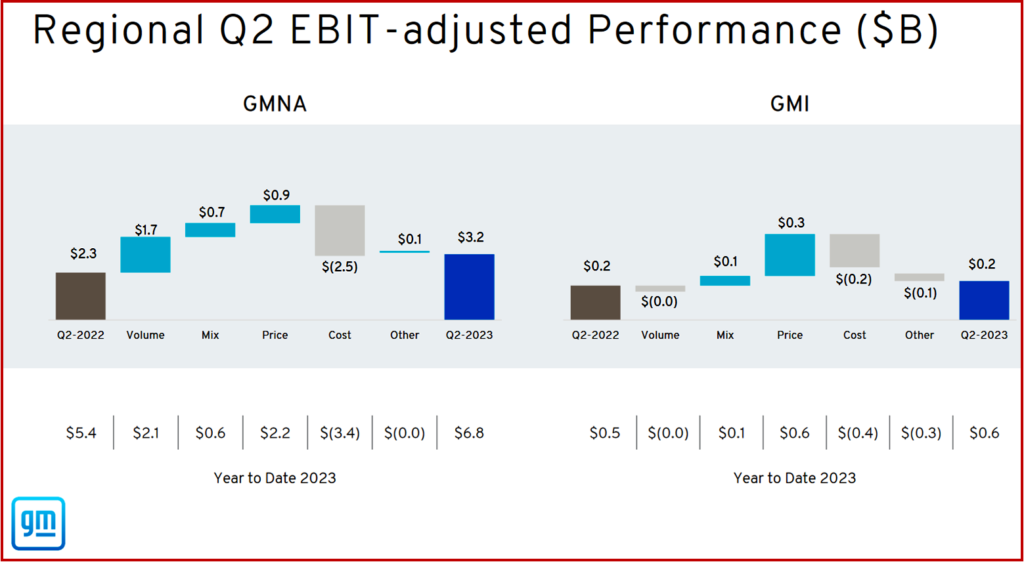

General Motors (NYSE: GM) today reported strong second-quarter 2023 revenue of $44.7 billion, net income attributable to stockholders of $2.6 billion and earnings [EBIT-adjusted] of $3.2 billion. GM delivered 1.4 million vehicles during Q2, many of them in premium truck and SUV segments. In the US, the Q2 Average Transaction Price (ATP) was $52,248, up $1890 Year-over-Year and $1600 compared to Q1 2023.

“The biggest driving force behind our financial results is customer demand for our vehicles, which have now led the U.S. industry in initial quality for two consecutive years. We have earned four consecutive quarters of higher retail market share in the U.S. versus a year ago with continued strong pricing and incentive discipline, we’re leading in both commercial and total fleet deliveries calendar year to date, and we’re growing profitably in international markets such as Brazil and Korea,” said CEO Mary Barra.

Click for more information.

“General Motors has made mind boggling profits over the last decade. GM’s recently announced quarterly earnings just set a post-bankruptcy record, but autoworkers and our communities have yet to be made whole for the sacrifices we’ve made since the Great Recession,” said UAW president Shawn Fain. “GM executives have closed 31 plants over the last 20 years and are now enriching themselves through joint venture battery plants that get billions from the federal government in taxpayer subsidies but pay poverty wages. It’s long past time for GM to pony up, end tiers, pay their employees competitive wages that keep up with the cost of living and provide everyone the ability to retire with dignity.”

GM also raised if full year outlook* to $12B-14B. The full-year EBIT-adjusted guidance is increased by $1 billion with adjusted automotive free cash flow guidance up $1.5 billion. GM now predicts earnings per share to be between $7.15 – $8.15. This is the second time GM has raised guidance this year. However, it assumes that GM successfully negotiate new labor agreements without work stoppages or strikes.

“We’re also spending less and lowering our capital spending guidance because we’re focusing on the most strategic internal combustion engine and EV programs, and our highest impact growth initiatives, including Cruise, BrightDrop and software-defined vehicles,” said Barra.

*GM Significantly Raises its full-year 2023 Outlook

- US GAAP net income attributable to stockholders of $9.3 billion-$10.7 billion, compared to the previous outlook of $8.4 billion-$9.9 billion.

- EBIT-adjusted of $12.0 billion-$14.0 billion, compared to the previous outlook of $11.0 billion-$13.0 billion.

- S. GAAP net automotive cash provided by operating activities of $18.0 billion-$21.0 billion, compared to the previous outlook of $16.5 billion-$20.5 billion.

- Adjusted automotive free cash flow of $7.0 billion-$9.0 billion, compared to the previous outlook of $5.5 billion-$7.5 billion

- Capital expenditures of $11 billion-$12 billion, compared to the previous outlook of $11 billion-$13 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Posts Strong Q2 Results with $3.2B in Earnings

General Motors (NYSE: GM) today reported strong second-quarter 2023 revenue of $44.7 billion, net income attributable to stockholders of $2.6 billion and earnings [EBIT-adjusted] of $3.2 billion. GM delivered 1.4 million vehicles during Q2, many of them in premium truck and SUV segments. In the US, the Q2 Average Transaction Price (ATP) was $52,248, up $1890 Year-over-Year and $1600 compared to Q1 2023.

“The biggest driving force behind our financial results is customer demand for our vehicles, which have now led the U.S. industry in initial quality for two consecutive years. We have earned four consecutive quarters of higher retail market share in the U.S. versus a year ago with continued strong pricing and incentive discipline, we’re leading in both commercial and total fleet deliveries calendar year to date, and we’re growing profitably in international markets such as Brazil and Korea,” said CEO Mary Barra.

Click for more information.

“General Motors has made mind boggling profits over the last decade. GM’s recently announced quarterly earnings just set a post-bankruptcy record, but autoworkers and our communities have yet to be made whole for the sacrifices we’ve made since the Great Recession,” said UAW president Shawn Fain. “GM executives have closed 31 plants over the last 20 years and are now enriching themselves through joint venture battery plants that get billions from the federal government in taxpayer subsidies but pay poverty wages. It’s long past time for GM to pony up, end tiers, pay their employees competitive wages that keep up with the cost of living and provide everyone the ability to retire with dignity.”

GM also raised if full year outlook* to $12B-14B. The full-year EBIT-adjusted guidance is increased by $1 billion with adjusted automotive free cash flow guidance up $1.5 billion. GM now predicts earnings per share to be between $7.15 – $8.15. This is the second time GM has raised guidance this year. However, it assumes that GM successfully negotiate new labor agreements without work stoppages or strikes.

“We’re also spending less and lowering our capital spending guidance because we’re focusing on the most strategic internal combustion engine and EV programs, and our highest impact growth initiatives, including Cruise, BrightDrop and software-defined vehicles,” said Barra.

*GM Significantly Raises its full-year 2023 Outlook

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.