With the exception of Chrysler, a frigid stormy February hurt car sales in the U.S. The other two of the Detroit Three, Ford Motor and GM were off -6% and -1% respectively. Among the major offshore brands, Honda was down -8%, Toyota down -5.8%, Hyundai down -6.3%, and Volkswagen, politically fraught in Southern anti-union politics, was down a whopping -13.8%.

The offshore winners were Subaru now on a long roll (up 24%), Nissan (up 16.7%), as well as luxury automakers Jaguar (up 35.2% from an admittedly small base), Mercedes-Benz (up 3.3%), and BMW (up 3.3%).

Offshore brands accounted for 53.2% of the U.S. auto market, down from 55.5% last month as strong truck and SUV sales were unevenly distributed between Ford and Chrysler Group and to a lessor extent GM, as the imports remain bit players in the business. Overall, offshore brands sold 635,418 units, up from 562,141 units last month, thought as the U.S. market slowly recovers in spit of the the disgraceful and repugnant political gridlock in Washington DC. .

Asian nameplates took 44.4% of the market, down from 46% last month. Overall, however, they sold 530,497 units, up from 466,162 vehicles in January. European brands occupied 8.8% of the January auto market, down from 9.5% last month. They sold 104,921 vehicles, up from 95,979 vehicles in January. Domestic brands finished the month with 46.8% of the auto market and sales of 558,454 units.

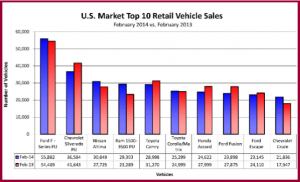

In the all-important Top Ten sales race – we are mostly rounding here – Ford F-Series (56,000) and Chevrolet Silverado (37,000) pickups continued to lead. In third place, the Nissan Altima (31,000) was the top-selling car in the U.S., with sales increasing 11.3% over last February – maybe Nissan is finally over selling price and emphasizing good product. As we wrote at its introduction, “By the end of this year, both Nissan plants will operate at three shifts to maximize production of what could be country’s second best-selling car. (See Family Car Wars Revived as Nissan Ships New 2013 Altima)

The mostly Mexican-built Ford Fusion, also revised for 2013, remains capacity restrained for the near future as Flat Rock is teaching neophyte workers on a newly added shift, is a factor here, as is the Hyundai Sonata, which is also bumping up against production constraints and is stating to age.

Nonetheless, the family car market has never been more competitive, nor have the products been as sophisticated – good news for buyers but not automakers and stockholders, where the bulk of transactions are in the $22,000 to $30,000 range. No wonder the Detroit Three remain addicted to SUVs and pickup trucks with far higher grosses.

Fourth place went to Ram pickup (29,000), which has finally caught the attention of Ford and GM executives for its extended run of successes and now newly introduced diesel engine. The comeback automaker upped the ante in the ongoing pickup truck fuel economy wars by offering the first light duty diesel engine pared with an 8-speed automatic transmission late last year, both exclusives in the segment. (See Light Duty Diesel Ram Ups Fuel Economy Ante in 2014)

Toyota Camry (25,239) moved to fifth place overall (Toyota Increases Fuel Economy and Equipment While Cutting Prices on 2012 Camry – a Gambit to Reestablish Leadership), followed by the Corolla/Matrix (24,622, see 2014 Toyota Corolla Ups Ante in Compact Car Game ) in sixth place.

At number seven, the Honda Accord (25,000, see First Drive: Honda’s 2013 Accord – a Comeback Car?) completed the list of offshore models on February’s Top Ten list. Eighth went to Ford Fusion (24,000). Ninth was Ford Escape at 23, 000, and Tenth was taken by the Chevrolet Cruze (22,000, see Driving Impression – Chevrolet Cruze and Chevrolet Cruze Diesel Rated at 46 MPG Highway).

AutoData estimates the seasonally adjusted annual rate (SAAR) at 15.34 million units, the same as last February and up slightly from January’s SAAR of 15.24 million units. Sales for all brands, unadjusted for business days, were unchanged from last February, but are down 1.4% for the year-to-date. Total industry unit deliveries increased 18% from January.