General Motors Co. (NYSE: GM) today reported disastrous Q3 2019 EPS-diluted of $1.60 and EPS-diluted-adjusted of $1.72, reduced by –$0.52 from UAW strike impact, and -$0.15 from Lyft and PSA revaluations on income of $2.3 billion, and revenue of $35.5 billion.

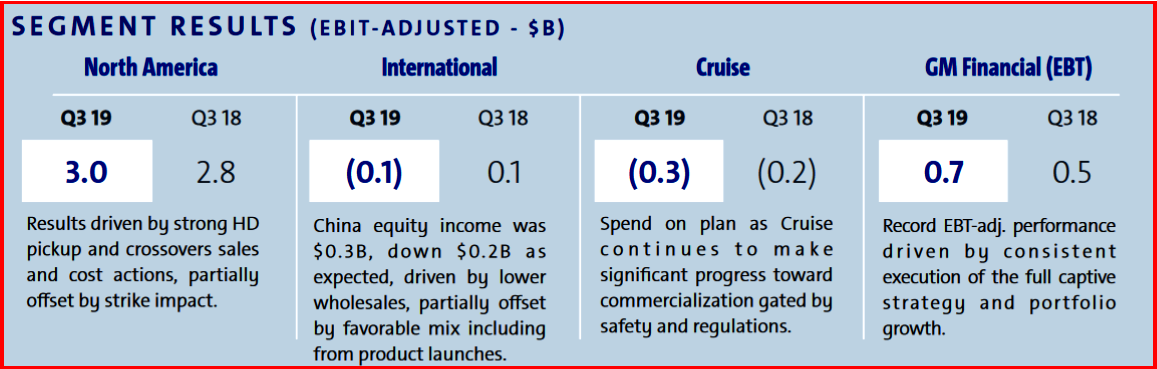

GM North America EBIT-adjusted was $3.0 billion. The net strike impact to GMNA was -$1.0 billion. However, this had $0.3 billion of “favorable timing items” and North America EBIT-adj. margin of 10.8% from full-size trucks and record crossover sales. GM’s breakeven point now requires an industry volume of 10-11 million units.

GM said it would not be able to makeup lost production and revenue losses this year. About two weeks of vehicle production was lost. GM predicts the 2019 calendar-year impact of the strike to be approximately -$2.00 per diluted-share. Worrisome items included increased warranty costs on larger vehicles – trucks -that totaled $700,000,000.

Q3 U.S. Sales

Q3 U.S. Sales

Dealerships delivered ~739,000 vehicles in the third quarter of 2019, an increase of 6% year-over-year. Results were led by GM’s all-new full-size pickups and the company’s revised crossovers. Deliveries increased for all brands, and crossover sales were the best-ever for any quarter, growing 29%. GM’s U.S. market share was 16.6%.

- Chevrolet crossover sales increased 35%, led by Traverse and Trax, which set quarterly records.

- Buick crossover sales were up 17%, led by Envision and Encore, which were up 39% and 18%, respectively.

- GMC sales increased 11%, led by the Acadia, which was up 51%.

- Cadillac crossover deliveries rose 67%, led by the segment-leading XT4 and the all-new XT6.

- GM’s next-generation full-size SUVs will arrive in dealerships in 2020.

Sales of the Chevrolet Silverado and GMC Sierra LD models were up 18 and 38% year over year respectively and have gained retail market share each month in Q3. Early production of HD models focused on crew cabs, and those deliveries were up 19%. Overall pricing of GM’s all-new pickups is up about $2,200 year to date versus 2018.

China

Year-over-year industry vehicle sales declined nearly 11% in the quarter and GM China was worse relative to the industry, due to segment shifts and lower demand for outgoing models. Despite continued softening of the overall vehicle market, Cadillac third-quarter sales increased 11%, driven by the XT4 and XT5. With XT6 joining the lineup, Cadillac will strengthen its foothold in the steadily growing luxury SUV segment.

For 2019 Full-Year GM now Forecasts:

- EPS-diluted $4.28 to $4.69

- EPS-diluted-adjusted$4.50 to $4.80

- Auto Operating Cash Flow $5.5B to $7.5B

- Adjusted Auto Free Cash Flow of $0B to $1B

GM declared a fourth quarter 2019 dividend of 38 cents per outstanding share of common stock. The dividend is payable Thursday, Dec. 19, 2019, to all common shareholders of record at the close of business on Friday, Dec. 6, 2019.

Pingback: Fasten Your Seat Belt – General Motors Files RICO Lawsuit Against Fiat Chrysler Automobiles | AutoInformed