Overall car sales rose 16% - roughly half the rate of trucks even though the industry is now betting heavily that U.S. buyers will accept Federal government dictated tiny and expensive B- and C-cars in spite of all historical evidence.

U.S. vehicle sales in February jumped to a surprising 13.4 million units on a seasonally adjusted annual rate (SAAR) as easier credit, liberal incentives and rising truck sales boosted the market.

The clear winners were a resurgent General Motors and Toyota Motor Sales, which each posted large increases of 34% and 30% respectively in a market that was up 23% overall.

Much of the improvement was due to surging light truck sales – up 30% for the month. However, in the face of now rapidly rising gasoline prices due to the revolutions in the Mideast and North Africa, questions are being raised how strong and, more importantly, how long the latest auto industry upswing will last.

Sales executives were universally cautious about the outlook given the unknown political outlook and the too well known official U.S. unemployment rate of almost 10%, which is an understated figure.

Worrisome is the fact that overall car sales rose 16% – roughly half the rate of trucks in an industry that is now betting heavily that U.S buyers will accept Federal government dictated tiny, and expensive, B- and C-cars in spite of all historical evidence to the contrary.

Ford Motor Company and Chrysler struggled against vigorous competition from General Motors and Toyota – both of whom have vowed to use incentives this year to keep their momentum going, which they clearly did for the second straight month.

Toyota is once again on the verge of passing Ford for the Number Two U.S. sales spot, lagging only 20,000 units in spite of its ongoing safety and quality recalls. Here, Ford is also guilty with its own series of less publicized but serious quality gaffs – so many that thus far in 2011 with five recalls (not including service actions) Ford is on track to posting a recall year that bests (worsts?) its 10 recalls of 2010.

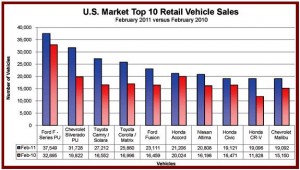

In the marketplace as opposed to service bays, Ford Motor was once again caught short – as it was in January – with light truck sales at only two-thirds the industry rate – clearly lagging the trend, puzzlingly behind in what was once Ford’s dominant strength in truck sales. Nonetheless, Ford F-Series still reigned as the largest selling vehicle in the land at 38,000 compared to the Chevrolet Silverado at 32,000. GMC sold 11,000 Sierra pickup trucks so an argument can be made that GM is the clear truck leader.

Ford’s car sales – at + 4% – were unexplainably weak even given a strong January in 2010 and worrisome if you are a shareholder given its small car dependent cycle plan this year, its disappointing fourth quarter results, and impending UAW contract negotiations since it is the only Detroit Three maker without a “no strike” clause in its contract.

Chrysler LLC, whose sales are comprised of roughly 75% in trucks, arguably, fared better. Chrysler truck sales at +32% were ahead of the February trend, but car sales dropped a breathtaking -31%. All told Chrysler sold 95,000 vehicles for the month, compared to GM at 207,000, Ford at 156,000 and Toyota at 142,000, Honda at 98,000 and Nissan, which also joined the new incentive wars, at 92,000.

All other companies in terms of volume – but not profitability – are footnotes.

There is an interesting battle royal going on the “let them eat cake” luxury business with Lexus at 27,000 sales year-to-date now lagging BMW at 32,000 and Mercedes-Benz USA at 33,000 vehicles. (Infiniti at 16,000 year-to-date is out of the leadership race.) Lexus – because of its successful RX crossover truck built from the Camry, which caught other luxury makers napping a decade ago – has long been the luxury leader in the U.S. but it appears the long Lexus leadership run is about to be over – unless of course more incentives are on the way…