecified supplier-quality issue with the new Kuga plug-in hybrid electric vehicle, among them the expense for CO2 pooling to comply with European emissions regulations.

Farley said electric vehicles are fundamental to the company’s future across its lineup – including in commercial vehicles, and the Lincoln line. Ford will reveal a new, all-electric Transit van for global markets in November.

Wholesale product shipments in China were up 22% as the company’s mix of SUVs increased 13 points, to 36%. That was driven by locally built versions of the Explorer, Escape, and the luxury Lincoln Aviator and Corsair, and represented the third quarter in a row of year- over-year gains in market share. The third quarter also was the second straight of EBIT improvement.

In South America, Ford posted its fourth straight year-over-year improvement in quarterly EBIT, with pricing increases and cost reductions helping to mitigate pressures from inflation and currency. The International Markets Group was profitable despite pandemic-related industry declines in vehicle shipments.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Q3 Net Income at $2.4B Treads Water. Q4 $500M Loss?

“We haven’t suddenly fixed the issues in our automotive business…

Ford Motor Company posted modest Q3 results after the market closed yesterday that continued to reflect the underlying weakness of the business compounded by ongoing negative effects of the Covid pandemic. The positives in Q3 – $2.4 billion in net income and 6.4% net income margin, on revenue of $37.5 billion were also areas of potential negatives in Q4 as Covid reappears in North America.

As a result, the Ford outlook is wobbly including a fourth quarter adjusted EBIT between break-even and a, gulp, $500 million loss. (Ford Pickup Truck Sales Best Q3 in 15 Years. Cars Dead, Ford Motor Q2- Sales Drop -53%. Debt Grows $10B, Ford Motor US Sales Down in -3% 2019 as War Worries Increase, 2019 Ford Motor US Sales Continue Slump, Ford Motor 2019 Q2 – Sales, Share, Net Income, EPS All down, Ford Motor 2018 US Sales drop -3.5% to 2.5 Million. Cars at 486,000 dive -18%. Trucks Up Again)

“We haven’t suddenly fixed the issues in our automotive business, but we have a clear turnaround plan to get that done,” said Jim Farley, Ford’s president and CEO. “That work is underway and we’re making progress.”

The latest plan among many, which Farley outlined on 1 October 2020, his first day as president and CEO, includes familiar platitudes:

Ford generated $6.3 billion in adjusted free cash flow during the third quarter, helped, as expected, by a $4 billion rebuild of supplier payables as vehicle production reached pre-pandemic levels. The company ended the period with cash of nearly $30 billion and total liquidity of more than $45 billion after fully repaying $15 billion in revolving credit drawn down in Q1 to maintain financial flexibility in the early days of the pandemic. (Ford Motor Maxes Out Lines of Credit)

In the upcoming fourth quarter, Ford is launching the next three all-new vehicles: F-150, including a hybrid electric-powered version. This means a huge loss in profits as the changeover takes place. Ford’s recent track record of failed product launches needs to be turned around.

Bronco Sport, ahead of the return of the full-size Bronco next year; and the all-electric Mustang Mach-E.

The three vehicles are now in production, but a stark warning comes from Europe in Q3 where a supplier problem and costly fix on the Kuga. Ford’s Europe under its latest restructuring program, with a cumulative $1 billion reduction in structural costs since 2018 would have been profitable in the third quarter excluding effects associated with an unspecified supplier-quality issue with the new Kuga plug-in hybrid electric vehicle, among them the expense for CO2 pooling to comply with European emissions regulations.

Farley said electric vehicles are fundamental to the company’s future across its lineup – including in commercial vehicles, and the Lincoln line. Ford will reveal a new, all-electric Transit van for global markets in November.

Wholesale product shipments in China were up 22% as the company’s mix of SUVs increased 13 points, to 36%. That was driven by locally built versions of the Explorer, Escape, and the luxury Lincoln Aviator and Corsair, and represented the third quarter in a row of year- over-year gains in market share. The third quarter also was the second straight of EBIT improvement.

In South America, Ford posted its fourth straight year-over-year improvement in quarterly EBIT, with pricing increases and cost reductions helping to mitigate pressures from inflation and currency. The International Markets Group was profitable despite pandemic-related industry declines in vehicle shipments.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.