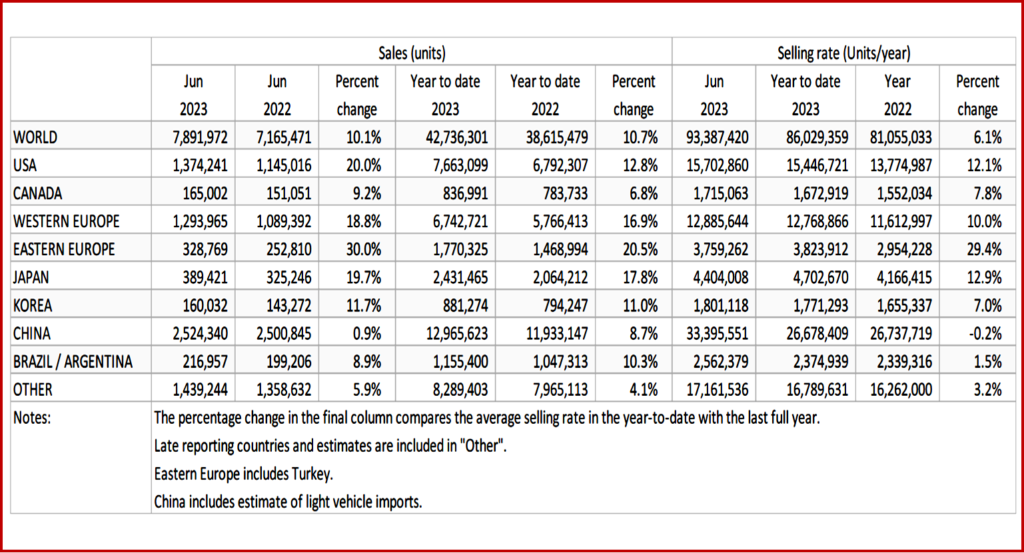

The Global Light Vehicle (LV) selling rate rose to 93 million units/year in June, from 89 million units/year in May, according to the respected consultancy GlobalData.* All major markets beat June 2022 for just the second time thus far in 2023, supported by the easing of supply constraints. Global LV sales for last month were 7.9 million units (+10% Year-over-Year).

“For a second consecutive month, US light vehicles sales registered 1.4 million units (+20% YoY) as OEMs saw improved vehicle production levels following the easing of supply chain issues. China had the strongest month of the year so far, with a selling rate of 33 million units/year. All major West European countries reported positive YoY growth as their markets continue to recover from the market headwinds in 2022,” according to the Global Light Vehicle Sales Forecasting Team.

Click for more GlobalData.

Summary

The June US Light Vehicle market saw sales increased by 20.0% YoY, at 1.4 million units. The selling rate also increased, reaching 15.7 million units/year (SAAR) in June, up from 15.1 million units/year in May. The average transaction price slightly increased in June, by $149 to $46,229. Incentives decreased to $1736 (However YoY they are up 89%).

Canadian Light Vehicle sales reached 165,000 units, an increase of 9.2% YoY. The selling rate also increased, from 1.5 million units/year in May to 1.7 million units/year in June.

Mexican sales grew by 25.7% YoY to 113,000 units in June. The selling rate accelerated from 1.3 million units/year in May, to 1.4 million units/year in June at pre-pandemic levels.

Europe

The West European selling rate in June stood at 12.9 million units annually. Monthly registrations rose to 1.3 million units (+18 % YoY). The region’s market has benefited from an improvement in supply constraints and higher delivery rates for consumers. Year- to-date, the region has recorded 6.7 million units (+16.9% YoY).

The East European selling rate grew to 3.8 million units/year in June from 3.7 million units/year in May. Monthly sales increased to 329,000 units, representing growth of 30% YoY, largely on account of Russia seeing YoY growth of 112% with monthly sales of ~68,000. With the stronger recovery so far in 2023, raw monthly sales were down just 8% from pre-pandemic 2019 levels.

China

Chinese market accelerated sharply in June. The June selling rate surged to 33.4 million units/year, up nearly 12% from a robust May, and the highest rate since August 2022. In YoY terms, however, sales (wholesales, which include exports) were virtually flat (+0.9%) in June and increased by 8.7% in H1 2023. NEVs remained the market driver, with their sales expanding by 44% YoY in H1 2023.

“According to preliminary reports, however, wholesales in June were boosted by rapidly expanding exports (especially to Russia and exports of EVs), which accounted for about 14% of June Passenger Vehicle sales. Domestic sales were sluggish. While NEVs’ sales growth moderated, sales of ICE models decelerated sharply in H1 2023, due to the end of the temporary tax cut on ICEs in December 2022. Consumers remain downbeat, as the urban youth unemployment rate hit a new record high of 20.8% and the economic outlook is uncertain,” GlobalData said.

Elsewhere Asia

The Japanese selling rate moderated to 4.4 million units/year in June after a catch-up in production boosted the average selling rate to a strong 4.8 million units/year in the first five months of this year. Sales increased by 20% YoY in June and 18% YoY in H1 2023, with the increased supply of semiconductors. “Demand remained robust, too. Consumer confidence continued to rise, thanks to strong wage growth, an improving job market, and a rebound in the services sector.”

The Korean selling rate swelled to 1.8 million units annually in June ahead of the expiration of the temporary excise tax cut, which has been extended multiple times over the past few years. “However, the rush to purchase new vehicles was muted, partially because the Korean government announced an overhaul in taxation, which resulted in lower taxes for domestically built vehicles from 1 July. (The former tax system used to disincentivize the purchase of locally built vehicles in favor of imports.) In H1 2023, sales increased by 11% YoY, boosted by the temporary tax cut, new model launches, and increased supply.

South America

Brazilian Light Vehicle sales increased by 8.1% YoY in June, as 180,000 units were estimated to have been sold. The selling rate also increased to 2.1 million annually in June, from 2.0 million units/year in May. “The government incentive program appeared only to have an impact on sales data towards the end of the month. This surge in sales at the close likely caused a decline in inventory, to 224k units, down from 252k units in May. Days’ supply also decreased in June, to days, from days in May.”

In Argentina, Light Vehicle sales are estimated to have grown to ~37,000, up by 13% YoY. The selling rate also increased in June, to 445,000 units/year, up from 425k units/year in May. This is the fourth consecutive month in which the selling rate has exceeded the 400k units/year, as the market appears to remain resilient against economic headwinds.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales at 7.9M Up Again in June

The Global Light Vehicle (LV) selling rate rose to 93 million units/year in June, from 89 million units/year in May, according to the respected consultancy GlobalData.* All major markets beat June 2022 for just the second time thus far in 2023, supported by the easing of supply constraints. Global LV sales for last month were 7.9 million units (+10% Year-over-Year).

“For a second consecutive month, US light vehicles sales registered 1.4 million units (+20% YoY) as OEMs saw improved vehicle production levels following the easing of supply chain issues. China had the strongest month of the year so far, with a selling rate of 33 million units/year. All major West European countries reported positive YoY growth as their markets continue to recover from the market headwinds in 2022,” according to the Global Light Vehicle Sales Forecasting Team.

Click for more GlobalData.

Summary

The June US Light Vehicle market saw sales increased by 20.0% YoY, at 1.4 million units. The selling rate also increased, reaching 15.7 million units/year (SAAR) in June, up from 15.1 million units/year in May. The average transaction price slightly increased in June, by $149 to $46,229. Incentives decreased to $1736 (However YoY they are up 89%).

Canadian Light Vehicle sales reached 165,000 units, an increase of 9.2% YoY. The selling rate also increased, from 1.5 million units/year in May to 1.7 million units/year in June.

Mexican sales grew by 25.7% YoY to 113,000 units in June. The selling rate accelerated from 1.3 million units/year in May, to 1.4 million units/year in June at pre-pandemic levels.

Europe

The West European selling rate in June stood at 12.9 million units annually. Monthly registrations rose to 1.3 million units (+18 % YoY). The region’s market has benefited from an improvement in supply constraints and higher delivery rates for consumers. Year- to-date, the region has recorded 6.7 million units (+16.9% YoY).

The East European selling rate grew to 3.8 million units/year in June from 3.7 million units/year in May. Monthly sales increased to 329,000 units, representing growth of 30% YoY, largely on account of Russia seeing YoY growth of 112% with monthly sales of ~68,000. With the stronger recovery so far in 2023, raw monthly sales were down just 8% from pre-pandemic 2019 levels.

China

Chinese market accelerated sharply in June. The June selling rate surged to 33.4 million units/year, up nearly 12% from a robust May, and the highest rate since August 2022. In YoY terms, however, sales (wholesales, which include exports) were virtually flat (+0.9%) in June and increased by 8.7% in H1 2023. NEVs remained the market driver, with their sales expanding by 44% YoY in H1 2023.

“According to preliminary reports, however, wholesales in June were boosted by rapidly expanding exports (especially to Russia and exports of EVs), which accounted for about 14% of June Passenger Vehicle sales. Domestic sales were sluggish. While NEVs’ sales growth moderated, sales of ICE models decelerated sharply in H1 2023, due to the end of the temporary tax cut on ICEs in December 2022. Consumers remain downbeat, as the urban youth unemployment rate hit a new record high of 20.8% and the economic outlook is uncertain,” GlobalData said.

Elsewhere Asia

The Japanese selling rate moderated to 4.4 million units/year in June after a catch-up in production boosted the average selling rate to a strong 4.8 million units/year in the first five months of this year. Sales increased by 20% YoY in June and 18% YoY in H1 2023, with the increased supply of semiconductors. “Demand remained robust, too. Consumer confidence continued to rise, thanks to strong wage growth, an improving job market, and a rebound in the services sector.”

The Korean selling rate swelled to 1.8 million units annually in June ahead of the expiration of the temporary excise tax cut, which has been extended multiple times over the past few years. “However, the rush to purchase new vehicles was muted, partially because the Korean government announced an overhaul in taxation, which resulted in lower taxes for domestically built vehicles from 1 July. (The former tax system used to disincentivize the purchase of locally built vehicles in favor of imports.) In H1 2023, sales increased by 11% YoY, boosted by the temporary tax cut, new model launches, and increased supply.

South America

Brazilian Light Vehicle sales increased by 8.1% YoY in June, as 180,000 units were estimated to have been sold. The selling rate also increased to 2.1 million annually in June, from 2.0 million units/year in May. “The government incentive program appeared only to have an impact on sales data towards the end of the month. This surge in sales at the close likely caused a decline in inventory, to 224k units, down from 252k units in May. Days’ supply also decreased in June, to days, from days in May.”

In Argentina, Light Vehicle sales are estimated to have grown to ~37,000, up by 13% YoY. The selling rate also increased in June, to 445,000 units/year, up from 425k units/year in May. This is the fourth consecutive month in which the selling rate has exceeded the 400k units/year, as the market appears to remain resilient against economic headwinds.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.