GM confirmed it would increase its quarterly stock dividend to $0.36 per share starting Q2 2015. This would result in a dividend payout of approximately $5 billion through year-end 2016.

General Motors Co. (NYSE: GM) and an investment group led by Harry Wilson jointly announced today that GM’s will distribute cash to shareholders and Wilson will withdraw his bid for a place on the Board of Directors. (Proxy Fight Looming at General Motors by Hedge Fund Sharks?)

The deal is a major victory for the investors while giving relief to GM of what could have evolved into a proxy fight with hedge fund shareholders. However, GM is slashing its previously amassed cash holdings of $25 billion that it had claimed was key to building and maintaining a ‘fortress balance sheet’ to make it recession resistant so it wouldn’t repeat its bankruptcy. How the ratings agencies react is unknown, but GM said during a conference call that it expects no impact on current ratings.

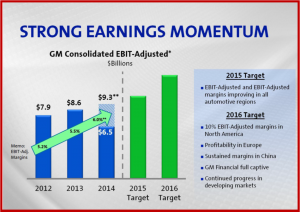

There is a real issue here about the borrowing costs of GM Financial, which are relatively high given GM’s ratings at the lowest level of investment grade. It needs to boost these ratings to bring down costs and increase margins. The amounts of money involved are not trivial. GM Financial assets increased from $8.7 billion in 2010 to more than $37 billion today. It continues to support the sale of new GM cars, trucks and crossovers around the world. GM Financial has sharply increased the number of GM customers it serves in the United States, Canada, South America and Europe, and is just getting established in China.

GM will begin immediately an initial repurchase of $5 billion in shares. The repurchase is scheduled to conclude before the end of 2016. This leads to speculation the GM is looking to repurchase $2 billion or more of its shares annually. GM stock was up $1:09 per share to $37.63 during early trading in New York this morning.

GM last month announced its intent to increase its quarterly stock dividend to $0.36 per share effective Q2 2015, which would result in an expected dividend payout of approximately $5 billion through year-end 2016.

GM’s so-called capital allocation framework announced today includes:

- High-Return Investment – GM previously said it expects capital expenditures in 2015 of $9 billion to invest in future growth, including a more aggressive vehicle launch schedule. GM will reinvest in its business with the objective of a 20% or higher return on invested capital (ROIC) through spending on vehicles and technology. This it is said will result in capital spending in the range of 5–5.5% of its annual revenue.

- Maintain Investment-Grade Balance Sheet – GM intends to maintain an investment-grade balance sheet, including a target cash balance of $20 billion.

- Return Capital to Shareholders – Beyond reinvesting in the business and maintaining an investment grade balance sheet, the company expects to return all available free cash flow to shareholders. Starting in January 2016, GM will develop its annual capital return plans and communicate them to the market during the first quarter of each year.