When GM bought into Peugeot neither had downsized in Europe. Plant closings and headcount cuts are now underway at both firms.

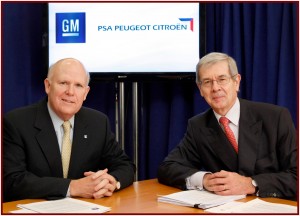

General Motors today announced it is selling its entire 7% stake of 24,839,429 shares in PSA Peugeot Citroen (PSA) through a private placement to institutional investors. GM acquired the stake in PSA when it entered into a strategic alliance in March 2012. (GM Buys 7% of PSA Peugeot Citroën to Share Parts, Vehicles)

“Our equity stake was planned to support PSA in their efforts to raise capital at the time of the creation of the GM and PSA alliance, and that support is no longer needed,” said GM Vice Chairman Steve Girsky. “The alliance remains strong with our focus on joint vehicle programs, cross manufacturing, purchasing, and logistics,” Girsky claimed.

As GM was issuing its statement, PSA shares in Paris were sinking after the automaker said more write-downs are coming with perhaps the need to raise more capital. Peugeot is known to be talking with Chinese automaker Dongfeng about further collaboration.

GM has already written off part of its investment in PSA, $220 million, and it is clearly cutting its losses, with an estimated (and in our view optimistic) net gain of $150 million that will be posted as a special item in Q4 results. Peugeot is trading at $15 a share, down from $30 in 2012. there will be at least one GM Q4 write down, as the just announced ending of manufacturing in Australia will cost shareholders as much as $0.5 billion (French Government Backs €7 Billion in PSA Peugeot Citroën Debt)

It is with these developments as background that Girsky, 51, is on his way out of the door at GM. The current vice chairman, Corporate Strategy, Business Development and Global Product Planning, moves to a “senior advisor role,” until leaving the company in April 2014. He will remain on the GM Board of Directors, but his operational influence and future at GM are over. (Mary Barra to become GM CEO when Dan Akerson Retires)

Back in 2012 a Girsky negotiated deal where both companies claimed they would leverage strengths, and contribute to their profitability, and “strongly improve” their competitiveness in Europe. At the time of the announcement, one biologist noted that mating two turkeys does not result in an eagle.

The Peugeot Group during Q3 posted revenues of €12.1 billion, down -3.7%. Automotive revenues were €8 billion, down -5.8%. Vehicle sales declined to 610,400 units in Q3, down -2.4%, tallying at 2,070,500 units in the first nine months of 2013, which is off -1.5% compared with the same period in 2012. Sales dropped in Europe, Brazil and Russia, partially offset by growth in China, Argentina and the Mediterranean basin. Revenue from the sales of new vehicles was €5.518 million compared with €6,125 million in third-quarter 2012. This is a -9.9% decline, and was primarily due to the sharp -7.3% drop in assembled vehicle sales outside of China. Peugeot also said an unfavorable market mix, Group pricing and growing pressure on market share from premium and low cost brands in Europe hurt results. There was also a -5% currency effect, attributable to the Russian ruble, Brazilian Real, Argentine Peso and British Pound. Peugeot is in big trouble.

A previous GM alliance started in Europe in 2002 with Fiat failed in 2005 when GM spent $2 billion to buy its way out of a put option in the deal that allowed Fiat to sell its automotive company to GM for market value. Globally, alliances have had mixed results at automakers.

Back in 2012 PSA already had partnerships with Ford, Toyota, BMW and Mitsubishi on components and engines. Ford then severed the relationship on diesel engines, no doubt, because PSA was going to develop diesels for archrival GM. GM is clearly taking steps now to limit its exposure. (GM and PSA Peugeot Citroën to Develop New Gas Engines)